FinTech App Development: Types, Features and Costs Analysis

- November 22, 2024

-

3586 Views

- by Ishan Vyas

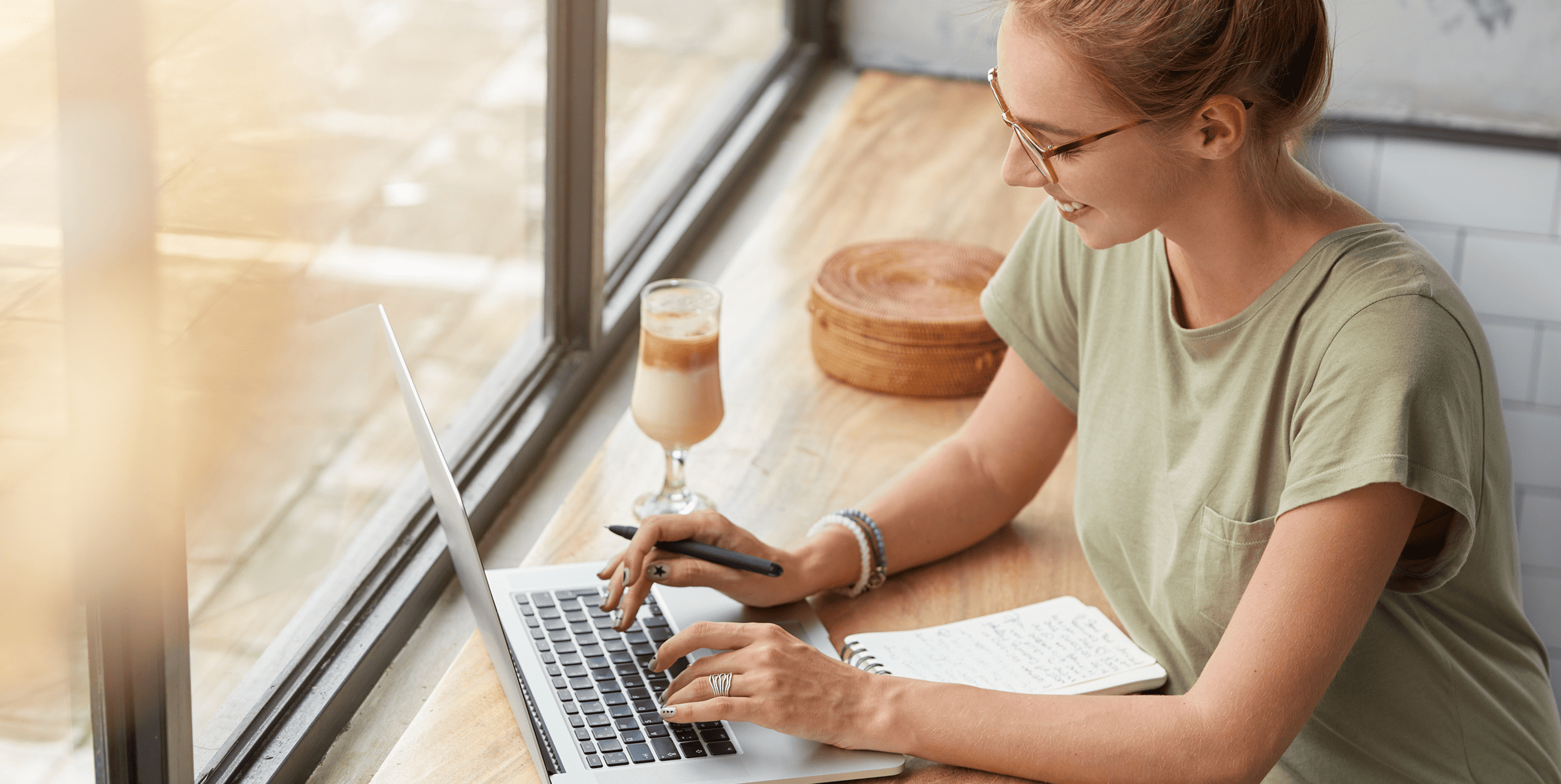

As market demands evolve and clients’ financial needs grow more complex, traditional banking solutions fall short. This shortfall fuels the rise of FinTech applications, pushing financial institutions to invest in FinTech app development and enhance customer experiences. Before diving in, it’s essential to gather all relevant insights on building a successful FinTech application, as advised in this blog.

Ethereum, cryptocurrency, and Bitcoin are familiar terms to those with financial knowledge. The financial industry is shifting toward digital solutions and advancing quickly through technology. Mobile and web-based payment systems are now mainstream.

People are more tech-savvy due to the rapid adoption of digital devices compatible with financial apps. This increased tech literacy drives the popularity of FinTech apps especially with the integration of AI in fintech solutions. FinTech represents the transformation of the financial sector using technology, including AI, to modernize and optimize daily operations.

FinTech Apps: Understanding The Concept

FinTech companies use technology to innovate financial services for individuals or businesses. Examples include mobile banking apps such as Venmo and CashApp, automated investment advisors like Wealthfront or Betterment and trading platforms like Robinhood. Some FinTech firms even work on cryptocurrency, with Bitcoin, Dogecoin, and Ether as famous examples.

Although FinTech is a broad industry, it’s possible to understand its core purpose. FinTech simplifies financial transactions, making them more accessible and often more affordable. This includes companies and services that use artificial intelligence, big data, and blockchain encryption for secure internal transactions.

At its core, the FinTech app streamlines the transaction process and reduces unnecessary steps for all involved parties. For instance, a mobile app like Venmo or CashApp allows users to send money directly to another account anytime, eliminating the need for the recipient to visit a bank. This process saves time and adds convenience, as opposed to using cash or checks, which would require a bank trip, adding extra steps for both the sender and receiver.

What Is FinTech App Development?

To begin with, FinTech application development leverages software development practices, methodologies, and technologies to craft financial applications tailored for both mobile and web platforms. The product development process typically revolves around the following key phases:

- Define the application’s objectives.

- Identify and address the problems on the application.

- Devise and implement infrastructure that sets applications apart from existing FinTech offerings.

- Conducted technical and user testing to assess functionality and security as well as maintain customer satisfaction.

Innovative technologies such as blockchain, machine learning, artificial intelligence, and cloud computing are commonly employed in FinTech development. The technology ensures privacy, security, and high performance and executes financial transactions and services. The elements contribute to delivering advanced tailored solutions that will fulfil the needs of users in today’s digital revolution.

Next, let’s discuss types of FinTech apps that will benefit both users and businesses while helping them manage their finances.

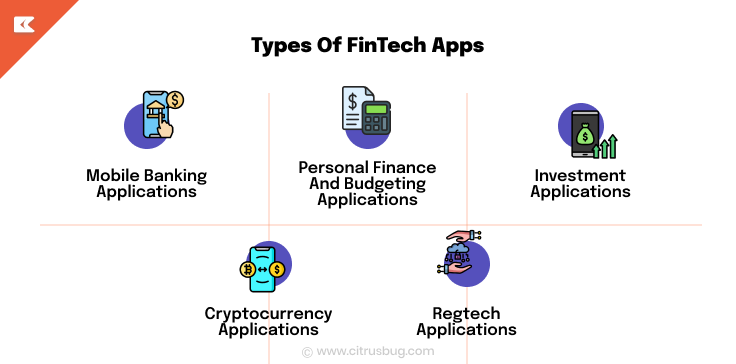

Types Of FinTech Apps

Fintech applications offer a wealth of benefits to businesses and users alike. With a growing market, companies can design various types of financial apps to meet diverse needs. Here are some of the most popular choices.

1. Mobile Banking Applications

Though mobile and online banking may sound similar, they have distinct differences. Online banking enables users to manage their finances and make global transactions from any device with Internet access. In contrast, mobile banking is an application designed specifically for smartphones, allowing users to handle all banking activities conveniently on the go.

Banking apps provide a broad range of features. Customers can track expenses, locate ATMs, and make faster money transfers, all without stepping into a physical bank. The convenience they offer is unmatched. Many also integrate consumer lending software, enabling users to apply for and manage loans directly from their mobile devices.

For business owners, such fintech applications can drive customer satisfaction, promote services, and open new revenue streams. Top examples of mobile banking apps include Ally Bank and Capital One, which set high standards for functionality and ease of use.

2. Personal Finance And Budgeting Applications

Financial planning and budgeting apps empower users to take greater control of their money. These types of fintech apps allow people to forecast investments and analyze their spending, making them widely popular among everyday users.

These apps help users manage, track, and budget their finances seamlessly within a single interface. Two leading budgeting apps worth exploring are Mint and MoneyPatrol, both known for their powerful features and ease of use.

3. Investment Applications

Investment apps offer an accessible platform for fintech investments across stocks, bonds, and mutual funds, eliminating intermediaries while making investments accessible to anyone with just a few taps of a screen.

With user-friendly features that make stock trading simpler than ever, these apps streamline stock trading by providing real-time market updates and insights. Users can effortlessly monitor their portfolios while making intelligent investment decisions.

4. Cryptocurrency Applications

As blockchain, a decentralized and secure digital ledger, gains popularity, financial institutions are increasingly incorporating cryptocurrency technologies into their operations. These technologies enable fast, anonymous transactions that operate independently from government regulations. This independence fuels the rising popularity of cryptocurrency, prompting more organizations to turn to fintech app development.

These fintech development solutions offer numerous benefits. Users can track crypto markets, explore investment opportunities, and access their mobile wallets seamlessly. Two standout cryptocurrency apps on the market today, Binance and eToro, are known for their comprehensive features, providing users with a sense of security and confidence in their investment decisions.

5. Regtech Applications

RegTech (short for regulatory technology) has revolutionized Fintech development through advanced technologies like AI and machine learning. RegTech automates data governance processes, tracks regulatory updates, minimizes false compliance alerts, and streamlines reporting. It replaces labour-intensive regulatory processes with efficient yet error-free solutions, thereby enabling seamless regulatory management and greater operational accuracy.

When developing a RegTech application, it’s essential to include features such as identity verification, risk assessment, and financial crime detection. RegTech apps like 6 Clicks and Passport showcase these advancements, automating KYC procedures and supporting financial services compliance.

Features to Consider While Building FinTech Apps

The success of a fintech app depends on how well it meets changing market trends and customer needs. A good fintech app is not just about looking nice; it should also be simple and easy to use. It must have a design that works for everyone and builds trust through transparency. Here is a list of must-have features for every fintech app.

- Biometrics and Authentication

Biometric authentication has become crucial as fears of fraud continue to grow. Users need to feel safe and protected. Traditional methods like passwords and PINs are no longer enough to ensure secure access. Advanced features such as fingerprint, facial, and voice recognition are replacing these outdated safety measures. These technologies enhance security and provide a smoother experience for users. They eliminate the need to repeatedly enter passwords or PINs, offering greater convenience and ease.

- Live Chat and Chat Bot

Always provide clear and timely support to your audience. Use live chat and chatbots to assist them effectively. Chatbots offer 24/7 availability, ensuring customers receive help whenever they need it. These bots respond to queries using pre-set information, addressing customer concerns quickly. This immediate support makes customers feel secure and valued. As a result, their experience improves, increasing the chances of building long-term loyalty.

- Multiple Payment Gateways

We always need to find out which payment gateway the customers prefer. They may likely abandon the fintech app when they cannot find their preferred payment gateway.

For instance, if you prefer PayPal as their payment option and the fintech application does not have PayPal, wouldn’t you consider making the payment? Therefore, having multiple payment gateways will increase user adoption, enhance accessibility, and reduce transaction failures. So, make sure to use an open cart payment gateway, as well as integrate other popular payment gateways to cater to your customers’ preferences.

- Scanners and QR Codes

In today’s fast-moving fintech world, convenience and efficiency are essential for success. Users prefer faster and easier solutions. Manually typing phone numbers for money transfers needs to be updated and prone to errors. Mistyped numbers can lead to transferring money to the wrong person, causing frustration. QR codes and scanners eliminate this issue by enabling smooth and error-free transactions. These tools make payments quicker and more reliable, improving the overall user experience. To further enhance this process, a QR code generator can help businesses create customized, scannable codes for seamless payments and transfers.

FinTech App Development Cost Estimation

Cost estimates for developing a FinTech application vary based on an organization’s unique goals and needs, taking into account factors like app type, features, and functionality, as well as where development takes place—on average, starting costs for custom apps that offer safe online transaction processing average around $40k with development taking three to four months on average.

Essential fintech apps with limited functionality and user interface typically cost between $300,00 to $100,000 to develop; adding advanced technologies or features may increase that estimate up to between $600.000 and $300000, depending on its complexity.

The fintech market is forecasted to experience phenomenal growth between 2024 and 2029, from USD 312.92 billion in 2024 up to USD 608.35 billion by 2029 (near-doubling over five years). The compound annual growth rate is expected to be 14% or more significant due to strong customer demand for fintech solutions and the transition towards digitalization.

Build a Solid FinTech App With Citrusbug

Citrusbug, a leading FinTech app development company, helps businesses create innovative and secure financial solutions. Our team specializes in crafting user-friendly apps tailored to meet your unique business needs. With advanced technologies, we ensure your app stands out in the competitive FinTech market. We focus on scalability and performance to support your business growth effectively. Partner with Citrusbug to transform your vision into a solid FinTech app that drives success.

SaaS Development

SaaS Development Web Application Development

Web Application Development Mobile Application Development

Mobile Application Development Custom Software Development

Custom Software Development Cloud Development

Cloud Development DevOps Development

DevOps Development MVP Development

MVP Development Digital Product Development

Digital Product Development Hire Python Developers

Hire Python Developers Hire Django Developers

Hire Django Developers Hire ReactJS Developers

Hire ReactJS Developers Hire AngularJS Developers

Hire AngularJS Developers Hire VueJS Developers

Hire VueJS Developers Hire Full Stack Developers

Hire Full Stack Developers Hire Back End Developers

Hire Back End Developers Hire Front End Developers

Hire Front End Developers AI Healthcare Software Development & Consulting

AI Healthcare Software Development & Consulting Healthcare App Development

Healthcare App Development EHR Software Development

EHR Software Development Healthcare AI Chatbot Development

Healthcare AI Chatbot Development Telemedicine App Development Company

Telemedicine App Development Company Medical Billing Software Development

Medical Billing Software Development Fitness App Development

Fitness App Development RPM Software Development

RPM Software Development Medical Device Software Development

Medical Device Software Development Patient Engagement Software Solutions

Patient Engagement Software Solutions Healthcare IT Consulting

Healthcare IT Consulting Mental Health App Development

Mental Health App Development Lending Software Development Services

Lending Software Development Services Payment Gateway Software Development

Payment Gateway Software Development Accounting Software Development

Accounting Software Development Mobile Banking Software Development

Mobile Banking Software Development Supply Chain Management Software Development

Supply Chain Management Software Development Fleet Management Software Development

Fleet Management Software Development Warehouse Management Software Development

Warehouse Management Software Development LMS Development

LMS Development Education App Development

Education App Development Inventory Management Software Development

Inventory Management Software Development Property Management Software Development

Property Management Software Development