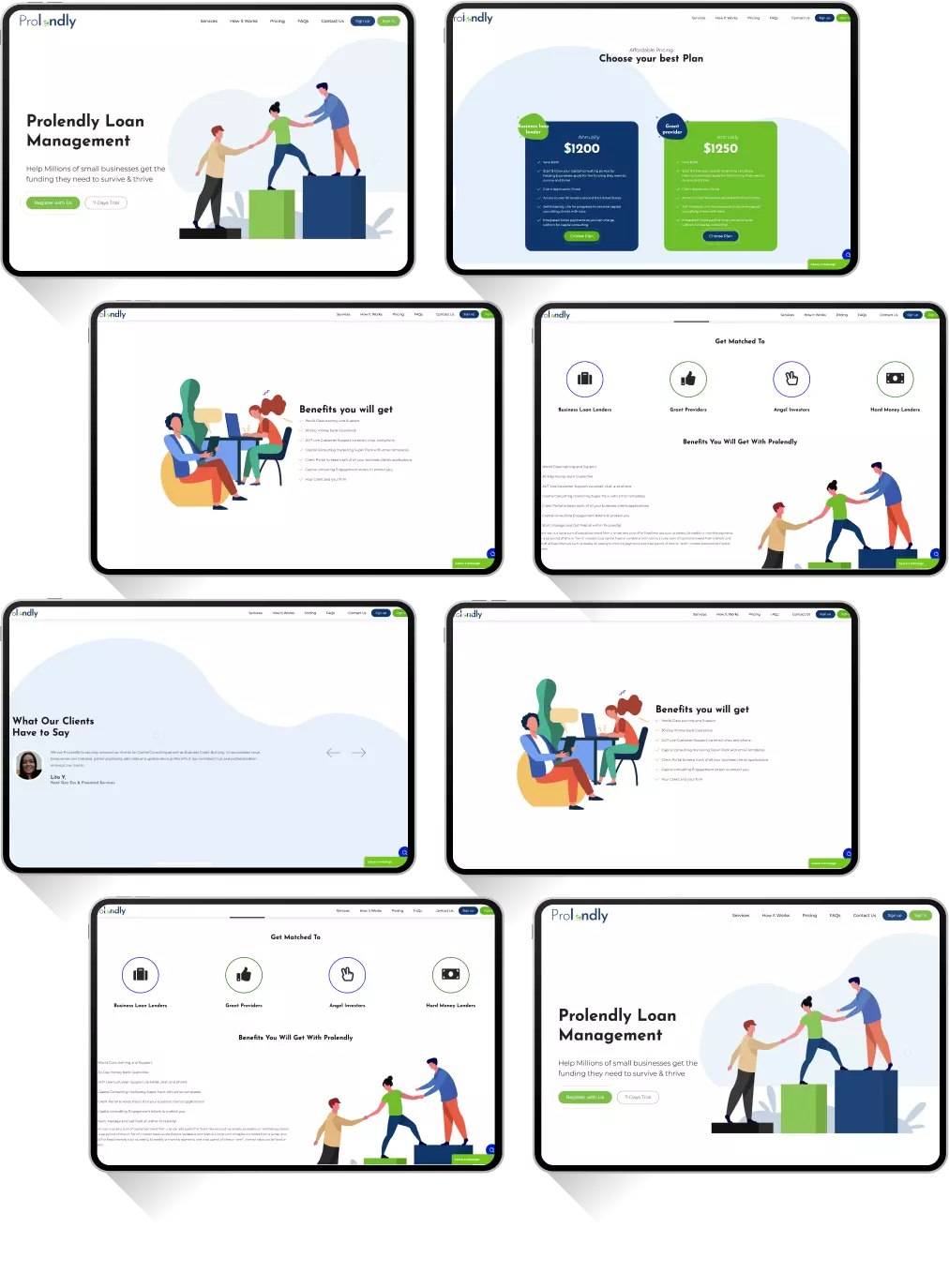

About Prolendly

We built an extensive SaaS architecture that helps businesses connect the dots between conceptualization and funding. Through Prolendly, we allowed users to securely onboard resources for Capital Consulting as well as Business Credit Building.

Prolendly creates a lot of value for users as they can onboard resources, collect payments, add tasks and update profiles for their customers. Through such a platform, users can increase trust and professionalism for their customer relations. This scalable SaaS platform supports a massive user base with constant ongoing enhancements and updates.

Service ProvidedThe Development Sprints

1-2

Month- Planning

- Infrastructure setup

- Dockerise setup

- AWS Architecture Infrastructure

- Techstack

- CI/CD setup

3-4>

Month- Planning

- Prototyping and Wireframing

- Sketch for each screen section design & prototyping

5-6

Month- Planning

- User management

- Login management

- Role management

7-9

Month- Planning

- Access management Price

- Plan management

- Stripe payment gateway API Integration

9-11

Month- Planning

- FAQ management

- Business Loan management

- Angel Investor management

12-14

Month- Planning

- Grant Provider management

- Lender Management

- Lead management

15-16

Month- Planning

- Annual Revenue management

- Funding management

- Grant Provider management

17-18

Month- Planning

- Grant module management

- Hard Money lender management

- Coupon code management

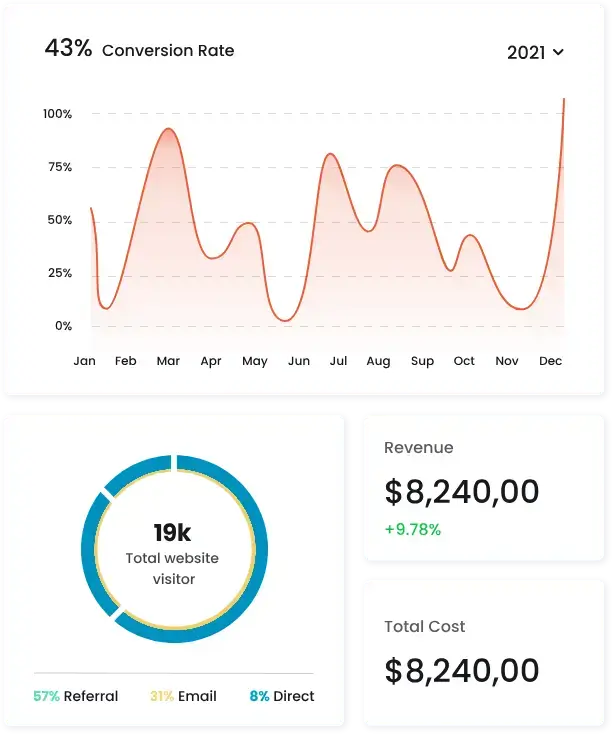

- Dashboard and Analytics

19-21

Month- Planning

- Application listing module

- Loan management

- Task management

- Document management

- Questionnaire management

22-24

Month- Planning

- Notification management

- Client management

- Hard Money Lender management

- Business Loan lender management

24+

Month- Planning

- Ongoing bug and support management

Technologies Used

-

HTML5 / CSS3

-

Bootstrap

-

Angular

-

Php

-

MySQL

-

Cake Php

-

LAMP stack

-

Stripe

-

AWS

-

AWS S3

-

AWS RDS

Final Outcome

Prolendly is a need of an hour, this fintech SaaS platform facilitates the transactions between startups and investors. This platform carries a massive user base with 50 lending institutions as partners (both traditional and non-traditional lenders) across the United States. Being individualistic, this platform carries a lot of traction and therefore the responsibility to fulfill the highest accuracy and precision.

More Case Studies

Ready To Start Your Dream Project?

SaaS Development

SaaS Development Web Application Development

Web Application Development Mobile Application Development

Mobile Application Development Custom Software Development

Custom Software Development Cloud Development

Cloud Development DevOps Development

DevOps Development MVP Development

MVP Development Digital Product Development

Digital Product Development Hire Chatbot Developers

Hire Chatbot Developers Hire Python Developers

Hire Python Developers Hire Django Developers

Hire Django Developers Hire ReactJS Developers

Hire ReactJS Developers Hire AngularJS Developers

Hire AngularJS Developers Hire VueJS Developers

Hire VueJS Developers Hire Full Stack Developers

Hire Full Stack Developers Hire Back End Developers

Hire Back End Developers Hire Front End Developers

Hire Front End Developers AI Healthcare Software Development & Consulting

AI Healthcare Software Development & Consulting Healthcare App Development

Healthcare App Development EHR Software Development

EHR Software Development Healthcare AI Chatbot Development

Healthcare AI Chatbot Development Telemedicine App Development Company

Telemedicine App Development Company Medical Billing Software Development

Medical Billing Software Development Fitness App Development

Fitness App Development RPM Software Development

RPM Software Development Medicine Delivery App Development

Medicine Delivery App Development Medical Device Software Development

Medical Device Software Development Patient Engagement Software Solutions

Patient Engagement Software Solutions Mental Health App Development

Mental Health App Development Healthcare IT Consulting

Healthcare IT Consulting Healthcare CRM Software Development

Healthcare CRM Software Development Healthcare IT Managed Services

Healthcare IT Managed Services Healthcare Software Testing services

Healthcare Software Testing services Medical Practice Management Software

Medical Practice Management Software Outsourcing Healthcare IT Services

Outsourcing Healthcare IT Services IoT Solutions for Healthcare

IoT Solutions for Healthcare Medical Image Analysis Software Development Services

Medical Image Analysis Software Development Services Lending Software Development Services

Lending Software Development Services Payment Gateway Software Development

Payment Gateway Software Development Accounting Software Development

Accounting Software Development AI-Driven Banking App Development

AI-Driven Banking App Development Insurance Software Development

Insurance Software Development Finance Software Development

Finance Software Development Loan Management Software Development

Loan Management Software Development Decentralized Finance Development Services

Decentralized Finance Development Services eWallet App Development

eWallet App Development Payment App Development

Payment App Development Money Transfer App Development

Money Transfer App Development Mortgage Software Development

Mortgage Software Development Insurance Fraud Detection Software Development

Insurance Fraud Detection Software Development Wealth Management Software Development

Wealth Management Software Development Cryptocurrency Exchange Platform Development

Cryptocurrency Exchange Platform Development Neobank App Development

Neobank App Development Stock Trading App Development

Stock Trading App Development AML software Development

AML software Development Web3 Wallet Development

Web3 Wallet Development Robo-Advisor App Development

Robo-Advisor App Development Supply Chain Management Software Development

Supply Chain Management Software Development Fleet Management Software Development

Fleet Management Software Development Warehouse Management Software Development

Warehouse Management Software Development LMS Development

LMS Development Education App Development

Education App Development Inventory Management Software Development

Inventory Management Software Development Property Management Software Development

Property Management Software Development Real Estate CRM Software Development

Real Estate CRM Software Development Real Estate Document Management Software

Real Estate Document Management Software Construction App Development

Construction App Development Construction ERP Software Development

Construction ERP Software Development