Certified Lending Software Developers By

Our Lending Software Development Services

Loan Management Systems

We offer a wide range of loan management solutions for consumers and businesses, such as loan servicing systems, debt collection tools, and loan origination software.

P2P Lending Software

We encourage the creation of peer-to-peer lending platforms because we recognise the importance of alternative finance and want to assist businesses in bringing together lenders and borrowers via online services.

Crowdfunding Platforms

Our team of software engineers will design an effective platform that allows fundraisers and the audience to engage based on your requirements.

Mortgage Software Products

Citrusbug implements mortgage management software that complies with important standards and is designed to fulfil a range of requirements, including loan processing, origination, and underwriting.

Merchant Cash Advance Systems

We assist in the construction of MCA platforms that link merchants seeking loans, MCA funders, and retail investors, thereby facilitating access to a small business financing asset class.

Auto Finance Solutions

We create solutions for the auto financing industry that may streamline the entire loan management process, from web-based software to mobile applications.

We're AI-Driven Lending Software Development Company

Lenders face challenges like high default risks, inefficient processing, compliance burdens, and a lack of real-time insights, leading to financial losses and poor borrower experiences.

Citrusbug Technolabs develops AI-powered lending software to streamline loan origination, automate risk assessment, and enhance compliance tracking—reducing costs and improving efficiency.

Our solutions include loan management systems, P2P lending platforms, mortgage software, and merchant cash advance systems, integrating AI-driven analytics, predictive risk modeling, and intelligent automation. With machine learning-powered tools, we optimize credit decisions, detect fraud, and improve borrower engagement, ensuring faster approvals, better portfolio management, and real-time insights for scalable, data-driven lending success.

Do you need an expert opinion or advice for your lending software development project?

If so, connect with us now for a free consultation call. Our solution architects and CTO can nudge you towards success.

Different Models of Lending Software Development

Consumer Lending

Implementing consumer loan software can improve your services and customer experience if you deal with individual and household consumers.

Commercial Lending

By creating safe and dependable software for commercial loan origination and servicing, we'll assist you in better serving the business sector with your financial operations.

Alternative Lending

Our proficiency in developing lending software extends well beyond applications for traditional loans; we are prepared to assist the alternative industry because we get it.

How Much Does it Cost to Develop AI-Driven Lending Software?

The cost of building AI-driven lending software can start from $30,000 for a simple version and go beyond $300,000 for advanced, enterprise-grade solutions.

Costs vary based on features, AI capabilities, and platform requirements. Submit your project details to receive a precise cost estimate tailored to your needs!

Lending Software Development Process That We Follow

We conduct in-depth market research and compliance analysis to shape lending solutions that are secure, user-friendly, and aligned with financial regulations. Our roadmap ensures a seamless borrowing and lending experience.

Our UI/UX experts craft intuitive and engaging designs tailored for lending platforms, ensuring effortless navigation, user trust, and a seamless loan application process.

Leveraging modern technologies and fintech best practices, we develop lending apps that are scalable, secure, and optimized for high performance, ensuring smooth loan management and transactions.

We follow an iterative approach to ensure your lending app meets the highest industry standards. Continuous improvements and rigorous testing guarantee a flawless and efficient lending experience.

Why Choose Citrusbug As Your Lending Software Development Agency?

Our lending software development company is rated 4.7 on clutch with 30+ client reviews, and we’re a top rated plus agency on Upwork. We proudly maintain a 97% job success rate and have successfully delivered 500+ projects, showcasing our commitment to quality, reliability, and client satisfaction.

Transparency & Integrity

We ensure transparency and integrity by protecting your real estate software ideas through strict NDA policies and secure development practices.

On-time Delivery

Hire our developers and get your real estate platform delivered on schedule, ensuring a smooth launch and seamless property transactions.

Cost-Efficient

We provide high-quality real estate software solutions at cost-effective prices while ensuring scalability, security, and optimal performance.

Vast Technical Knowledge

Our developers have extensive experience in building real estate platforms with advanced property search, virtual tours, AI-driven recommendations, and CRM integration.

QA And Testing

Our QA experts ensure your real estate software is bug-free, secure, and optimized for high performance before launch.

24X7 Availability

Get round-the-clock support via text, email, Skype, or call to resolve any technical or operational queries.

Client Testimonials (We're Rated 4.7 on Clutch)

Some Amazing Fintech Software We Developed

We built an extensive SaaS architecture that helps businesses connect the dots between conceptualization and funding. Through Prolendly, we allowed users to securely onboard resources for Capital Consulting as well as Business Credit Building.

Prolendly creates a lot of value for users as they can onboard resources, collect payments, add tasks and update profiles for their customers. Through such a platform, users can increase trust and professionalism for their customer relations. This scalable SaaS platform supports a massive user base with constant ongoing enhancements and updates.

Profit Frog is a budgeting and forecasting software tailored for small businesses, aiming to alleviate uncertainty and empower informed decision-making. By enabling users to model future profitability and analyze various scenarios, Profit Frog facilitates the creation of dynamic business plans that adapt to changing conditions. With a focus on simplicity, clarity, and actionability, Profit Frog transforms the complex task of financial forecasting into an intuitive and accessible process.

Cicada is a trading platform designed for individuals and organizations to trade securities such as stocks, bonds,futures, and options. It provides users with a user-friendly interface that is easy to navigate, even for beginners. It is a comprehensive trading platform that offers a range of features and tools to help traders of all levels make informed investment decisions easily and interactively.

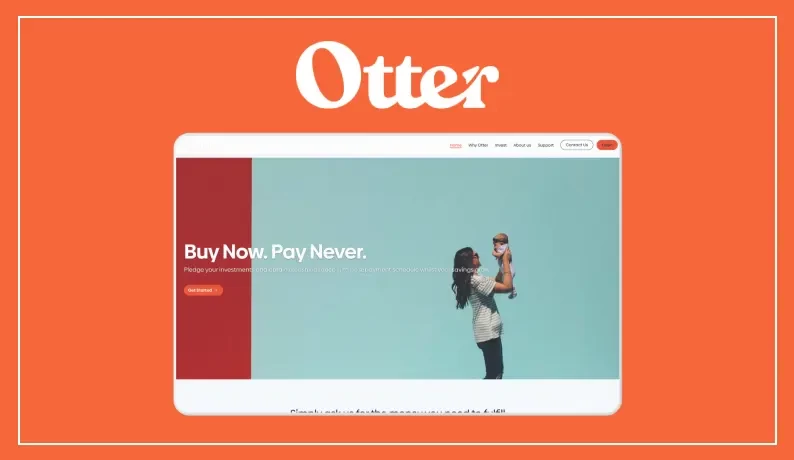

Otter, a European fintech solution, lets users leverage their assets for liquidity without selling them. With user management, dashboards, investment tools, and product management, Otter simplifies finance. Manage profiles, documents, KYC, and settings effortlessly. Support for multiple languages and newsletters keeps users informed and connected.

FAQs on Lending Software Development

Our AI-powered lending software is designed for various sectors, including consumer lending, commercial lending, mortgage providers, P2P lending platforms, crowdfunding platforms, and alternative lending businesses.

AI enhances loan management by automating risk assessment, detecting fraud, predicting loan defaults, and optimizing credit decision-making using machine learning and predictive analytics. This leads to faster approvals, reduced errors, and improved borrower experience.

Yes, our lending software solutions are designed for seamless integration with core banking systems, payment gateways, credit bureaus, and other third-party financial services to ensure smooth operations.

AI-powered chatbots provide 24/7 support, assist borrowers with loan applications, answer queries, and offer personalized recommendations—enhancing customer satisfaction and operational efficiency.

Yes, we develop lending solutions that comply with industry regulations such as GDPR, PCI DSS, and other relevant financial and data security standards to ensure full regulatory compliance.

SaaS Development

SaaS Development Web Application Development

Web Application Development Mobile Application Development

Mobile Application Development Custom Software Development

Custom Software Development Cloud Development

Cloud Development DevOps Development

DevOps Development MVP Development

MVP Development Digital Product Development

Digital Product Development Hire Chatbot Developers

Hire Chatbot Developers Hire Python Developers

Hire Python Developers Hire Django Developers

Hire Django Developers Hire ReactJS Developers

Hire ReactJS Developers Hire AngularJS Developers

Hire AngularJS Developers Hire VueJS Developers

Hire VueJS Developers Hire Full Stack Developers

Hire Full Stack Developers Hire Back End Developers

Hire Back End Developers Hire Front End Developers

Hire Front End Developers AI Healthcare Software Development & Consulting

AI Healthcare Software Development & Consulting Healthcare App Development

Healthcare App Development EHR Software Development

EHR Software Development Healthcare AI Chatbot Development

Healthcare AI Chatbot Development Telemedicine App Development Company

Telemedicine App Development Company Medical Billing Software Development

Medical Billing Software Development Fitness App Development

Fitness App Development RPM Software Development

RPM Software Development Medicine Delivery App Development

Medicine Delivery App Development Medical Device Software Development

Medical Device Software Development Patient Engagement Software Solutions

Patient Engagement Software Solutions Mental Health App Development

Mental Health App Development Healthcare IT Consulting

Healthcare IT Consulting Healthcare CRM Software Development

Healthcare CRM Software Development Healthcare IT Managed Services

Healthcare IT Managed Services Healthcare Software Testing services

Healthcare Software Testing services Medical Practice Management Software

Medical Practice Management Software Outsourcing Healthcare IT Services

Outsourcing Healthcare IT Services IoT Solutions for Healthcare

IoT Solutions for Healthcare Medical Image Analysis Software Development Services

Medical Image Analysis Software Development Services Lending Software Development Services

Lending Software Development Services Payment Gateway Software Development

Payment Gateway Software Development Accounting Software Development

Accounting Software Development AI-Driven Banking App Development

AI-Driven Banking App Development Insurance Software Development

Insurance Software Development Finance Software Development

Finance Software Development Loan Management Software Development

Loan Management Software Development Decentralized Finance Development Services

Decentralized Finance Development Services eWallet App Development

eWallet App Development Payment App Development

Payment App Development Money Transfer App Development

Money Transfer App Development Mortgage Software Development

Mortgage Software Development Insurance Fraud Detection Software Development

Insurance Fraud Detection Software Development Wealth Management Software Development

Wealth Management Software Development Cryptocurrency Exchange Platform Development

Cryptocurrency Exchange Platform Development Neobank App Development

Neobank App Development Stock Trading App Development

Stock Trading App Development AML software Development

AML software Development Web3 Wallet Development

Web3 Wallet Development Robo-Advisor App Development

Robo-Advisor App Development Supply Chain Management Software Development

Supply Chain Management Software Development Fleet Management Software Development

Fleet Management Software Development Warehouse Management Software Development

Warehouse Management Software Development LMS Development

LMS Development Education App Development

Education App Development Inventory Management Software Development

Inventory Management Software Development Property Management Software Development

Property Management Software Development Real Estate CRM Software Development

Real Estate CRM Software Development Real Estate Document Management Software

Real Estate Document Management Software Construction App Development

Construction App Development Construction ERP Software Development

Construction ERP Software Development

BOOK A 30 MIN CALL

BOOK A 30 MIN CALL