AI in FinTech: Key Roles, Opportunities, and Practical Use Cases

- October 17, 2024

-

10710 Views

- by Ishan Vyas

Artificial intelligence is one of the largest drivers for this change in the FinTech industry, which is experiencing great transformation. AI in FinTech transforms financial services into becoming more customer-centric and efficient while optimizing operations and reducing risks. The key to the new opportunities that AI creates by presenting practical solutions across the financial ecosystem are the processing of large datasets and task automation.

The Role of AI in FinTech

Artificial intelligence is therefore transforming the way financial services get delivered and consumed. From algorithmic trading to fraud detection, AI now impacts industry through the various aspects of automation, cost savings, and more accurate decision-making abilities.

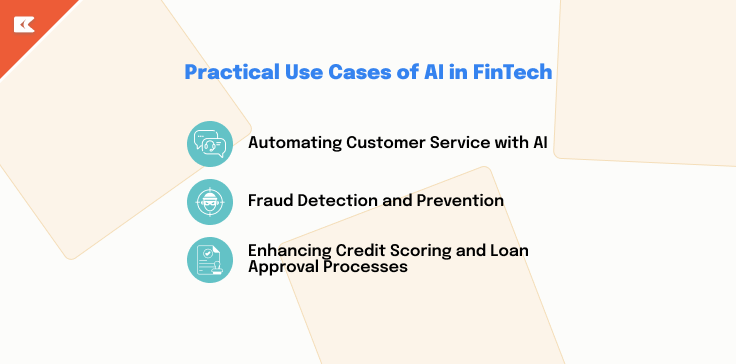

1. Automating Customer Service with AI

Customer service is probably one of the most traditional uses of AI in FinTech. AI-based chatbots and virtual assistants back up the banks, payment processors, and other financial firms in providing an improved customer service delivery. These intelligent systems use NLP to understand the language being communicated through customers and respond in real-time. For example, chatbots provide 24/7 customer support by answering simple queries or guiding customers navigating online banking systems without humans’ involvement.

Virtual assistants in FinTech can be used for solving more complicated tasks, such as walk-through procedures on how to apply for loans, manage an investment portfolio, and even execute transactions. Artificial intelligence eliminates response delays and consequently reduced waiting time and offers much better service delivery to the customers while alleviating the human agents of loads of workloads. As NFT wallets are also a huge part of FinTech nowadays, these assistants can also help users manage their NFT collections, track their value, and even facilitate NFT trades.

2. Fraud Detection and Prevention

Fraud is, without a doubt, the biggest fear in the financial world. Due to the vast number of daily transactions it becomes difficult for traditional systems to detect fraud effectively. But, in the case of AI Fintech, this problem can be easily dealt with by observing transaction patterns and identifying anomalies that may indicate fraudulent activities, strengthening FinTech security.

Machine learning algorithms learn from historical data and can pick up unusual behavior and lagging potential fraud cases before they escalate. This ability to predict fraud cases at the earliest point would actually be a big win for financial institutions in which proactive measures could be undertaken to preclude fraud before it’s too late.

For example, Visa is using AI for processing every transaction that passes its hands by analyzing 500 different attributes of risk in real-time. This helps the company identify suspicious activity and reduce instances of fraud.

3. Enhancing Credit Scoring and Loan Approval Processes

Traditionally, credit worthiness would be determined by just two items of data, such as credit history and income. Income is often verified through a pay stub, helping lenders assess financial stability. However, AI may help open the access of financial institutions to alternative data sources that may reflect social media activities, purchasing behavior, even mobile data usage, to score credit risk holistically.

Such broader analysis of data leads to more precise and unbiased credit scores, that way educating lenders about the borrowers’ credit profiles better. AI-based systems also automate the loan sanction process, analyzing a humongous amount of data for determining the eligibility to provide loans. Companies such as ZestFinance apply AI to provide a higher degree of accuracy for credit risk models, especially for customers with little or almost no credit history.

Opportunities Brought by AI in FinTech

AI in FinTech not only develops new processes but also creates potential business opportunities. AI Software Development Solutions make financial institutions more competitive through personalized, secure, and efficient services.

1. Personalization of Financial Services

The key trend in FinTech is personalization, where AI lets companies tailor services toward the individual customer’s needs and preferences. Customer data – whether investment product, savings plan, or loan – is analyzed through AI algorithms for offering personalized recommendations.

Robo-advisors use AI to automate investment advice with consideration of what kind of goals, risk appetite, and market conditions a user has, thus making it easier for people to manage their investments with minimal fees, democratizing access to wealth management services.

AI FinTech development services also enable customized financial solutions for customers on the fly. Through AI, a FinTech company can design super-niche offers based on the shifting behaviors and preferences of customers.

2. Risk Management and Compliance

AI continues to play an important role in the risk management and regulatory compliance functions within the highly regulated financial sector. Systems that develop through artificial intelligence have the ability to analyze large sets of data to discover trends, identify market movements, and calculate the level of risk, whereupon financial institutions may make better decisions.

Implementing a robust risk management information system allows these institutions to centralize risk data, automate reporting, and enhance decision-making. This integration ensures they stay ahead of potential threats while maintaining operational efficiency.

Apart from risk management, AI can even automate the compliance process so that financial institutions may be guaranteed to meet the required regulatory standards. Analysis of legal documents and industry regulations made by AI systems will signify possible compliance issues, thus reducing the risk of punitive measures and fines. Anti-Money Laundering(AML) and Know Your Customer(KYC) are also streamlined by helping companies to do away with the hassles of identity verification and monitoring suspicious activity in an AI-based solution.

3. AI in Investment Management

One of the most revolutionary developments that AI brought into FinTech is probably algorithmic trading. AI algorithms can analyze huge datasets, track real-time movements of the market, and operate trades faster than human traders. These systems are programmed to act based on data-driven decisions with higher precision and lower human biases to increase efficiency in trading.

Hedge funds and investment firms have come closer to AI to better handle their management of portfolio strategies. AI identifies new or hidden opportunities that human analysts would otherwise not think of; hence, they gain a sense of better returns on their investments. Companies like BlackRock and Renaissance Technologies apply AI-based quant models to drive their trading strategies to the maximum extent while optimizing portfolios.

Practical Use Cases of AI in FinTech

The practical applications of AI in FinTech are enormous and constantly growing. Among them, a few examples of how AI affects financial services already are:

1. AI-Powered Chatbots in Banking

Perhaps the most classic example of how AI is reinventing customer service is Bank of America’s Erica, the AI-powered chatbot. Now, customers can almost do everything via the Erica chatbot-from account balance checks to track spending patterns and credit cards. Based on a customer’s financial history and requirements, predictive analytics and artificial intelligence produce individualized advice.

Since its launch, Erica has emerged as one of the most utilized AI-powered chatbots in finance. The bot responds to millions of customer queries every month.

This sort of automation and customer interaction resulted in cost savings, saving Bank of America time and resources while it could deliver an amazing user experience.

2. Automated Loan Approval at Kabbage

Kabbage is an AI lending platform that is one of the prime examples of how AI brings a positive change in loan approvals. Kabbage allows assessment of the loan applications of small businesses through AI algorithms. It pulls out real-time data from sources that can include bank accounts, payment processors, and accounting software.

The company can process data within minutes to evaluate a business’s creditworthiness, which will enable the loan approval process to occur more quickly and accurately. This new application of AI will allow Kabbage to reach those businesses that traditional lenders would otherwise miss, while at the same time reducing defaults.

3. Robo-Advisory Services at Wealthfront

Wealthfront is one of the most well-known robo-advisors that uses AI to provide automated solutions for investment management and financial planning. The company provides a user-specific portfolio based on their goal, risk tolerance, and time horizon using AI algorithms. Continuous market monitoring and, as such, portfolio rebalancing by the AI-based systems of Wealthfront are designed to optimize returns optimally.

A further aspect in which Wealthfront and other robo-advisors have enabled investment management for a younger age group and also for individuals who prefer to adopt a low-cost, hands-off approach to investing.

4. AI in Fraud Detection at PayPal

PayPal used machine learning to support its methods of fraud detection. PayPal’s use of AI in fraud detection enables the system to identify suspicious activities and highlight potential fraud through the real-time analysis of transaction data. The advanced machine learning models continue to learn from new data, allowing PayPal to stay ahead of emerging fraud patterns.

PayPal’s proactive approach has seriously limited fraudulent transactions, thereby improving the user experience by reducing false positives.

The Future of AI in FinTech

As financial institutions continue to adopt new technologies to remain competitive in the digital world, the demand for AI in the FinTech sector remains promising. The demand for AI software development companies also continues to rise as financial institutions anticipate using AI to their advantage.

In FinTech, with the advent of blockchain and quantum computing, comes a promise of new windows of opportunity for AI. AI-driven financial solutions will become more intelligent, secure, and responsive to the new regulatory challenges. Those financial institutions which invest in AI development services today, keeping in mind tomorrow’s customers, will be better off in advance.

Conclusion

AI in FinTech is reshaping and transforming the financial services landscape through process automation, enhanced decision-making capabilities, and improving customer experiences. From fraud detection to personalized service delivery, to loan approvals, and even sophisticated investment management, AI brings forth an immense range of operational applications that work best for businesses as well as consumers. As the demand for AI Software Development Solutions continues to grow, FinTech firms that adopt AI technologies will be well-positioned to thrive in this rapidly evolving landscape.

Financial institutions that leverage AI’s capabilities are not only optimizing operations but also open up new fields of growth, risk mitigation, and better customer experience. Evidently, FinTech is coupled with the future of AI, and businesses will be required to prepare and keep ahead of such a wave of transformative technologies.

SaaS Development

SaaS Development Web Application Development

Web Application Development Mobile Application Development

Mobile Application Development Custom Software Development

Custom Software Development Cloud Development

Cloud Development DevOps Development

DevOps Development MVP Development

MVP Development Digital Product Development

Digital Product Development Hire Chatbot Developers

Hire Chatbot Developers Hire Python Developers

Hire Python Developers Hire Django Developers

Hire Django Developers Hire ReactJS Developers

Hire ReactJS Developers Hire AngularJS Developers

Hire AngularJS Developers Hire VueJS Developers

Hire VueJS Developers Hire Full Stack Developers

Hire Full Stack Developers Hire Back End Developers

Hire Back End Developers Hire Front End Developers

Hire Front End Developers AI Healthcare Software Development & Consulting

AI Healthcare Software Development & Consulting Healthcare App Development

Healthcare App Development EHR Software Development

EHR Software Development Healthcare AI Chatbot Development

Healthcare AI Chatbot Development Telemedicine App Development Company

Telemedicine App Development Company Medical Billing Software Development

Medical Billing Software Development Fitness App Development

Fitness App Development RPM Software Development

RPM Software Development Medicine Delivery App Development

Medicine Delivery App Development Medical Device Software Development

Medical Device Software Development Patient Engagement Software Solutions

Patient Engagement Software Solutions Mental Health App Development

Mental Health App Development Healthcare IT Consulting

Healthcare IT Consulting Healthcare CRM Software Development

Healthcare CRM Software Development Healthcare IT Managed Services

Healthcare IT Managed Services Healthcare Software Testing services

Healthcare Software Testing services Medical Practice Management Software

Medical Practice Management Software Outsourcing Healthcare IT Services

Outsourcing Healthcare IT Services IoT Solutions for Healthcare

IoT Solutions for Healthcare Medical Image Analysis Software Development Services

Medical Image Analysis Software Development Services Lending Software Development Services

Lending Software Development Services Payment Gateway Software Development

Payment Gateway Software Development Accounting Software Development

Accounting Software Development AI-Driven Banking App Development

AI-Driven Banking App Development Insurance Software Development

Insurance Software Development Finance Software Development

Finance Software Development Loan Management Software Development

Loan Management Software Development Decentralized Finance Development Services

Decentralized Finance Development Services eWallet App Development

eWallet App Development Payment App Development

Payment App Development Money Transfer App Development

Money Transfer App Development Mortgage Software Development

Mortgage Software Development Insurance Fraud Detection Software Development

Insurance Fraud Detection Software Development Wealth Management Software Development

Wealth Management Software Development Cryptocurrency Exchange Platform Development

Cryptocurrency Exchange Platform Development Neobank App Development

Neobank App Development Stock Trading App Development

Stock Trading App Development AML software Development

AML software Development Web3 Wallet Development

Web3 Wallet Development Robo-Advisor App Development

Robo-Advisor App Development Supply Chain Management Software Development

Supply Chain Management Software Development Fleet Management Software Development

Fleet Management Software Development Warehouse Management Software Development

Warehouse Management Software Development LMS Development

LMS Development Education App Development

Education App Development Inventory Management Software Development

Inventory Management Software Development Property Management Software Development

Property Management Software Development Real Estate CRM Software Development

Real Estate CRM Software Development Real Estate Document Management Software

Real Estate Document Management Software Construction App Development

Construction App Development Construction ERP Software Development

Construction ERP Software Development