Key Challenges and Solutions in FinTech SaaS Development

- March 12, 2025

-

2380 Views

- by Ishan Vyas

Over the last few years, the FinTech industry has grown and changed beyond imagination due to the growing demand for digital financial services, new technologies and changes in consumers’ behavior. In the course of providing financial services, FinTech companies are now facing the challenge of designing scalable, secure, and user-friendly Software-as-a-Service (SaaS) solutions for the increasingly complex consumers of financial services. However, the development of FinTech SaaS solutions is accompanied by severe technical, operational, and regulatory challenges that can slow down innovation, threaten security, and erode customers’ trust. In this article, we will be discussing the challenges and solutions in FinTech SaaS development, with a focus on the role of Automation testing as a key enabler of seamless and secure financial services.

What is SaaS Development?

SaaS which is an acronym for Software as a Service and is defined as the process of developing software applications that are owned by one party, developed by another party, and delivered digitally over the internet to the user. SaaS applications are among the most loved and adopted business models that drive increased ROI for delivering companies as well as its users, thus a win-win situation from both ends. In SaaS development, the application is developed and made available to users to use in various ways such as through the internet or any other digital platform. This means that the user does not have to worry about the software update, management, or security since the provider will take charge of this. Instead, the application is accessed by users through a web browser or mobile application and the provider has to make sure that the application is the latest version, secure, and available at all times.

Understanding SaaS Development in FinTech

FinTech SaaS product is about developing software applications that deliver financial solutions and services to organizations and individuals over the web. Such applications are scalable, secure, and can be accessed anywhere, on any device. PayPal, the global FinTech leader in digital payments and financial services, announced a new way for customers to pool money with friends and family. The new pooling option enables users to create a pool directly through the PayPal app or online. Once created, organisers can invite contributors, track their contributions and move funds to their PayPal balance for either spending or withdrawal.

The fundamental features of SaaS advancement in FinTech:.

- The use of cloud infrastructure, such as AWS, Azure, or Google Cloud, is crucial for the scalability, reliability, and security of finTech SaaS applications.

- Interdependence with financial services: FinTech SaaS applications interact with a range of financial products, including payment gateways, banking systems, and credit scoring platforms.

- Regulatory scrutiny: FinTech SaaS applications must comply with rigorous security and compliance requirements, including PCI security standard council PCI-DSS (pcisecuritystandards.org), GDPR, and AML/KYC regulations.

- FinTech SaaS applications are built with utmost user-friendliness in mind, including responsive design and mobile friendly features for seamless experience.

- The use of API-based architectures is prevalent in FinTech SaaS applications, which enable them to integrate with other financial services, platforms, and systems.

The Challenges of FinTech SaaS Development

FinTech SaaS development is a highly regulated and multi-stakeholder business, with high security requirements. FinTech SaaS developers encounter significant hurdles, including:

- Security and Compliance

Ensuring the protection and accuracy of personal financial data while adhering to evolving regulatory standards, including GDPR, PCI-DSS, and AML/KYC. This means using strong security measures, such as encryption, access controls, and secure storage for the data.

- Scalability and Performance

Building strategic solutions to address high volume transactions and simultaneously treat user traffic, while achieving the highest levels of performance, reliability, and uptime. This involves developing scalable architectures, leveraging cloud computing, and utilizing load balancing and content delivery networks..

- Third-Party Integrations & API Management

With multiple third-party services to integrate with, it can be a complex and resource-intensive process to develop the solution. With so many APIs to connect to, like payment gateways, banking systems, and credit scoring platforms, FinTech developers spend most of their time coordinating to allow for effortless and safe financial services through third-party vendors.

- Data Management

Managing massive volumes of financial data, so as to render actionable insights while ensuring data quality, integrity and compliance This involves addressing data warehousing, business intelligence, and data analytics and building data management processes to scale.

- User Experience

Providing intuitive and easy-to-use interfaces developed on the changing needs of financial services consumers whilst enabling access through usability and engagement. Doing so involves using concepts of user-centered design, running user research, and testing for usability and accessibility.

Solutions for FinTech SaaS Development

Here are the solutions that FinTech SaaS developers can adopt to get rid of these challenges:

- Building Solutions on Cloud Native Architecture

Build solutions on cloud-native architectures which are highly scalable, flexible with improved security such as Amazon Web Services (AWS), Microsoft Azure or Google Cloud Platform (GCP).

- Microservices-Based Development

Use of Microservices based development approaches that helps break the monolithic application into smaller, indexes in the form(small) of services, this way creating much more agile, scalable & fault tolerant applications.

- Automation Testing

Its never ending financial services, the risk increases, using Automation testing to test and balance hundreds of transactions in the backend, checking for readability or performance issues, and ensuring compliance to regulations are thoroughly adhered.

- DevOps and Continuous Integration

Implementing DevOps practices and Continuous Integration to automate testing, deployment, and monitoring of FinTech SaaS solutions, to ensure speed of deployment, monitoring and maintenance of FinTech SaaS solutions.

- Artificial Intelligence and Machine Learning

The use of AI and ML facilitates financial services to use large data sets to find trends, analyze patterns and make predictions for risk management, personalized offerings, credit scoring, and more.

The Role of Automation Testing in FinTech SaaS Development

Automation testing is an essential aspect of achieving quality, security, and reliability in FinTech SaaS projects. Automating the testing process allows developers to:

- Reduce Testing Time

Implementing test automation speeds up the testing processes, allowing developers to decrease time-to-market and quickly respond to changing market conditions.

- Improve Test Coverage

With automation testing, developers can simulate a multitude of scenarios, which increases test coverage, reduces the risk of errors, and ensures applications meet the regulatory requirements.

- Ensure Compliance

Automation testing helps make sure that regulatory compliance is followed, thus reducing penalties for non-compliance, and ensuring that the applications are up to industry standards.

- Enhance Security

Automation testing identifies potential security loopholes that developers can fix before deployment and ensures applications are secure and confidential of financial information.

Automation testing has been essential for FinTech software development as it assures the quality, security, and reliability of FinTech SaaS solutions. For people who want to start their career in testing, taking an automation testing course would be a great start to gain a deeper understanding of the principles and techniques of software. This is because you can now automate the testing process and conduct tests more quickly, with greater coverage, more compliance and integrity.

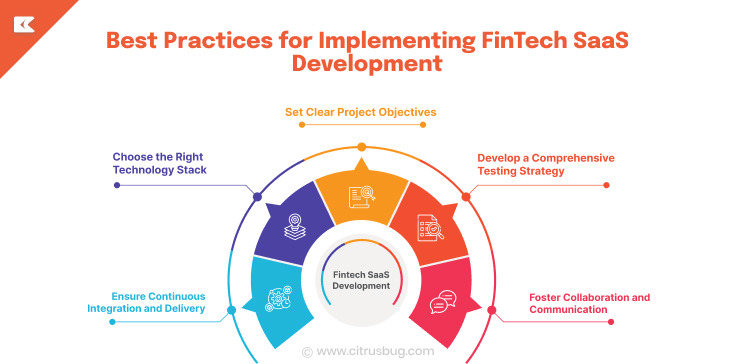

Best Practices for Implementing FinTech SaaS Development

Best practices for FinTech SaaS development – Why is it so important? There are many factors to consider in FinTech SaaS development, including security, compliance, scalability, and performance. By following these best practices, developers can ensure their FinTech SaaS solutions meet the ever-changing demands of financial services consumers. Best practices for FinTech SaaS development that meet industry-specific challenges Here are a few things to keep in mind:

- Set Clear Project Objectives

You should have the objectives of the project outlined in clear terms such as functional requirements, performance, and security requirements. This includes determining the business requirements and objectives of the project, as well as the technical specifications for scalability, security, and compliance. Defining goals clearly means that the FinTech SaaS solution meets the needs of financial services consumers and is a step ahead of competitors. If your goals include efficient revenue management and streamlined billing, SaaS billing software can be a key driver of success.

- Choose the Right Technology Stack

Choose the technology stack fitting the project needs like scalability, security & compliance This process also includes assessing various technology choices including cloud-native architecture, microservices-based development, and containerization. The technology stack of the FinTech SaaS solution After deciding on the FinTech SaaS platform, developers need to choose technology tools, software, and libraries that can help them build a perfect solution that allows for a scalable, secure, compliant SaaS solution as per regulatory requirements.

- Develop a Comprehensive Testing Strategy

Create a strategy for testing which incorporated automated testing along with manual testing and exploratory testing. This step consists of identifying types of testing required i.e., functional, performance, security, etc. With a comprehensive testing strategy, it is possible to deliver a FinTech SaaS solution that meets the highest standards of quality and reliability.

- Ensure Continuous Integration and Delivery

Use practices that ensure integration, delivery, monitoring, and maintenance of applications in rapid cycles. DevOps practices, such as Continuous Integration and Continuous Delivery (CI/CD), allow you to automate the build, test and deployment process and integrate monitoring and logging tools so you can act quickly to resolve application or environment issues before they impact a user. Continuous integration and delivery help developers to ensure that their solution to Fin-Tech as a service is constantly up to date as per the current needs of consumers in financial services.

- Foster Collaboration and Communication

Encourage collaboration and communication among cross-functional teams, such as development, testing, and operations. These include practices like implementing agile development methodologies (Scrum, Kanban, etc.) and getting all team members to be on the same page in terms of project goals and objectives. When developers prioritize collaboration and communication above all else, they create a FinTech SaaS solution that is developed swiftly and accurately, meeting the pinnacle of quality and reliability standards.

Conclusion

From security and compliance adhered patterns to scalable and performant outputs, FinTech SaaS Development comes with its own sets of challenges. Developers, on the other hand, have the ability to step over these challenges with earnings benefits of cloud-native architectures, microservices-based development, Automation testing, and DevOps practices to deliver seamless and secure financial services. Increase scope of Automation testing in FinTech, since the FinTech sector is rapidly evolving, the significance of Automation testing will be on the rise. This common understanding helps FinTech SaaS Developers maintain the quality, security, and reliability of their solutions, leading them towards successful business.

SaaS Development

SaaS Development Web Application Development

Web Application Development Mobile Application Development

Mobile Application Development Custom Software Development

Custom Software Development Cloud Development

Cloud Development DevOps Development

DevOps Development MVP Development

MVP Development Digital Product Development

Digital Product Development Hire Chatbot Developers

Hire Chatbot Developers Hire Python Developers

Hire Python Developers Hire Django Developers

Hire Django Developers Hire ReactJS Developers

Hire ReactJS Developers Hire AngularJS Developers

Hire AngularJS Developers Hire VueJS Developers

Hire VueJS Developers Hire Full Stack Developers

Hire Full Stack Developers Hire Back End Developers

Hire Back End Developers Hire Front End Developers

Hire Front End Developers AI Healthcare Software Development & Consulting

AI Healthcare Software Development & Consulting Healthcare App Development

Healthcare App Development EHR Software Development

EHR Software Development Healthcare AI Chatbot Development

Healthcare AI Chatbot Development Telemedicine App Development Company

Telemedicine App Development Company Medical Billing Software Development

Medical Billing Software Development Fitness App Development

Fitness App Development RPM Software Development

RPM Software Development Medicine Delivery App Development

Medicine Delivery App Development Medical Device Software Development

Medical Device Software Development Patient Engagement Software Solutions

Patient Engagement Software Solutions Mental Health App Development

Mental Health App Development Healthcare IT Consulting

Healthcare IT Consulting Healthcare CRM Software Development

Healthcare CRM Software Development Healthcare IT Managed Services

Healthcare IT Managed Services Healthcare Software Testing services

Healthcare Software Testing services Medical Practice Management Software

Medical Practice Management Software Outsourcing Healthcare IT Services

Outsourcing Healthcare IT Services IoT Solutions for Healthcare

IoT Solutions for Healthcare Medical Image Analysis Software Development Services

Medical Image Analysis Software Development Services Lending Software Development Services

Lending Software Development Services Payment Gateway Software Development

Payment Gateway Software Development Accounting Software Development

Accounting Software Development AI-Driven Banking App Development

AI-Driven Banking App Development Insurance Software Development

Insurance Software Development Finance Software Development

Finance Software Development Loan Management Software Development

Loan Management Software Development Decentralized Finance Development Services

Decentralized Finance Development Services eWallet App Development

eWallet App Development Payment App Development

Payment App Development Money Transfer App Development

Money Transfer App Development Mortgage Software Development

Mortgage Software Development Insurance Fraud Detection Software Development

Insurance Fraud Detection Software Development Wealth Management Software Development

Wealth Management Software Development Cryptocurrency Exchange Platform Development

Cryptocurrency Exchange Platform Development Neobank App Development

Neobank App Development Stock Trading App Development

Stock Trading App Development AML software Development

AML software Development Web3 Wallet Development

Web3 Wallet Development Robo-Advisor App Development

Robo-Advisor App Development Supply Chain Management Software Development

Supply Chain Management Software Development Fleet Management Software Development

Fleet Management Software Development Warehouse Management Software Development

Warehouse Management Software Development LMS Development

LMS Development Education App Development

Education App Development Inventory Management Software Development

Inventory Management Software Development Property Management Software Development

Property Management Software Development Real Estate CRM Software Development

Real Estate CRM Software Development Real Estate Document Management Software

Real Estate Document Management Software Construction App Development

Construction App Development Construction ERP Software Development

Construction ERP Software Development