How to Ensure Security in FinTech Apps: A Developer’s Guide

- January 6, 2025

-

5956 Views

- by Ishan Vyas

FinTech’s rapid growth has transformed how people manage their finances-from mobile banking and investment platforms to AI-powered loan services. FinTech apps bring with it significant security challenges, which are mainly due to its sensitive user data, financial information, and real-time transactions. Developers must ensure robust security to maintain user trust and comply with industry regulations.

Why is FinTech Security a Problem?

The FinTech industry is one of the most promising targets for hackers. According to a Statista report from 2024, it was mentioned that 30% of data breaches worldwide were contributed by the financial sector, majorly through phishing, ransomware, and API vulnerabilities.

The introduction of AI into FinTech, opens up a plethora of threats such as algorithm manipulation and data leakages. Furthermore, the highly connected nature of financial systems with third-party APIs and cloud services opens up a variety of entry points.

To the fintech app developers, protecting user data is a technical requirement but also a legal need because regulatory frameworks like GDPR and PCI DSS have implemented stiff compliance. Developers must also integrate consent mechanisms into their apps to ensure users explicitly agree to data collection and processing practices. Lack of adherence to these requirements often calls for heavy penalties with a reputation and loss of consumer trust.

FinTech App Security Challenges

FinTech apps have revolutionized the financial industry but throw up tremendous security challenges. These apps are at an all-time high risk of being targeted for cyberattacks, because they deal with sensitive user information and financial transactions. In addition to data breaches, there are regulatory compliance issues, so this calls for robust security with easy user experiences. Vigilance in innovation is needed so that trust and operational integrity will be achieved in a rapidly evolving digital landscape.

-

Data Breaches

FinTech apps keep highly sensitive user information like bank account details and personal identification data. Hackers are attracted to these repositories because they can steal information that is used for financial fraud or identity theft. Sometimes, weak encryption methods or insecure APIs can heighten the risk. Good encryption and real-time monitoring would reduce the chances of breaches.

-

Fraudulent Transactions

Fraudulent activities include, fake accounts, and transaction manipulation, posing a significant threat to cybercriminals. Such malicious activities exploit vulnerabilities found in payment gateways or authentication systems. Implementing AI-driven fraud detection systems like scam detector and multi-factor authentication may help prevent unauthorized transactions.

-

Third-Party Integration Risks

Many FinTech applications rely on third-party APIs and services for functionalities such as payments or analytics. Integrating third-party services introduces possible vulnerabilities unless secured properly. Regular auditing of third-party services and secure API connections are significant in the protection of user’s data.

-

Regulatory Compliance

It is challenging but compulsory to follow financial regulations like GDPR, PCI DSS, or PSD2. Non-compliance may bring in heavy fines and a loss of credibility. Maintaining the standard by checking the applications for compliance with regular audits and legal expertise is important for sustainability in the long run.

-

Ransomware and Malware Attacks

Fintech Applications have become potential targets of ransomware and malware developed to encrypt or even steal valuable data. Such attacks cause disruption to operations and, at times, lead to financial losses. Therefore, proactive endpoint security, employee education, and regular software updates are included in the implementation of measures against these attacks.

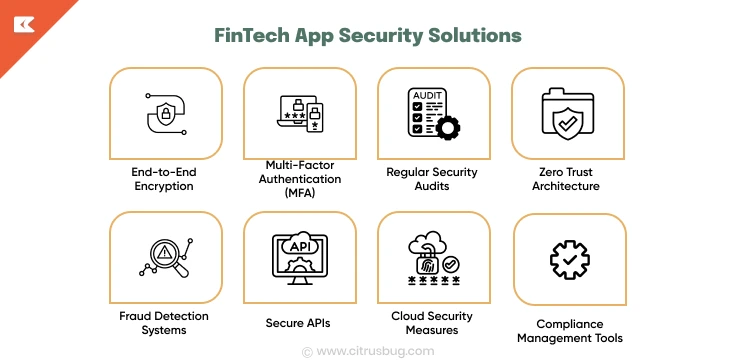

FinTech App Security Solutions

1. End-to-End Encryption

Implement strong encryption protocols such as AES-256 for securing data in transit and storage. End-end security will ensure no transaction detail passes through to unauthorized users during transit.

2. Multi-Factor Authentication (MFA)

By using more than one channel to authenticate accessing a system, such as SMS codes or biometrics, MFA provides another level of security. This lowers the chance of unauthorized access, even when the login credentials are compromised.

3. Regular Security Audits

Routine security checks pinpoint weaknesses before they become a target for exploitation. All tests including penetration tests, code reviews, and compliance audits are crucial during audits to ensure allegiance to different regulations such as PCI DSS or GDPR. Additionally, tools like a domain analyzer can be used to scan for misconfigurations in DNS records and email authentication protocols such as SPF, DKIM, and DMARC, helping uncover vulnerabilities that might otherwise go unnoticed.

4. Zero Trust Architecture

Adopts a Zero Trust framework wherein no entity, either inside or outside the network, is trusted by default. This way, users and devices are continuously verified to prevent insider threats and breaches.

5. Fraud Detection Systems

Utilize AI and machine learning to recognize anomalies in transaction patterns. For example, systems can immediately flag unusual login locations or irregular transaction amounts in real-time, reducing fraudulent activities.

6. Secure APIs

As FinTech apps often integrate with third-party services, securing APIs through authentication, rate-limiting, and encryption is crucial to prevent data leaks and unauthorized access.

7. Cloud Security Measures

As FinTech apps usually communicate with third-party services, APIs should be protected from data leakage and unauthorized access through authentication, rate limitation, and encryption.

8. Compliance Management Tools

Many FinTech apps run on the cloud. Cloud-specific protection in terms of access controls, encrypted backups, and secure configurations are required to counter breaches from the misconfigured cloud environment.

5 Essential FinTech App Security Features

1. Biometric Authentication

The secure and convenient use of identity verification using biometric security features includes facial recognition and fingerprint scanning. Methods here rely on unique physical attributes, making them close to impossible to replicate. As opposed to passwords, the biometric data will be phishing or brute-force attacks. For instance, in integrating into mobile apps, Face ID from Apple and fingerprint authentication by Android merge into the apps to further increase fintech app security while improving usability. To be on the safe side, biometric data should be locally stored on a device after being encrypted.

2. Real-Time Fraud Monitoring

AI-driven fraud detection systems analyze user behavior and patterns in transactions to identify anomalies. These anomalies may include logins coming from unusual locations, among other things, which call for alerts or supplementary verification. For example, in order to flag fraudulent activities quickly, PayPal uses AI algorithms on all transactions. Real-time monitoring builds users’ trust in the app as well as protects it against fraudsters.

3. Data Masking

Data masking is the process where sensitive data is replaced by fictitious but realistic data in processes where the real data is not necessary, like testing environments. This means that even if unauthorized access occurs, the exposed data is non-usable. For instance, a masked credit card number might just display the last four digits and keep the full data away from potential breaches.

4. Role-Based Access Control (RBAC)

RBAC allocates permissions according to a user’s role, making appropriate information available only to employees and third parties who need it for their job, thus minimizing the risk of threats from within and preventing data leakage. For example, a customer service representative may only see account balances, while more senior roles handle sensitive operations such as refunds. The combination of RBAC with regular audits and role updates helps to keep up with changes in the organization.

5. Tokenization

Tokenization replaces credit card numbers with unique tokens which don’t have any exploitable value outside specific transactions. Such a process ensures that, even if hackers intercept these tokens, they won’t get the original data. For example, Visa and MasterCard use tokenization in securing mobile payment systems such as Apple Pay, greatly reducing the risk of exposure of data during transactions.

Top 5 FinTech Apps Security Technologies for 2025

1. Quantum-Resistant Cryptography

As a result of the quantum computing inception, traditional cryptographic techniques such as RSA or ECC might not function effectively anymore. It delivers resilience with respect to protecting data from unauthorized access by cryptographic algorithms whose efficiency is not threatened by a quantum computer attack. These approaches, such as lattice-based cryptography, are under extensive research and testing by entities like the National Institute of Standards and Technology (NIST).

2. AI-Driven Anomaly Detection

Artificial intelligence will become better at detecting fraud and security breaches. Advanced machine learning models can handle vast datasets in real time, identifying subtle anomalies that may include unusual transaction patterns or login attempts from non-typical locations. For example, companies like PayPal and Stripe are already using AI to detect fraudulent transactions with high accuracy.

3. Zero Trust Architecture (ZTA)

ZTA removes implicit trust in a network, ensuring that any user and device trying to gain access will be strictly verified. It thereby reduces the attack surface and keeps sensitive information away from insider threats. The usage is expected to increase through 2025, especially in the highly regulated FinTech industry, as more firms embrace “never trust, always verify” principles.

4. Homomorphic Encryption

This new technology enables computations on encrypted data without decrypting the same. It ensures that even during processing, sensitive data remains secure, providing privacy that is unmatched for financial analytics and fraud detection. Financial institutions are researching applications of homomorphic encryption for privacy-preserving data sharing and analysis.

5. Decentralised Identity Systems

Blockchain-based decentralized identity systems enable users to manage their credentials, supplanting traditional username-password systems. Such systems authenticate the identity of the user using blockchain’s immutable ledger, thereby making the system more secure and less dependent on centralized databases, which are known to be breached. Some examples include Microsoft’s Decentralized Identity solution and initiatives by ConsenSys.

By incorporating these technologies, FinTech companies can ensure they remain ahead in safeguarding user data and maintaining trust in the rapidly evolving cybersecurity landscape.

Conclusion

When it comes to fintech, security is definitely the pillar behind innovation and trust. In an expanding digital financial ecosystem, risks associated with cyberattacks, fraud, and non-compliance to regulations develop and grow with the industry. These issues can be better dealt with by using proactive and multi-layered approaches in security that integrate more complex encryption techniques, AI-based fraud detection, Zero Trust principles, and advanced technologies including homomorphic encryption and decentralized identity systems.

Moreover, these strict security measures are an investment in protecting user data and preserving long-term operational integrity. For developers working on fintech app development, ensuring compliance with regulatory standards like GDPR and PCI DSS is essential, not only to avoid penalties but also to enhance customer trust and confidence in the platforms they deliver.

As we approach 2025, quantum-resistant cryptography and AI-driven anomaly detection will redefine how security challenges are approached, thus setting the stage for more secure and innovative financial services. Security must be a strategic imperative for FinTech companies in this changing landscape, enabling them to protect their users but also drive sustainable growth in an increasingly digital world.

SaaS Development

SaaS Development Web Application Development

Web Application Development Mobile Application Development

Mobile Application Development Custom Software Development

Custom Software Development Cloud Development

Cloud Development DevOps Development

DevOps Development MVP Development

MVP Development Digital Product Development

Digital Product Development Hire Chatbot Developers

Hire Chatbot Developers Hire Python Developers

Hire Python Developers Hire Django Developers

Hire Django Developers Hire ReactJS Developers

Hire ReactJS Developers Hire AngularJS Developers

Hire AngularJS Developers Hire VueJS Developers

Hire VueJS Developers Hire Full Stack Developers

Hire Full Stack Developers Hire Back End Developers

Hire Back End Developers Hire Front End Developers

Hire Front End Developers AI Healthcare Software Development & Consulting

AI Healthcare Software Development & Consulting Healthcare App Development

Healthcare App Development EHR Software Development

EHR Software Development Healthcare AI Chatbot Development

Healthcare AI Chatbot Development Telemedicine App Development Company

Telemedicine App Development Company Medical Billing Software Development

Medical Billing Software Development Fitness App Development

Fitness App Development RPM Software Development

RPM Software Development Medicine Delivery App Development

Medicine Delivery App Development Medical Device Software Development

Medical Device Software Development Patient Engagement Software Solutions

Patient Engagement Software Solutions Mental Health App Development

Mental Health App Development Healthcare IT Consulting

Healthcare IT Consulting Healthcare CRM Software Development

Healthcare CRM Software Development Healthcare IT Managed Services

Healthcare IT Managed Services Healthcare Software Testing services

Healthcare Software Testing services Medical Practice Management Software

Medical Practice Management Software Outsourcing Healthcare IT Services

Outsourcing Healthcare IT Services IoT Solutions for Healthcare

IoT Solutions for Healthcare Medical Image Analysis Software Development Services

Medical Image Analysis Software Development Services Lending Software Development Services

Lending Software Development Services Payment Gateway Software Development

Payment Gateway Software Development Accounting Software Development

Accounting Software Development AI-Driven Banking App Development

AI-Driven Banking App Development Insurance Software Development

Insurance Software Development Finance Software Development

Finance Software Development Loan Management Software Development

Loan Management Software Development Decentralized Finance Development Services

Decentralized Finance Development Services eWallet App Development

eWallet App Development Payment App Development

Payment App Development Money Transfer App Development

Money Transfer App Development Mortgage Software Development

Mortgage Software Development Insurance Fraud Detection Software Development

Insurance Fraud Detection Software Development Wealth Management Software Development

Wealth Management Software Development Cryptocurrency Exchange Platform Development

Cryptocurrency Exchange Platform Development Neobank App Development

Neobank App Development Stock Trading App Development

Stock Trading App Development AML software Development

AML software Development Web3 Wallet Development

Web3 Wallet Development Robo-Advisor App Development

Robo-Advisor App Development Supply Chain Management Software Development

Supply Chain Management Software Development Fleet Management Software Development

Fleet Management Software Development Warehouse Management Software Development

Warehouse Management Software Development LMS Development

LMS Development Education App Development

Education App Development Inventory Management Software Development

Inventory Management Software Development Property Management Software Development

Property Management Software Development Real Estate CRM Software Development

Real Estate CRM Software Development Real Estate Document Management Software

Real Estate Document Management Software Construction App Development

Construction App Development Construction ERP Software Development

Construction ERP Software Development