FinTech Statistics in 2025: Market Trends & Key Insights

- March 10, 2025

-

4877 Views

- by Ishan Vyas

Fintech extends to innovation in the finance industry through better-digitized solutions. There is a growing reliance on AI-powered financial tools, blockchain technology, and mobile payment systems to execute business transactions.

Investment scrutiny in the FinTech space has increased multifold, and the adoption of FinTech services is rising at an exponential rate. Even traditional financial services firms have started embracing digital transformation to retain their market share. The finance industry is experiencing a transformational shift, and FinTech statistics highlight the rapid market growth and changing client preferences. With the rise of FinTech app development, businesses are leveraging innovative solutions to enhance user experience and stay competitive in the evolving financial landscape.

New technologies for contactless payments, digital wallets, and decentralized finance transactions have become common worldwide. Developing economies, in particular, are adopting the features of the global financial technology market very quickly. The overwhelming investment of billions of dollars into contactless payment systems, fintech, and financial services innovation is creating a boom in lending, wealth management, and even insurance.

At the same time, regulatory authorities that embrace innovation but prefer security will have to solve the challenge of creating rules for an increasingly digitized economic environment. With the development of AI and blockchain technology, the service sector of finance will be transformed radically, making the fintech industry a bright prospect.

Fintech Market Growth: An Overview

Fintech refers to the use of software and programmed systems to improve and automate the provision of financial products. It allows companies, businesses, and individuals to manage their economic activities seamlessly through computers and smart devices. Fintech confines functions of banking and other financial institutions, investments, insurance, trading, and even financial risks simplistically.

Alterations in the utilization of the internet and smart devices, along with the increase in the use of digital payments, are some of the key reasons for the rise in the use of financial technology. FinTech statistics show a rapid increase in adoption, especially among younger millennials and Gen-Z consumers

Fintech Statistics: Key Insights and Market Trends

- By April 2021, the value of the global fintech market was USD 226.71 billion, where it is estimated to hover from 2024. Further, the global market for fintech is expected to expand at a compound annual growth rate of 16.8% from 2025 to 2034 until it reaches up to USD 917.17 billion by 2034.

- The total revenue of the global fintech industry surged between 2017 to 2023. The total revenue of the industry in 2023 was estimated at USD 79.38 billion, according to Statista. The estimate showed that in the following years, the revenue of the global fintech sector will increase, projected to exceed USD 141.18 billion by 2028.

- North America led the fintech industry in 2024, with over 12,000 companies, growing slightly from 2023. Europe remained the second-largest hub with 9,200 fintech firms, while the Asia-Pacific had 6,365. The industry expanded steadily from 2008 to 2024, but new fintech startups slowed after 2021. The United States dominated in 2024, hosting five times more fintech unicorns than the United Kingdom.

- Fintech fundraising in India almost doubled to $3.7 billion in 2019 and had larger gains in Singapore, which grew to $861 million.

- Digital payments led the fintech market, with over three billion users in 2024, and are expected to reach 4.45 billion by 2029. Other segments have fewer users, including digital assets, with 860 million, digital investment, with 590 million, and digital banking, with 300 million. Statista Market Insights predicts that all segments will grow, but digital payments will stay dominant.

Key Fintech Trends Shaping the Industry

1. The Increase in Mobile Wallets and Digital Payments

Payment methods such as Apple Pay and PayPal are expected to experience a boom, with e-commerce transactions likely to increase by over 15% each year until 2027. Digital wallets are favoured over traditional payment methods due to their speed, ease, and security on smart devices.

In Asia, mobile wallets are widely accepted, with Alipay and Gojek services helping the unbanked population in regions where banks are scarce. Meanwhile, Latin America and MEA are still behind, though there’s been an increase of digital payment acceptance in emerging markets.

2. Growth of Blockchain and Cryptocurrency Adoption

Blockchain Technology has transformed traditional fintech by enabling decentralized finance (DeFi), which facilitates fast, reliable, and transparent transactions without intermediaries. Financial institutions are embracing blockchain to enhance the efficiency and accessibility of banking, payments, and asset transfer processes.

The Fintech Blockchain market from 2022 is pegged at $10.02 billion and is increasing at a yearly rate of 87.7%. Alongside, the DeFi market, which was valued at $13.61 billion in 2022, is growing at an annual figure of 46% demonstrating the market’s adoption at an accelerated pace.

3. Growth of AI and ML in Fintech Solutions

The introduction of Artificial Intelligence in the FinTech sector has profoundly changed the industry by embedding a customer-centric and efficient approach towards the usage of financial services. AI in FinTech increases operational efficiency, mitigates risks, and simplifies intricate processes so that companies are able to provide more intelligent and rapid solutions. With the ability to analyze huge volumes of data and perform myriad tasks automatically, AI technology opens new doors within the entire complex ecosystem of finance.

AI-powered tools are changing the cadence of engagement between businesses and customers across the globe, from detecting fraud to providing people-centric financial guidance. However, the future expectation suggests that the advancement in AI technology would create deeper penetration within the FinTech sector, thereby driving the industry towards a secure and user-friendly infrastructure.

4. Embedded Finance and Its Significance in E-commerce and Retail

Embedded finance integrates payments, lending, or banking into non-finance domains, transforming them into useful financial services. As an example, a food delivery application allows customers to pay after receiving the order helping them to relish their meal without measuring the need for instant payment.

Customers can shop effortlessly, thanks to instant checkout and “Buy Now, Pay Later.” This feature enables retailers to offer flexible payments, which helps improve sales as well as foster customer loyalty. By using AI-based insights, businesses can tailor financing solutions, which makes shopping even easier. As FinTech continues to progress, the enhancement of embedded finance will further simplify transactions and improve the customer’s shopping experience

Investment and Funding in Fintech

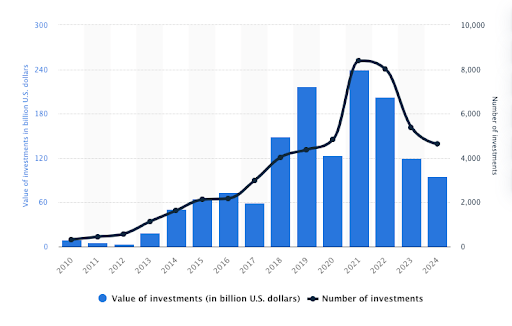

From 2010 to 2019, global hilariously funny technological investment increased significantly, peaking at 216.8 billion U.S. dollars. In 2020, investments plummeted to below 124 billion U.S. dollars but rebounded sharply in 2021 to surpass 239 billion U.S. dollars.

After this peak in 2021, investment plummeted to the lowest values recorded since 2017, with 2024 projected to be the most around this number. While these fluctuations were happening, the majority of investment relied heavily on the Americas, which was measured to be over half of the total investment value.

India ranks third globally in fintech funding in 2024 despite a 33% annual decline to $1.9 billion. The ecosystem showed resilience with two new unicorns and eight IPOs. Significant funding rounds included DMI Finance and Credit Saison, while digital lending solutions dominated funding. Major investors included Peak XV Partners and Elevation Capital.

Final Thoughts on the Market’s Growth Potential

By 2035, AI could increase profitability by 39% across industries, adding an estimated USD 14 trillion in global economic gains. The FinTech sector is rapidly adopting AI and machine learning services to enhance user experience and strengthen security. FinTech statistics show a significant rise in digital finance adoption, making financial interactions more seamless. As more people embrace digital finance, discussing money is becoming easier. 63% of Americans say FinTech has made financial conversations with friends more comfortable.

The focus is shifting toward B2B2X, serving end-users beyond businesses, and B2B, catering to small businesses. FinTech has enormous potential in the B2B space, especially since SMEs worldwide face a staggering USD 5 trillion credit gap each year. Meanwhile, Asia-Pacific is emerging as a FinTech leader, driving 42% of revenue growth. Developing regions like China, India, and Southeast Asia are leading this surge by improving financial accessibility.

Currently, FinTech accounts for only 2% of global financial earnings. However, by 2030, it could grow by USD 1.5 trillion, reaching nearly a quarter of global banking values.

(Source: https://plaid.com/blog/report-the-fintech-effect-2021/ )

Experience FinTech Innovation with Citrusbug Technolabs.

These FinTech statistics show how emerging IT trends are expanding business opportunities and transforming financial operations. When used effectively, FinTech can boost revenue and enhance customer experience.

Citrusbug Technolabs helps businesses stay ahead. From developing next-gen FinTech apps to deploying advanced financial solutions, we focus on your goals and compliance. Our experts design and build digital financial products for B2B, B2C, and P2P markets. We help you deliver seamless digital finance experiences that empower customers while driving real business growth.

Contact us today to take your financial services to the next level!

SaaS Development

SaaS Development Web Application Development

Web Application Development Mobile Application Development

Mobile Application Development Custom Software Development

Custom Software Development Cloud Development

Cloud Development DevOps Development

DevOps Development MVP Development

MVP Development Digital Product Development

Digital Product Development Hire Chatbot Developers

Hire Chatbot Developers Hire Python Developers

Hire Python Developers Hire Django Developers

Hire Django Developers Hire ReactJS Developers

Hire ReactJS Developers Hire AngularJS Developers

Hire AngularJS Developers Hire VueJS Developers

Hire VueJS Developers Hire Full Stack Developers

Hire Full Stack Developers Hire Back End Developers

Hire Back End Developers Hire Front End Developers

Hire Front End Developers AI Healthcare Software Development & Consulting

AI Healthcare Software Development & Consulting Healthcare App Development

Healthcare App Development EHR Software Development

EHR Software Development Healthcare AI Chatbot Development

Healthcare AI Chatbot Development Telemedicine App Development Company

Telemedicine App Development Company Medical Billing Software Development

Medical Billing Software Development Fitness App Development

Fitness App Development RPM Software Development

RPM Software Development Medicine Delivery App Development

Medicine Delivery App Development Medical Device Software Development

Medical Device Software Development Patient Engagement Software Solutions

Patient Engagement Software Solutions Mental Health App Development

Mental Health App Development Healthcare IT Consulting

Healthcare IT Consulting Healthcare CRM Software Development

Healthcare CRM Software Development Healthcare IT Managed Services

Healthcare IT Managed Services Healthcare Software Testing services

Healthcare Software Testing services Medical Practice Management Software

Medical Practice Management Software Outsourcing Healthcare IT Services

Outsourcing Healthcare IT Services IoT Solutions for Healthcare

IoT Solutions for Healthcare Medical Image Analysis Software Development Services

Medical Image Analysis Software Development Services Lending Software Development Services

Lending Software Development Services Payment Gateway Software Development

Payment Gateway Software Development Accounting Software Development

Accounting Software Development AI-Driven Banking App Development

AI-Driven Banking App Development Insurance Software Development

Insurance Software Development Finance Software Development

Finance Software Development Loan Management Software Development

Loan Management Software Development Decentralized Finance Development Services

Decentralized Finance Development Services eWallet App Development

eWallet App Development Payment App Development

Payment App Development Money Transfer App Development

Money Transfer App Development Mortgage Software Development

Mortgage Software Development Insurance Fraud Detection Software Development

Insurance Fraud Detection Software Development Wealth Management Software Development

Wealth Management Software Development Cryptocurrency Exchange Platform Development

Cryptocurrency Exchange Platform Development Neobank App Development

Neobank App Development Stock Trading App Development

Stock Trading App Development AML software Development

AML software Development Web3 Wallet Development

Web3 Wallet Development Robo-Advisor App Development

Robo-Advisor App Development Supply Chain Management Software Development

Supply Chain Management Software Development Fleet Management Software Development

Fleet Management Software Development Warehouse Management Software Development

Warehouse Management Software Development LMS Development

LMS Development Education App Development

Education App Development Inventory Management Software Development

Inventory Management Software Development Property Management Software Development

Property Management Software Development Real Estate CRM Software Development

Real Estate CRM Software Development Real Estate Document Management Software

Real Estate Document Management Software Construction App Development

Construction App Development Construction ERP Software Development

Construction ERP Software Development