How Generative AI Development is Redefining the FinTech Dialogue?

- January 26, 2024

-

2986 Views

- by Ishan Vyas

Generative AI, is a class of AI algorithms that seeks to create new and original material based on patterns in existing data. It has two main components: a generator and a discriminator network. The generator renders fresh data samples, and the discriminator network separates genuine and produced data.

The generator and discriminator networks compete in a learning process in which the generator attempts to make data that the discriminator cannot distinguish from data. Iterative training helps the generator improve its ability to produce high-quality, realistic outputs.

The fast advancement of large language models, which include models with billions or even trillions of parameters, has ushered in a new era. Generative AI models driven by LLMs can generate engaging text, photorealistic visuals, and even funny sitcoms on demand. An AI art generator is one exciting application within generative AI, designed specifically to create original visual art by analyzing and learning from existing artwork. This allows it to produce new images that mimic particular styles or introduce unique concepts, making it a powerful tool for digital artists, designers, and anyone in need of creative visuals.

Generative AI has the potential to bring about numerous changes in the FinTech industry. It might help companies make better decisions, reduce risks, increase customer loyalty, and streamline operations.

With generative AI, FinTech companies may use complex processes that were previously resource- and time-consuming to streamline. Generative AI systems those used in finance, can generate financial data, analyze market trends, and identify investment opportunities on the fly

For financial companies, increasing customer engagement is a top priority, and generative AI might make a big difference in achieving this objective.

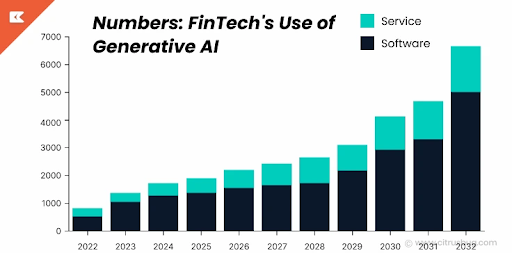

Numbers: FinTech’s Use of Generative AI

The market is anticipated to grow at an astounding CAGR of 22.5% between 2023 and 2032, continuing its meteoric rise. After this thrilling journey, the market is tossed to reach a massive $6.256 billion in size in 2032. What is driving this remarkable expansion? Let’s examine it:

FinTech businesses are adopting the generative AI trend. They are utilizing it to create innovative new goods and services, save expenses, and boost their operating engines.

Mobile payments and digital banking are revolutions, not simply fads! This change comprehends the demand for financial services that combine intelligence with a human touch.

Resources for computation and data are getting easier to get. It indicates that generative AI models are becoming increasingly sophisticated, intelligent, and acute.

This increase shows that the financial sector is becoming more significant about AI & ML and isn’t merely toying with the concept. Prominent financial organizations are already demonstrating the potential of this technological marvel with many fascinating initiatives.

Let’s now explore how generative AI might benefit financial and banking organizations.

Enhancing Client Experiences

Beyond simply improving the back end of the FinTech sector, generative AI development is completely transforming how customers interact with financial services.

1. Tailored Financial Counseling

In the FinTech industry, generating highly customized financial advice is where generative AI truly excels.

Traditional financial consulting services fit many people, but not everyone exactly. They’re similar to one-size-fits-all t-shirts. Conversely, generative AI functions similarly to a personal financial stylist.

To create investment strategies that perfectly suit you, it delves into your financial closet (also known as data), gauges your comfort level with risk, and examines your investing objectives.

It’s not just about satisfying clients; it’s about assisting them in precisely and stylishly reaching their financial goals.

2. Virtual assistants and chatbots

Greetings from the age of quick gratification!

The new MVPs in FinTech are chatbots and virtual assistants that run on generative AI. Imagine having a knowledgeable friend who can quickly respond to your financial questions, provide you with account updates, or even complete transactions on your behalf.

These AI friends never shut off, simplifying consumer lives and saving financial institutions money on overhead. It’s similar to having a nightly financial assistant!

3. An Analysis of Sentiment

In FinTech SaaS products, knowing what customers think is crucial, and generative AI is the best way to gauge sentiment. It sorts through a bunch of text to find out what people are debating about financial services or goods. The text includes reviews, comments, and tweets.

It goes beyond simple math calculations; it’s like instantly gauging the atmosphere of space. Businesses can sense customer moods fast, adjust their offerings, and maintain happier, more devoted customers.

4. Fraud Detection

Generative artificial intelligence is the unsung hero we never knew we needed in the complex world of financial crime. It functions primarily like a sophisticated investigator, continuously examining transaction trends to identify unusual activity.

Notice something strange about this transaction? Whoa! It’s detected using AI. It increases clients’ faith in transaction security while protecting them from losing their hard-earned money.

Streamlining FinTech via Automation and Efficiency: The Effect of Generative AI

In the FinTech software development industry, generative AI is like a superpower for efficiency. Let’s see how it’s automating tedious tasks, cutting expenses, and modernizing procedures.

1. Reducing Operating Expenses

In the financial industry, operational costs can be a significant pain. Let us introduce generative AI, your efficiency guru. It substitutes time-consuming and resource-consuming operations like data input, document processing, and customer service.

This AI aims to eliminate mistakes that people may make in addition to reducing expenses. Routine tasks require fewer workers, which increases savings and improves operations.

2. Streamlining Back-Office Functions

Generative AI is the perfect organizer in the back office, where the magic of money happens. It handles necessary but, let’s face it, uninteresting activities like data reconciliation, record-keeping, and compliance assurance.

The human workforce can concentrate on the intricate and creative tasks that machines simply cannot replicate, as AI development services take care of these.

3. Intelligent Agreements

Smart contracts and blockchain are the newest members of the FinTech community. As the attorney, generative AI drafts intelligent contracts for a financial transaction, including loans and insurance.

These AI-generated contracts eliminate the intermediary and save time and money when conditions are fulfilled.

4. Simplifying KYC and Customer Onboarding

KYC (Know Your Customer) and customer onboarding are essential but time-consuming processes. AI synthesis to the rescue. Identity checks and risk evaluations are automated, which expedites the entire process. Customers will enjoy a speedier, more comfortable ride, and regulations will be supported.

Predictive Models and Data Analytics

Not only is generative AI breaking the rules, but it’s also thoroughly rewriting the rules for data analytics and financial prediction modeling. Let’s explore how it’s granting financial firms some useful advantages.

1. Evaluation of Risk and Credit Rating

The evaluation of credit risk is the lifeblood of FinTech businesses. Financial organizations may see a more accurate, real-time picture of creditworthiness, which works like a crystal ball. These days, it goes beyond simply analyzing transaction history.

AI looks into everything, including unusual data and your tweets, to provide a more complete picture of credit risk. It entails reducing bad loans as well as providing access to the financial system for those who were excluded.

2. Allocating Assets and Managing Portfolios

Generative AI is similar to a financial guru for asset managers and investors. It juggles many elements, including world events and economic trends, and instantly modifies portfolios.

The outcome? Improved allocation of resources, increased returns, and more astute risk management. As a financial counselor, it’s similar to owning a supercomputer.

3. Algorithms for Trading and Market Forecasting

Generative AI is the newest child in trading. It quickly makes trades by consuming vast amounts of market data.

Additionally, it recognizes patterns and trends in the market that even the most astute human traders might overlook. Better returns and less instability in the market translate into better sailing for financial institutions.

4. Reporting and Compliance with Regulations

Getting around the maze of banking regulations? AI generatively takes care of it. Automating the tedious task of tracking and reporting transactions helps financial firms avoid regulatory penalties.

Consider it as an attentive watchdog that makes sure the intricate web of compliance is managed properly, sparing institutions from costly fines and hassles.

Difficulties and Prospects: Defining AI’s Path in FinTech

It’s not all sailing as we accelerate into the future of generative AI in the FinTech industry. There are some rough seas and unfamiliar ground ahead.

1. Data Requirements

The focus shifts to scaling and resource requirements as generative AI gains traction in the FinTech industry. These AI models require a lot of gasoline, processing power, and a good road, or large datasets, to function, much like sports vehicles.

FinTech’s smaller firms may find this challenging, and the industry may end up in a David vs. Goliath situation.

2. Combining AI and Traditional Finance

Integrating generative AI with their antiquated systems is like attempting to put a square peg in a round hole for large, established financial institutions. It’s difficult, expensive, and requires the appropriate kind of skill.

However, they risk falling behind in the race if they don’t join the AI party.

3. Anticipating Unexpected Turns

The FinTech industry has a lot of surprises in store because AI is developing so quickly. It is essential to be prepared for unanticipated changes and obstacles.

After all, there are often storms in the finance industry, and adaptability and resilience are necessary to stay afloat.

What’s Next?

In conclusion, generative AI has put custom software development services on the verge of a revolution. This path is regarding cooperation, astute adaptability, and responsible AI development from altering customer experiences to addressing ethical issues.

SaaS Development

SaaS Development Web Application Development

Web Application Development Mobile Application Development

Mobile Application Development Custom Software Development

Custom Software Development Cloud Development

Cloud Development DevOps Development

DevOps Development MVP Development

MVP Development Digital Product Development

Digital Product Development Hire Chatbot Developers

Hire Chatbot Developers Hire Python Developers

Hire Python Developers Hire Django Developers

Hire Django Developers Hire ReactJS Developers

Hire ReactJS Developers Hire AngularJS Developers

Hire AngularJS Developers Hire VueJS Developers

Hire VueJS Developers Hire Full Stack Developers

Hire Full Stack Developers Hire Back End Developers

Hire Back End Developers Hire Front End Developers

Hire Front End Developers AI Healthcare Software Development & Consulting

AI Healthcare Software Development & Consulting Healthcare App Development

Healthcare App Development EHR Software Development

EHR Software Development Healthcare AI Chatbot Development

Healthcare AI Chatbot Development Telemedicine App Development Company

Telemedicine App Development Company Medical Billing Software Development

Medical Billing Software Development Fitness App Development

Fitness App Development RPM Software Development

RPM Software Development Medicine Delivery App Development

Medicine Delivery App Development Medical Device Software Development

Medical Device Software Development Patient Engagement Software Solutions

Patient Engagement Software Solutions Mental Health App Development

Mental Health App Development Healthcare IT Consulting

Healthcare IT Consulting Healthcare CRM Software Development

Healthcare CRM Software Development Healthcare IT Managed Services

Healthcare IT Managed Services Healthcare Software Testing services

Healthcare Software Testing services Medical Practice Management Software

Medical Practice Management Software Outsourcing Healthcare IT Services

Outsourcing Healthcare IT Services IoT Solutions for Healthcare

IoT Solutions for Healthcare Medical Image Analysis Software Development Services

Medical Image Analysis Software Development Services Lending Software Development Services

Lending Software Development Services Payment Gateway Software Development

Payment Gateway Software Development Accounting Software Development

Accounting Software Development AI-Driven Banking App Development

AI-Driven Banking App Development Insurance Software Development

Insurance Software Development Finance Software Development

Finance Software Development Loan Management Software Development

Loan Management Software Development Decentralized Finance Development Services

Decentralized Finance Development Services eWallet App Development

eWallet App Development Payment App Development

Payment App Development Money Transfer App Development

Money Transfer App Development Mortgage Software Development

Mortgage Software Development Insurance Fraud Detection Software Development

Insurance Fraud Detection Software Development Wealth Management Software Development

Wealth Management Software Development Cryptocurrency Exchange Platform Development

Cryptocurrency Exchange Platform Development Neobank App Development

Neobank App Development Stock Trading App Development

Stock Trading App Development AML software Development

AML software Development Web3 Wallet Development

Web3 Wallet Development Robo-Advisor App Development

Robo-Advisor App Development Supply Chain Management Software Development

Supply Chain Management Software Development Fleet Management Software Development

Fleet Management Software Development Warehouse Management Software Development

Warehouse Management Software Development LMS Development

LMS Development Education App Development

Education App Development Inventory Management Software Development

Inventory Management Software Development Property Management Software Development

Property Management Software Development Real Estate CRM Software Development

Real Estate CRM Software Development Real Estate Document Management Software

Real Estate Document Management Software Construction App Development

Construction App Development Construction ERP Software Development

Construction ERP Software Development