Fintech SaaS Product: Types, Features & Development Steps

- May 19, 2023

-

5750 Views

- by Ishan Vyas

What is FinTech?

The emerging technology world is attracting all industries to rely on it. From healthcare to finance, all industries have their own digital platforms for their services and solutions. Fintech, a word that stands for financial technology, has made a huge impact globally.

Fintech is the colloquial term for the financial sector’s digitalization. Examples are digital banking apps, trading platforms, NFT, cryptocurrency, digital wallets, etc.

The above-mentioned mobile applications or software-as-a-service platforms are categorized in the industry of financial operations. This industry has grown in popularity since COVID-19, and a large crowd has gathered around it. The market for the fintech industry is expected to increase at a CAGR of 26.3% from USD 145.6 billion in 2022 to USD 942.7 billion by 2030.

SaaS solutions for fintech products are the new trending market for investment. However, building such applications or platforms requires software development expertise. The solution is to choose a suitable agency for your fintech product development.

Define SaaS Fintech Products:

Fintech SaaS refers to software applications delivered over the internet, allowing financial institutions, startups, or service providers to offer financial products and services to customers on a subscription basis. In the software industry, several fintech development companies offer digital financial services. From net banking to digital payments, various types of products offered by fintech firms are built on the SaaS concept, be it vertical or horizontal SaaS.

While expertise in fintech development is crucial for building a secure and scalable fintech SaaS application it also requires a strong foundation in cloud technologies. Thus, partnering with a reputable cloud development company with experience in the financial sector can be a wise decision. These companies possess the necessary infrastructure and expertise to build robust cloud-based fintech solutions.

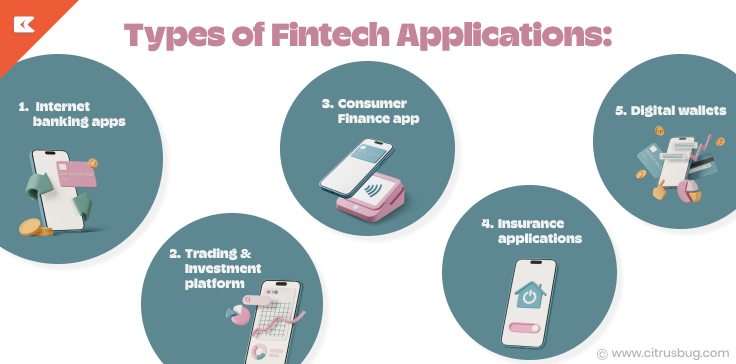

Types of Fintech SaaS Applications:

On the market, many SaaS fintech applications are available for financial transactions. The financial industry is as vast as an ocean, and there are numerous opportunities and business models available. Most finance business owners are investing in fintech startups to benefit from a high ROI. Here are a few fintech SaaS application examples:

Internet Banking Apps:

The development of SaaS net banking applications for fintech has simplified life. A few clicks on mobile applications have taken the place of the hassle of driving to banks and losing time in lines. Additionally, there are now banks that only operate online. In the USA, banks like Acrons, Current, Chime, Ally Mobile, etc. are the top-ranked net banking applications. They enable users to open accounts, process payments, manage them, and use them online for all their financial regulatory requirements.

Trading and investment platforms:

Such SaaS fintech applications offer handy services that include stocks, forex, and the capital market. They aid in the creation, administration, and trading of your investment. By engaging in online trading, these applications assist you in making money. Some of the best examples of stock trading and investing applications are Robinhood, Webull, Cash App, Firsttrade, E-trade, etc.

Consumer Finance Apps:

Applications for consumer finance are the ones that aid in money management. The application helps you save money and manage your expenses.

Insurance Applications:

These apps serve the insurance industry, both businesses and customers. This kind of system can be anything from a specific CRM on an insurance provider’s website to a mobile app. Also, for customers, that allows them to view all their insurance policies and add more if necessary. Additionally, they are a key driver in the ongoing insurance transformation, enabling customers to view all their policies, manage claims, and add new coverage with ease.

Digital Wallet:

This is the perfect example of what the term “digitalization” implies: digital wallet creation. Digital wallets aim to let users store their finances and make online payments. Examples of digital wallets are ApplePay, Paypal, Paytm, GPay, etc.

Top 10 SaaS Examples of Fintech Products

The SaaS development industry has grown in popularity among various businesses. Several fintech SaaS companies are indulgent in their efforts to meet the needs of their customers. The fintech industry is creating opportunities for SaaS companies to build various applications. Here are the top 10 SaaS examples for fintech software products.

Shift Technology:

Shift Technology is an AI-native fintech SaaS solution. It aims to assist companies in preventing fraud and automating claims in the event of unforeseen events. Their AI-driven technology supports their customers in making trustworthy and precise insurance selections.

Khatabook:

Khatabook is one of the world’s fastest-growing SaaS businesses. Micro, small, and medium-sized institutions can use it to safely track their financial transactions.

MANTL:

MANTL is a SaaS enterprise business model. It assists consumers in opening deposit accounts quickly and from any device. Every year, their technology aids firms in raising core deposits worth billions of dollars.

Stripe:

The most successful fintech SaaS example is Stripe. Stripe offers various products like global payments, bank-as-a-service, revenue, and financial automation. Stripe is an application serving the finance industry that allows you to accept online payments across the world.

ZETA:

Zeta is a provider of cloud-based banking and payment solutions for businesses and banks. It offers users options for managing employee payments, collecting payments from customers, and paying vendors.

GuideWire:

GuideWire is a company that offers cloud-based and AI-based solutions. The main goal is to manage and monitor insurance policies. Solutions for managing insurance claims, insurance billing, underwriting, and policy administration are some of its products. Additionally, it provides solutions for sales, underwriting, and predictive risk analysis.

Riskified:

Riskified is an AI-based eCommerce solution for preventing payment fraud. It makes use of machine learning algorithms and big data analytics to provide organizations with payment insights that let them approve or deny transactions.

Pilot.com:

Pilot.com serves a plate of services like bookkeeping for companies and advisory CFO support to help businesses upscale. This platform helps run the firm’s finances.

BitSight:

BitSight is a cloud-based fintech SaaS application that provides cyber-risk management solutions. It offers financial management solutions for businesses in the service sector, retail, healthcare, manufacturing, and educational sectors.

JusPay:

JusPay is a platform that delivers end-to-end payment solutions. It offers payment gateways, UPI full-stack solutions, unified solutions for all your payout needs, and many more.

Key Features of the Fintech SaaS Product

When you want to build a fintech SaaS product, the main concerns are features that keep your SaaS application on target. Well, out in the market, there are plenty of SaaS companies that provide highly scalable and secure fintech SaaS applications. Let’s understand the features that are considered while building fintech SaaS applications.

Insightful user-interface:

The most engaging feature is to build an easy-to-use and attractive user interface. The user interface signs in rapidly and helps with a better understanding of the processing steps.

Security:

Security in fintech products is the most difficult and important aspect that business owners must be satisfied with. The fintech industry is directly connected to the financial sector and money transactions. High security and data management standards are required for fintech SaaS applications.

Payment gateways:

SaaS fintech applications must not face any hassle with financial tasks like money transfers, online payments, and balance checking. Also, the payment gateway feature needs high security. Nowadays, AI and cloud computing have created an easy pathway for such tasks.

User management:

Users have many options with fintech SaaS. For instance, clients can decide whether to build single-user or multi-user support depending on their needs. Mostly to manage user data and their financial services, such features are used.

Customized experience:

When an app is created with their needs in mind, users adore it. Users must be given the option to filter the information they get (such as push alerts), at the very least.

AI-powered features:

Many fintech SaaS applications leverage AI-powered chatbots to enhance user experience and automate customer support tasks. Consider partnering with an AI chatbot development company to integrate these intelligent chat functionalities into your fintech SaaS product. Their expertise in AI and chatbot development can significantly improve user engagement and streamline customer interactions.

Steps to Building a SaaS Fintech Product

Let’s move on to the section on the development of the SaaS fintech product now that we have a solid understanding of it. Here are the proven steps to building a fintech SaaS product.

Pilot the research:

When you decide to build your fintech solution software, the important thing is to research it. So what kind of software or application are you looking to build? Will it be helpful for specific industries and services, or will it be general?

While conducting research, you must analyze your target audience, end-consumer, and scope of work.

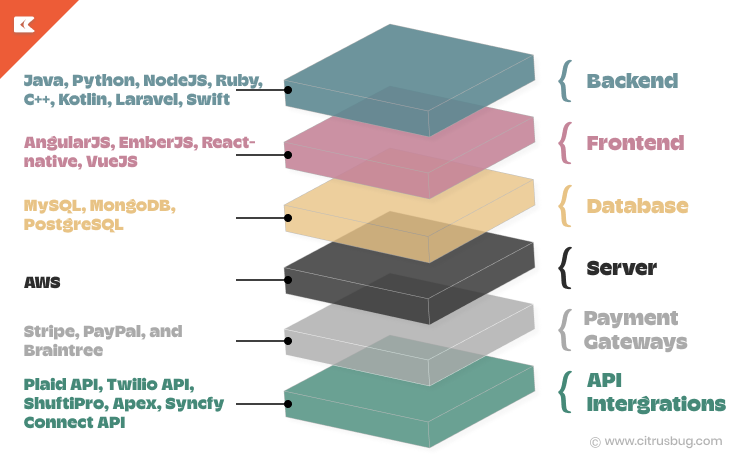

Selection of the Technology Stack:

After comprehending the scope of work, it’s crucial to define a well-structured process for developing a digital product to choose the right technologies for your development.

Fintech SaaS applications are challenging and diversified to build; they need a rich technology stack. Here is a list of the technologies that you can select for the fintech SaaS development process.

Backend: Java, Python, NodeJS, Ruby, C++, Kotlin, Laravel, Swift

Frontend: Angular.Js, EmberJS, React-native, VueJS

Database: MySQL, MongoDB, PostgreSQL

Server: AWS

Payment Gateways: Stripe, PayPal, and Braintree

API Integrations: Plaid API, Twilio API, ShuftiPro, Apex, Syncfy Connect API

Gather a dedicated team:

After gathering the scope of work and realizing the technology stack, choose the team to work on your project. UI/UX designers, backend developers, frontend developers, project managers, and DevOps developers will be required.

So, how many developers you need on board is based on the size of your type of fintech application.

If you already have a team in-house, you can get started right away. Otherwise, you’ll need to either hire a team or outsource your project to a SaaS development company. Outsourcing companies can help you with end-to-end SaaS solutions. By choosing the outsource option for your SaaS business projects, you avail yourself of various benefits. SaaS development companies like Citrusbug offer affordable and highly robust development services. Such companies handle the whole development cycle along with automatic updates. Additionally, outsourcing your SaaS business project allows you to hire specialists, which takes less time overall.

Make a prototype and workflow:

Whenever you build software or a web application, making a prototype is necessary for better understanding and a better user experience. Prototyping with sketches and enhancing them with a click creates a clear image.

UI/UX design:

Once your prototype is ready, you can start developing a full-scale UI/UX design. The UI/UX design of a fintech application must be user-engaging and easy to use. The steps must be designed as a way of guiding the user and keeping them simple and coherent.

Develop and check MVP:

Developing a Minimum Viable Product (MVP) is a critical step in the fintech development process. An MVP provides invaluable insights into user behavior and helps validate product-market fit. Partnering with an experienced MVP development company can significantly accelerate this phase, ensuring your product is aligned with user expectations. Rigorous testing is essential to verify the MVP’s functionality and performance.

Launch and Updates:

Launching and updating a Fintech SaaS (Software-as-a-Service) product will be the final step to the completion of your project. By posting it on the appropriate app stores, websites, or platforms, the application or software will be made available to the public. Furthermore, release app updates regularly to fix bugs, improve performance, and add new features. Consider user feedback and market trends when planning updates.

Throughout the process, it is important to prioritize safety and compliance with relevant regulations and industry standards. In addition, fintech SaaS applications may require partnerships with financial institutions and other third-party service providers to ensure seamless integration with banking systems and payment gateways.

Such integrations often rely heavily on banking IT services to maintain robust security and efficiency

Fintech Product Regulations are Followed as per Country

Fintech SaaS applications are related to money transactions and are subject to government compliance. If you are looking to invest in making a fintech SaaS product, you must educate yourself about the regulations in your region.

Fintech regulation in the US:

Building a business in the financial sector requires support from the legal system and the government. There are some types of compliance regulations in the US that you need to know before investing in the financial industry.

- Electronic Fund Transfer Act (EFTA): EFTA shields the funding transfer using credit cards, online payments, ATMs, and any electronic transactions.

- Fair Credit Reporting Act (FCRA): The FCRA regulates how financial institutions collect and use data from consumer reports.

- Anti-Money Laundering Acts (AML): AML incorporates the Bank Secrecy and Patriot Acts and reports control anti-money laundering, such as global transactions.

- Gramm-Leach Bliley Act (GLBA): This law requires financial services and discloses how we store and share your information.

- Jumpstart our business startup acts (JOBS): JOBS is a set of requirements for crowdfunding platforms. The law includes requirements for disclosure, registration, and funding restrictions.

Fintech regulation in the UK

The United Kingdom doesn’t have a unified administrative system for fintech companies. Subsequently, monetary SaaS companies must assess their business’s sort, scale, and estimate to see if it falls inside the administrative border.

- FCA Handbook Rules and Guidance: The FCA Handbook encloses banks, investment companies, insurance companies, and other financial services.

- Prudential Regulation Authority Rulebook: The PRA Rulebook builds up criteria for monetary education and assesses the hazard these companies pose to the market’s capacity to preserve its money-related stability.

Fintech regulation in the EU

A wide range of European Union legislation covers different types of financial services. The most commonly followed regulations are:

- Payment Service Directives (PSD): PSD1 and PSD2 define requirements for consumers and providers of electronic payment services. This includes liability for transactions, refunds, payment cancellations, and unauthorized payment instruments.

- General Data Protection Regulation (GDPR): The GDPR regulates how fintech companies process customer data and how it is transferred outside the European Economic Area.

- Fintech Action Plan (FAP): It establishes standard operating procedures for retail payments, digital finance, and crowdfunding platforms.

- Markets in Financial Instruments Regulation (MiFIR): MiFIR emphasizes openness in all trading processes and imposes requirements on investment firms and trading platforms.

Conclusion:

The world is revolving around digitalization and enhancing itself daily. All industries are trying to give a digital touch and offer flexibility to customers. The financial sector provides a range of online services and products as well. The fintech sector is currently growing its market by offering fintech SaaS applications. All services, including bank account opening and international money transfers, are available through your mobile device with just a few clicks.

In this blog, we learned about fintech, its industry, and how you can build a SaaS fintech product. Additionally, you gained a fundamental understanding of the financial technology sector and the various international laws and regulations. If you intend to develop a fintech product, make sure you are familiar with the rules and laws. As the fintech industry continues to redefine financial services, navigating SaaS application development challenges becomes imperative for sustained success and innovation.

SaaS Development

SaaS Development Web Application Development

Web Application Development Mobile Application Development

Mobile Application Development Custom Software Development

Custom Software Development Cloud Development

Cloud Development DevOps Development

DevOps Development MVP Development

MVP Development Digital Product Development

Digital Product Development Hire Chatbot Developers

Hire Chatbot Developers Hire Python Developers

Hire Python Developers Hire Django Developers

Hire Django Developers Hire ReactJS Developers

Hire ReactJS Developers Hire AngularJS Developers

Hire AngularJS Developers Hire VueJS Developers

Hire VueJS Developers Hire Full Stack Developers

Hire Full Stack Developers Hire Back End Developers

Hire Back End Developers Hire Front End Developers

Hire Front End Developers AI Healthcare Software Development & Consulting

AI Healthcare Software Development & Consulting Healthcare App Development

Healthcare App Development EHR Software Development

EHR Software Development Healthcare AI Chatbot Development

Healthcare AI Chatbot Development Telemedicine App Development Company

Telemedicine App Development Company Medical Billing Software Development

Medical Billing Software Development Fitness App Development

Fitness App Development RPM Software Development

RPM Software Development Medicine Delivery App Development

Medicine Delivery App Development Medical Device Software Development

Medical Device Software Development Patient Engagement Software Solutions

Patient Engagement Software Solutions Mental Health App Development

Mental Health App Development Healthcare IT Consulting

Healthcare IT Consulting Healthcare CRM Software Development

Healthcare CRM Software Development Healthcare IT Managed Services

Healthcare IT Managed Services Healthcare Software Testing services

Healthcare Software Testing services Medical Practice Management Software

Medical Practice Management Software Outsourcing Healthcare IT Services

Outsourcing Healthcare IT Services IoT Solutions for Healthcare

IoT Solutions for Healthcare Medical Image Analysis Software Development Services

Medical Image Analysis Software Development Services Lending Software Development Services

Lending Software Development Services Payment Gateway Software Development

Payment Gateway Software Development Accounting Software Development

Accounting Software Development AI-Driven Banking App Development

AI-Driven Banking App Development Insurance Software Development

Insurance Software Development Finance Software Development

Finance Software Development Loan Management Software Development

Loan Management Software Development Decentralized Finance Development Services

Decentralized Finance Development Services eWallet App Development

eWallet App Development Payment App Development

Payment App Development Money Transfer App Development

Money Transfer App Development Mortgage Software Development

Mortgage Software Development Insurance Fraud Detection Software Development

Insurance Fraud Detection Software Development Wealth Management Software Development

Wealth Management Software Development Cryptocurrency Exchange Platform Development

Cryptocurrency Exchange Platform Development Neobank App Development

Neobank App Development Stock Trading App Development

Stock Trading App Development AML software Development

AML software Development Web3 Wallet Development

Web3 Wallet Development Robo-Advisor App Development

Robo-Advisor App Development Supply Chain Management Software Development

Supply Chain Management Software Development Fleet Management Software Development

Fleet Management Software Development Warehouse Management Software Development

Warehouse Management Software Development LMS Development

LMS Development Education App Development

Education App Development Inventory Management Software Development

Inventory Management Software Development Property Management Software Development

Property Management Software Development Real Estate CRM Software Development

Real Estate CRM Software Development Real Estate Document Management Software

Real Estate Document Management Software Construction App Development

Construction App Development Construction ERP Software Development

Construction ERP Software Development