Certified Insurance Software Development Company By

Our Insurance Software Development Services Include

Insurance Claims Management Software

Computerize the claims processing with real-time tracking and fraud detection. Ensure accuracy, less manual effort and offer faster resolution of claims to increase customer satisfaction.

Insurance Policy Management Software

Make policy making, renewals and cancellations easy through a centralized system. Promote quality control, adherence, and smooth management of various insurance products and consumer segments.

Insurance Underwriting Software

Streamline effective risk evaluation using automated underwriting applications. Improve decision-making, minimize mistakes and get faster approval of decisions to streamline the insurance workflow.

Insurance Compliance Management Software

Make sure that your operations are in line with the changing regulations. Our compliance management software offers maximum transparency and accountability through audit-ready reporting, monitoring, and governance.

Insurance Billing and Quoting Software

Simplify premium billing, invoicing, and quote generation. Deliver transparent, accurate, and faster processes that improve trust and strengthen client relationships.

Insurance Fraud Detection Software

Defend revenue using AI-based fraud detection software. Detect red flags, reduce risk, and increase operational security of both the insurers and policyholders.

We're an AI-Driven Insurance Software Development Company

Insurance is a complicated business that deals with the administration of policies, claims and management of compliance. Manual processes and disjointed data can slow down decision-making, add to costs and become burdensome to insurers and customers alike.

Citrusbug Technolabs develops custom insurance software systems that automate routine tasks, centralize information and provide accuracy. Our solutions simplify claims, policy and underwriting processes and maintain operations that are compliant and efficient.

With AI, machine learning, and advanced analytics, our platforms identify anomalies, forecast trends, and provide actionable insights. This enables insurers, brokers and insurtech startups to minimize mistakes, become more efficient in operations and provide a better experience to policyholders.

Are you searching for the best insurance software development company in India and the USA?

Connect with our experienced insurance software developers for expert guidance and customized solutions that perfectly align with your business goals.

Our Insurance Software Development Solutions

Intelligent Document Processing

Automate the process of document capture, classification, and extraction to minimize the number of human errors, workflow automation, and expedited insurance procedures that are more accurate.

Personalized Insurance Recommendations

Utilize AI and customer data to provide differentiated product recommendations, which will work best in terms of policy conversions and customer satisfaction.

Custom CRM Platforms

Develop insurance-specific CRMs that track leads, manage policies, and strengthen customer relationships with integrated communication and analytics.

Insurance Data Analytics

Turn raw insurance data into practical models to assist insurers in better risk models, pricing strategies, and decision-making in general.

Insurance Document Management System

Store, organize and keep all insurance records in a centralized system that is compliant and can be easily accessed.

Insurance Claim Adjustment Solutions

Automated workflows, real-time tracking, and better accuracy can help the claim adjuster get better resolutions faster.

Insurance API Development and Integration

Create and integrate APIs that link the insurance system to payment gateways, compliance, and third-party applications to flow seamlessly.

Insurance Chatbot Development

Increase customer service through AI chatbots, which can offer quick replies, handle policy-related inquiries, and process claims effectively.

End-to-End Digital Transformation

Upgrade older insurance environments using cloud-native, AI-based platforms to help them scale, comply, and engage customers better.

How Much Does It Cost to Develop Insurance Software?

The cost of developing insurance software typically starts at $50,000 for a basic solution and can go beyond $500,000 for a feature-rich enterprise platform.

Every project is unique and requires different features. So share your requirements with us by filling the form, and we will provide you accurate estimate.

Next-Gen Insurance Technologies

We provide insurers with new digital solutions that improve efficiency, achieve greater security, and become more innovative, making it smarter and future-ready insurance systems.

AI and Machine Learning

Our AI/ML services are applied in predictive underwriting, risk assessment, fraud detection, and personalized recommendations, which help insurers make smarter and faster business decisions

Robotic Process Automation (RPA)

RPA is used to automate tedious insurance operations, including claims verification, policy renewals, and reporting, increasing the accuracy and decreasing operational expenses.

Internet of Things (IoT)

IoT-enabled insurance models utilize connected devices for real-time risk monitoring, usage-based premiums, and faster claims verification.

Blockchain Solutions

Blockchain guarantees secure records of policies, clear claims, and transactions, which are resistant to fraud and create trust in the insurance ecosystem.

Cloud-Native and API-First Platforms

We build cloud-based, scalable, compliant, and API-driven systems that have smooth integration with CRM, payment systems, and third-party applications.

Insurance Business Models We Support

-

Peer-to-Peer (P2P) Insurance

Establish community-based resources where members combine their resources and share risks. This is a cost-saving method that builds trust and fosters protection among policyholders.

-

Microinsurance

Provide affordable, targeted coverage for underserved or low-income segments. These policies protect health, life, or property with minimal premiums and simple, easy-to-access enrollment.

-

On-Demand and Short-Term Insurance

Facilitate temporary and flexible coverage of travel, events, or daily coverage. The digital platforms allow customers to activate policies immediately, guaranteeing them protection at the time when it is needed the most.

-

Usage and Lifestyle-Based Insurance

Provide custom insurance policies with variable premiums depending on actual usage, behavior, or lifestyle information. This enhances healthiness, equity, and better pricing for the policyholders.

Process We Follow For an Insurance Software Development

We begin by understanding your insurance needs, compliance requirements, and customer expectations. Our research and analysis produce a roadmap that provides an easily quantifiable value.

Our design ensures insurance platforms are intuitive, user-friendly, and secure. We develop interfaces that make things easy for the agents, customers and administrators.

We develop a tailored insurance software based on modern technologies and proven frameworks that is scalable, compliant, and future-ready. From claims to policies, every feature is reliable.

We deliver solutions that exceed expectations through an agile approach. Our commitment to quality ensures insurance software stays efficient, adaptable, and business-ready.

Why Choose Citrusbug Technolabs as Your Insurance Software Development Agency?

Our insurance software development company is rated 4.7 on Clutch with 30+ client reviews, and we’re a top-rated plus agency on Upwork. We proudly maintain a 97% job success rate and have successfully delivered 500+ projects, showcasing our commitment to quality, reliability, and client satisfaction.

Transparency & Integrity

We embrace transparency and integrity by keeping your insurance software ideas under strong policies of NDA, which ensures confidentiality and trust during the process of development.

On-time Delivery

Our developers operate in organized milestones and ensure that the insurance software solutions are delivered in time, so that you get full peace of mind and are ready to enter the market in time.

Cost-Efficient

We offer quality insurance software at affordable rates, which will guarantee you the best value without affecting performance, compliance, and security.

Deep Technical Knowledge

With expertise in insurance domain software, our developers design state-of-the-art solutions — from policy management systems to claims automation and underwriting platforms.

QA and Testing

Before launching, our committed QA team makes sure that your insurance software is completely tested and bug-free, and meets industry standards.

24x7 Availability

We provide 24x7 support. Whether it’s queries on claims modules, policy workflows, or compliance updates, we’re always just a call or message away.

Client Testimonials (We're Rated 4.7 on Clutch)

Some Top-Notch Fintech Software Projects We Developed

We built an extensive SaaS architecture that helps businesses connect the dots between conceptualization and funding. Through Prolendly, we allowed users to securely onboard resources for Capital Consulting as well as Business Credit Building.

Prolendly creates a lot of value for users as they can onboard resources, collect payments, add tasks and update profiles for their customers. Through such a platform, users can increase trust and professionalism for their customer relations. This scalable SaaS platform supports a massive user base with constant ongoing enhancements and updates.

Profit Frog is a budgeting and forecasting software tailored for small businesses, aiming to alleviate uncertainty and empower informed decision-making. By enabling users to model future profitability and analyze various scenarios, Profit Frog facilitates the creation of dynamic business plans that adapt to changing conditions. With a focus on simplicity, clarity, and actionability, Profit Frog transforms the complex task of financial forecasting into an intuitive and accessible process.

Cicada is a trading platform designed for individuals and organizations to trade securities such as stocks, bonds,futures, and options. It provides users with a user-friendly interface that is easy to navigate, even for beginners. It is a comprehensive trading platform that offers a range of features and tools to help traders of all levels make informed investment decisions easily and interactively.

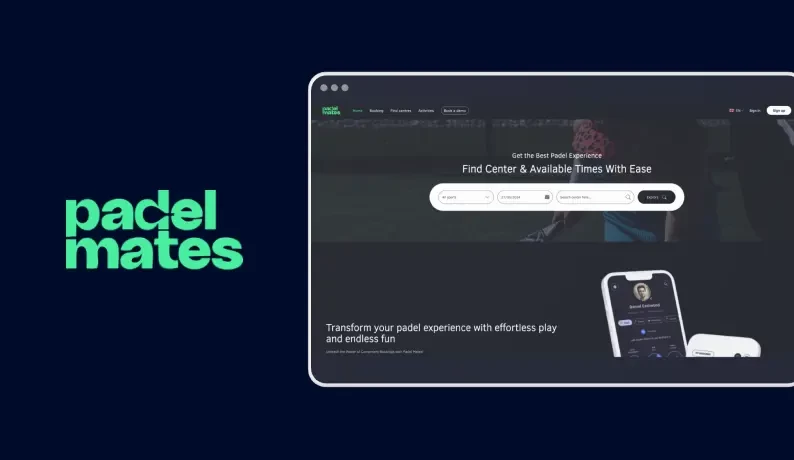

PadelMates is a comprehensive sports booking app catering to racket sport enthusiasts worldwide. Designed to streamline the booking process, it offers users the convenience of booking courts, matches, training sessions, and tournaments at their preferred venues effortlessly. Whether it's padel, tennis, badminton, pickleball, or squash, PadelMates provides a seamless platform to connect venues and players, ensuring maximum playing time and enjoyment.

Latest Posts on Fintech Software Development

FAQs on Insurance Software Development

Insurance software is a digital product that automates and controls the most common insurance activity, which is policy administration, claims processing, underwriting, risk assessment, compliance and reporting.

The main advantages of custom insurance software are enhanced data accuracy, reduced manual errors, efficiency, which allows real-time insights, regulatory compliance, and scalable growth.

We create policy management solutions, claims processing solutions, underwriting solutions, risk management solutions, compliance solutions, billing solutions, agency management solutions, and bespoke insurtech solutions.

Yes, we apply AI and machine learning in automation processes, fraud detection, risk anticipation, and provide clear insights for quick decision-making.

Our software serves various industries, including life insurance, health insurance, auto insurance, property and casualty, reinsurance, and insurtech startups, where the solutions are in the requirements of the industry.

The timeframes of the development can differ depending on complexity, features and integration needs. Small projects require 2 to 3 months, a mid-sized platform requires 4 to 6 months and a complex business solution requires 9 to 15 months or more.

Yes, we offer API development and easy third-party integration to integrate with CRMs, payment gateways, legacy systems, and other systems.

Yes. Our solutions align with the industry regulations, including IRDAI, HIPAA, GDPR, SOC 2, and PCI DSS, which guarantee full data security, privacy, and compliance in all insurance modules.

Yes, we offer 24/7 access, including constant maintenance and updates to keep your insurance software running well and keep it up to date.

Absolutely. We help insurtech startups to build MVPs, scalable platforms, and AI-driven solutions to validate ideas and grow efficiently.

Our security practices are strong and effective, such as encryption, role-based access, secure API, and adherence to industry standards of data protection.

Collaboration with a specialized agency will guarantee access to domain knowledge, AI-based technology, secure and compliant solutions, rapid implementation, and specialized solutions that suit your unique insurance business requirements.

Before choosing an insurance software development company for your custom software, you should look for a proven track record of building insurance solutions, strong Clutch reviews from past clients, familiarity with compliance regulations such as IRDAI, HIPAA, or GDPR and the capability of delivering secure and scalable software that can be easily integrated.

SaaS Development

SaaS Development Web Application Development

Web Application Development Mobile Application Development

Mobile Application Development Custom Software Development

Custom Software Development Cloud Development

Cloud Development DevOps Development

DevOps Development MVP Development

MVP Development Digital Product Development

Digital Product Development Hire Chatbot Developers

Hire Chatbot Developers Hire Python Developers

Hire Python Developers Hire Django Developers

Hire Django Developers Hire ReactJS Developers

Hire ReactJS Developers Hire AngularJS Developers

Hire AngularJS Developers Hire VueJS Developers

Hire VueJS Developers Hire Full Stack Developers

Hire Full Stack Developers Hire Back End Developers

Hire Back End Developers Hire Front End Developers

Hire Front End Developers AI Healthcare Software Development & Consulting

AI Healthcare Software Development & Consulting Healthcare App Development

Healthcare App Development EHR Software Development

EHR Software Development Healthcare AI Chatbot Development

Healthcare AI Chatbot Development Telemedicine App Development Company

Telemedicine App Development Company Medical Billing Software Development

Medical Billing Software Development Fitness App Development

Fitness App Development RPM Software Development

RPM Software Development Medicine Delivery App Development

Medicine Delivery App Development Medical Device Software Development

Medical Device Software Development Patient Engagement Software Solutions

Patient Engagement Software Solutions Mental Health App Development

Mental Health App Development Healthcare IT Consulting

Healthcare IT Consulting Healthcare CRM Software Development

Healthcare CRM Software Development Healthcare IT Managed Services

Healthcare IT Managed Services Healthcare Software Testing services

Healthcare Software Testing services Medical Practice Management Software

Medical Practice Management Software Outsourcing Healthcare IT Services

Outsourcing Healthcare IT Services IoT Solutions for Healthcare

IoT Solutions for Healthcare Medical Image Analysis Software Development Services

Medical Image Analysis Software Development Services Lending Software Development Services

Lending Software Development Services Payment Gateway Software Development

Payment Gateway Software Development Accounting Software Development

Accounting Software Development AI-Driven Banking App Development

AI-Driven Banking App Development Insurance Software Development

Insurance Software Development Finance Software Development

Finance Software Development Loan Management Software Development

Loan Management Software Development Decentralized Finance Development Services

Decentralized Finance Development Services eWallet App Development

eWallet App Development Payment App Development

Payment App Development Money Transfer App Development

Money Transfer App Development Mortgage Software Development

Mortgage Software Development Insurance Fraud Detection Software Development

Insurance Fraud Detection Software Development Wealth Management Software Development

Wealth Management Software Development Cryptocurrency Exchange Platform Development

Cryptocurrency Exchange Platform Development Neobank App Development

Neobank App Development Stock Trading App Development

Stock Trading App Development AML software Development

AML software Development Web3 Wallet Development

Web3 Wallet Development Robo-Advisor App Development

Robo-Advisor App Development Supply Chain Management Software Development

Supply Chain Management Software Development Fleet Management Software Development

Fleet Management Software Development Warehouse Management Software Development

Warehouse Management Software Development LMS Development

LMS Development Education App Development

Education App Development Inventory Management Software Development

Inventory Management Software Development Property Management Software Development

Property Management Software Development Real Estate CRM Software Development

Real Estate CRM Software Development Real Estate Document Management Software

Real Estate Document Management Software Construction App Development

Construction App Development Construction ERP Software Development

Construction ERP Software Development

BOOK A 30 MIN CALL

BOOK A 30 MIN CALL