AI in Fraud Detection: How Small Businesses Can Prevent Financial Fraud

- August 13, 2025

-

1622 Views

- by Ishan Vyas

Table of Contents

- Understanding Financial Fraud in Small Businesses

- Limitations of Traditional Fraud Detection Methods

- What is AI-Based Fraud Detection?

- How AI Detects and Prevents Financial Fraud?

- Benefits of Using AI for Fraud Detection for Small Businesses

- Tools & Platforms Small Businesses Can Explore

- Get Started with AI-Based Fraud Detection

- Key Challenges to Consider

- The Future of AI for Fraud Detection in Small Business

- Conclusion

Financial fraud remains one of the most critical risks to small companies. As per the Association of Certified Fraud Examiners (ACFE), any small business loses 5% of its annual revenue due to fraud, which can be especially damaging to small businesses. Many also lack the sophisticated security systems that large companies may be equipped with, with small teams and resource constraints. But with AI for fraud detection, small businesses now have a chance to protect themselves more than ever, even though digital transactions and the associated risks are rising.

With the evolution of AI software development, the situation is slowly improving. Today, there are tools designed with AI-powered software to detect fraud, enabling small businesses to access resources previously accessible only to large enterprises and banks. By collaborating with an AI software development company, small business owners can now safeguard their operations with more intelligent, faster, and more reliable fraud prevention systems.

Understanding Financial Fraud in Small Businesses

Financial fraud isn’t solely confined to larger organizations. In fact, smaller businesses are more impacted because of their smaller financial cushions and narrower profit margins.

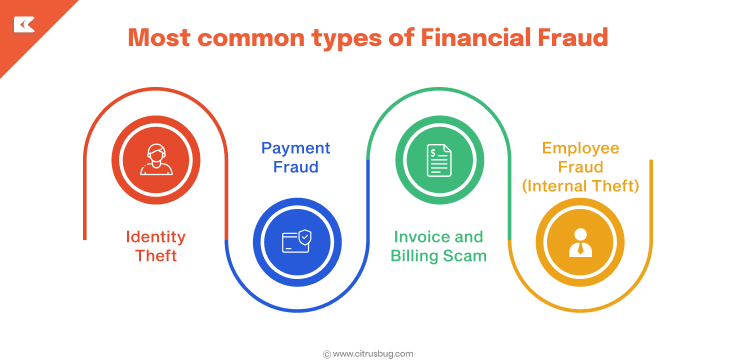

Here are a few of the most common types of financial fraud targeting small businesses:

- Identity Theft

Cyber criminals steal account holder information, create fictitious accounts, or use stolen ones along with genuine vendor accounts used in their fraudulent transactions, and gain access to sensitive financial data.

- Payment Fraud

Fraud payments are also payments that were made with stolen credit and debit cards. Small businesses with unprotected payment gateways, in particular, are vulnerable.

- Invoice and Billing Scams

These frauds are often the result of badly designed approval workflows. The lack of verification for invoicing and billing contributes greatly to unmonitored fraud prevention processes in small businesses.

- Employee Fraud (Internal Theft)

Includes misuse of company resources, manipulation of payroll, and asset misappropriation. These employees can perpetrate these crimes in an environment with limited employee oversight, which highlights the importance of implementing payroll software for small business to ensure transparency and control.

Organizations and businesses face a growing threat of fraud. Whether it is in the form of ghost employees, fabricated billing, or unauthorized payments, fraud can creep into the day-to-day activities of an organization without anybody noticing. These potential hazards may remain unnoticed and concealed for years, if not decades, without the necessary intervention. To safeguard their assets, businesses of all sizes are now turning to AI for fraud detection and prevention.

Limitations of Traditional Fraud Detection Methods

Traditional methods of fraud detection, such as manual audits and static rule-based systems, are often inadequate in today’s real-time, digital world. Most such techniques are based on predetermined rules and require human involvement to detect new attacks, which is reactive in nature and not proactive.

The increasing amount of financial information produced by small firms can not be managed using manual monitoring. The damage has already been caused before suspicious activities are often recognised, because the response between the occurrence and the recognition of fraud is vast. Also, the lack of real-time alerts inhibits a business response.

There is also the chance of error and inconsistency due to the involvement of a human being. Small businesses won’t have a big team, and complex data flows can be hard to understand. Traditional systems will not be able to keep up with the evolution of fraud tactics, and therefore, companies will be exposed to new dangers.

In short, traditional fraud detection methods offer only a basic level of protection. They lack the speed and accuracy needed in today’s environment. This is why AI in fintech is becoming more essential, helping businesses detect and prevent fraud in real time with greater precision.

What is AI-Based Fraud Detection?

AI for fraud detection in the fintech industry uses artificial intelligence techniques to detect and stop fraudulent activities better than the traditional approach. Rather than being based on fixed rules, AI technologies use patterns in individual data to get smarter and constantly adapt to newer threats.

Key technologies used in the AI-driven fraud detection are:

- Machine Learning (ML): Algorithms trained on historical transaction data to do real-time anomaly detection.

- Natural Language Processing (NLP): Examines unstructured data such as emails or chat logs to identify fraudulent intent.

- Predictive Analytics: Anticipates future fraud incidents by patterns and behaviors from the past.

Techniques like real-time monitoring and behavioral analysis, which are commonly used to modernize fraud detection with AI in the fintech industry, are now being adapted for small businesses. These AI technologies also provide enterprise-level defense to small and medium-sized businesses (SMBs) that struggle to detect threats early and respond quickly and accurately through automation.

For businesses considering custom software development, this approach enables them to design AI systems that seamlessly integrate into their existing operations, whether that involves verifying payments, scanning invoices, or tracking internal transactions.

How AI Detects and Prevents Financial Fraud?

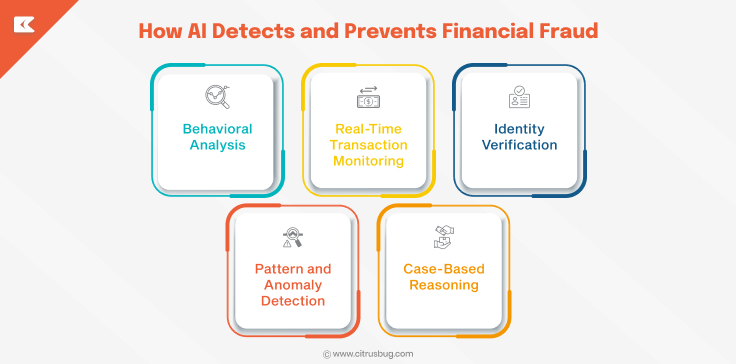

AI for fraud detection systems goes beyond flagging obvious red flags. They have a multi-layered, adaptive defense strategy that is always changing. This is just how these kinds of systems work:

Behavioral Analysis

AI tracks user behavior across transactions to establish a baseline. When an employee who regularly makes transfers of payment below $5000 makes an immediate transfer of $20,000, the system instantly red-statuses the transfer as anomalous. This form of behavioral profiling has a major effect in mitigating insider threats.

Real-Time Transaction Monitoring

AI monitors every transaction as it happens. Strange transactions like quick bulk purchases or transactions made in uncommon places are flagged or even blocked automatically. This helps small businesses to stop the fraud during its initiation stage rather than being limited to responding after the fraud has occurred.

Identity Verification

AI reads the document, performs facial matching, and compares biometrics to confirm the integrity of the individual joining the system. For instance, AI can confirm an end user’s identity against known sources when signing up or handling high-value transactions.

Pattern and Anomaly Detection

AI is not a static rule-based system and can find subtle patterns of fraud that are difficult to recognize. Even the tiniest deviation, like slight changes on an invoice, can trigger alarm bells.

Case-Based Reasoning

AI technology is able to learn from previously raised fraud attempts, so it can identify them quickly in the future. This continuous learning can help businesses keep themselves protected against changing fraud tactics.

For example, in fraud detection using AI in banking, systems are trained to analyze transaction history and geo-patterns in order to avoid fraudulent wire transfers. Smaller businesses can integrate similar tools into their accounting software development or online stores to gain enterprise-level fraud protection with minimal manual effort.

Benefits of Using AI for Fraud Detection for Small Businesses

Small business owners can take full advantage of the benefits that AI for fraud detection solutions offers without having to spend an enterprise-level budget:

- 24/7 Monitoring Without Human Fatigue: AI systems never get tired and are always looking at transactions, employee activity, and access logs. Unlike human teams, they do not require breaks or rest, providing for the identification of threats even during off-hours.

- Reduced Financial Losses: The AI is used to detect attacks and prevent unauthorized transactions in real time, which limits the financial losses to a large extent. For small businesses, often struggling with tight cash flow, that could be the difference between survival and going under.

- Improved Trust With Customers and Vendors: Secure buying environments inspire confidence. When buyers feel confident in purchasing, sellers are more likely to keep and return business from customers who know their financial transactions are secure.

- Faster Detection and Response Time: Traditional systems can take days or weeks to detect fraud after it occurs. AI turns that into seconds; it shortens the window of potential damage.

- Cost-Effective in the Long Term: Implementations may have an initial cost, but AI is known to cut costs by automating work and minimizing your investment into financial recovery and loss of reputation.

- Scalable Solutions That Grow With Your Business: AI for fraud detection solutions are easily able to adjust to the increase in transaction volumes, entering new markets or adding new payment gateways, to provide your business with the flexibility it needs to grow.

These are all important in the digital world we live in today, where threats are ever-evolving and small businesses need to look for smart and sustainable ways to secure their operations.

Tools & Platforms Small Businesses Can Explore

Here’s a comparison of a few leading AI-powered fraud detection tools suitable for small businesses:

| Tool | Focus Area | Ideal For | Integration |

|---|---|---|---|

| Sift | E-commerce & payment fraud | Online retail platforms | Shopify, Stripe |

| Kount | Payment fraud prevention | SMBs in digital commerce | PayPal, BigCommerce |

| SEON | Identity & transaction fraud | Startups & SMEs | Custom APIs |

| Zensed | Real-time risk scoring | Subscription-based apps | Stripe, WooCommerce |

These tools offer flexible pricing models, making them feasible for even smaller operations.

Get Started with AI-Based Fraud Detection

AI for fraud detection doesn’t need to entirely replace digital transformation overnight. Start by identifying the areas of your business that are most sensitive to fraud, whether that’s online payments, sending invoices or approving them, processing payroll, or something else. Being aware of where you are most vulnerable also helps you to focus on work in areas where AI can be most effective.

Then pick a tool that aligns with the way your business operates. AI fraud detection in fintech will not be the same as fraud detection in e-commerce or B2B services. Start with a small rollout in high-risk areas, train your team to understand the alerts, and arm yourself with information. To ensure seamless integration and customized functionality, many small businesses choose to hire AI engineers who can tailor fraud detection systems to their unique workflows and industry challenges. The combination of AI evaluation and human intelligence in fraud oversight is a far more effective and adaptive approach.

Key Challenges to Consider

Although AI for fraud detection delivers significant benefits, small businesses must be mindful of the possible challenges when implementing AI. Addressing these early ensures smoother adoption and greater ROI.

- Initial cost and learning curve

Many tools have setup or integration costs. Teams may need time to adapt to new workflows and interfaces.

- Data privacy and regulatory compliance

AI systems access sensitive data. Ensure they comply with laws like GDPR or CCPA and that customer data is handled securely.

- False positives and accuracy concerns

AI may incorrectly flag legitimate transactions in the early stages, potentially affecting customer trust or internal operations.

- Dependence on high-quality data

Poor or incomplete data weakens AI’s ability to detect fraud. Clean, well-structured datasets are critical for accuracy.

- Vendor reliability and long-term support

Choose providers with strong track records, consistent product updates, and reliable customer support.

Being aware of these challenges helps businesses build a more informed and resilient fraud prevention plan.

The Future of AI for Fraud Detection in Small Business

With the ever-changing AI trends, small businesses are shifting the strategy they use to protect themselves from financial fraud. Equally, as the threats grow larger, AI systems are becoming crucial for preventing fraud because of their ability to self-learn.

New technologies, such as deep learning and federated learning, will produce more precise detection and more security and privacy-aware products and applications for detecting fraud. It enables AI tools to identify subtle patterns without consuming user data, making them highly suitable for small businesses with limited resources.

Looking ahead, AI is going to become more closely integrated with cloud systems, the Internet of Things (IoT), and digital payment systems to give a more unified approach to monitoring risk. As AI becomes more obtainable, it will allow small businesses to transition from a reactive to a proactive approach, so that secure growth becomes more attainable than ever before.

Conclusion

Financial fraud doesn’t just impact profits; it undermines trust, threatens trust, damages reputation, and undermines long-term growth. The good news is that today, small businesses do have access to intelligence from data and capabilities that until now were only economically feasible for large enterprises.

With advancements in AI software development, fraud detection has shifted to a more proactive, dynamic model that is also highly accurate. From anomaly detection based on NLP to real-time behavioral analysis, these solutions give small businesses a critical advantage in an increasingly high-risk threat landscape.

Working with a custom software development company like Citrusbug Technolabs allows you to develop AI fraud detection-powered solutions according to your specific workflows and risk areas. For the small business looking for smarter financial security, however, embracing AI is more than just smart — it’s the future.

SaaS Development

SaaS Development Web Application Development

Web Application Development Mobile Application Development

Mobile Application Development Custom Software Development

Custom Software Development Cloud Development

Cloud Development DevOps Development

DevOps Development MVP Development

MVP Development Digital Product Development

Digital Product Development Hire Chatbot Developers

Hire Chatbot Developers Hire Python Developers

Hire Python Developers Hire Django Developers

Hire Django Developers Hire ReactJS Developers

Hire ReactJS Developers Hire AngularJS Developers

Hire AngularJS Developers Hire VueJS Developers

Hire VueJS Developers Hire Full Stack Developers

Hire Full Stack Developers Hire Back End Developers

Hire Back End Developers Hire Front End Developers

Hire Front End Developers AI Healthcare Software Development & Consulting

AI Healthcare Software Development & Consulting Healthcare App Development

Healthcare App Development EHR Software Development

EHR Software Development Healthcare AI Chatbot Development

Healthcare AI Chatbot Development Telemedicine App Development Company

Telemedicine App Development Company Medical Billing Software Development

Medical Billing Software Development Fitness App Development

Fitness App Development RPM Software Development

RPM Software Development Medicine Delivery App Development

Medicine Delivery App Development Medical Device Software Development

Medical Device Software Development Patient Engagement Software Solutions

Patient Engagement Software Solutions Mental Health App Development

Mental Health App Development Healthcare IT Consulting

Healthcare IT Consulting Healthcare CRM Software Development

Healthcare CRM Software Development Healthcare IT Managed Services

Healthcare IT Managed Services Healthcare Software Testing services

Healthcare Software Testing services Medical Practice Management Software

Medical Practice Management Software Outsourcing Healthcare IT Services

Outsourcing Healthcare IT Services IoT Solutions for Healthcare

IoT Solutions for Healthcare Medical Image Analysis Software Development Services

Medical Image Analysis Software Development Services Lending Software Development Services

Lending Software Development Services Payment Gateway Software Development

Payment Gateway Software Development Accounting Software Development

Accounting Software Development AI-Driven Banking App Development

AI-Driven Banking App Development Insurance Software Development

Insurance Software Development Finance Software Development

Finance Software Development Loan Management Software Development

Loan Management Software Development Decentralized Finance Development Services

Decentralized Finance Development Services eWallet App Development

eWallet App Development Payment App Development

Payment App Development Money Transfer App Development

Money Transfer App Development Mortgage Software Development

Mortgage Software Development Insurance Fraud Detection Software Development

Insurance Fraud Detection Software Development Wealth Management Software Development

Wealth Management Software Development Cryptocurrency Exchange Platform Development

Cryptocurrency Exchange Platform Development Neobank App Development

Neobank App Development Stock Trading App Development

Stock Trading App Development AML software Development

AML software Development Web3 Wallet Development

Web3 Wallet Development Robo-Advisor App Development

Robo-Advisor App Development Supply Chain Management Software Development

Supply Chain Management Software Development Fleet Management Software Development

Fleet Management Software Development Warehouse Management Software Development

Warehouse Management Software Development LMS Development

LMS Development Education App Development

Education App Development Inventory Management Software Development

Inventory Management Software Development Property Management Software Development

Property Management Software Development Real Estate CRM Software Development

Real Estate CRM Software Development Real Estate Document Management Software

Real Estate Document Management Software Construction App Development

Construction App Development Construction ERP Software Development

Construction ERP Software Development