AI in Banking Statistics: Trends, Market Growth, and Future Predictions

- November 12, 2025

-

950 Views

- by Ishan Vyas

Table of Contents

- Introduction

- Why does AI matter in banking?

- Key AI in Banking Statistics and Impact

- Global AI in Banking Statistics and Adoption Insights

- How AI Is Driving Efficiency and Cost Savings in Banking?

- Emerging AI Trends in Banking: Top Use Cases Transforming Finance

- Key Areas Where Banks Are Using AI to Elevate Customer Engagement

- Recent Developments in AI Applications in Banking

- Artificial Intelligence (AI) in Banking Market Size and Forecast 2025 to 2034

- Conclusion

Introduction

In an era where digital transformation is rewriting the way traditional services operate, AI banking app development has emerged as a key driver of change in the banking sector. As banks and financial institutions race to deliver smarter, faster, more personalised services, the role of artificial intelligence (AI) becomes increasingly central.

This article examines the landscape of AI in banking statistics, exploring how the AI in banking market is evolving, what the current trends are, and how banks are leveraging AI to deliver value, reduce costs and up-their game. We’ll also touch on AI trends in banking that are shaping the future of the industry.

Why does AI matter in banking?

Banks have access to a massive amount of customer, transaction, and market data, the perfect fuel for artificial intelligence. AI helps banks spot fraud in real time, offer personalised products, automate routine back-office tasks, and power chatbots that handle millions of customer queries every day.

Because of these benefits, many banks are no longer just experimenting with AI. They are now using it across their entire organisations. Reports from the World Economic Forum and other studies show that financial institutions are seeing real results and value from their AI investments.

Key AI in Banking Statistics and Impact

Turning from market size to real outcomes, the following statistics highlight how AI is being used in banking, and what results are being achieved.

1) Operational Efficiency & Cost Savings

- A recent compilation of AI in banking statistics shows that AI automation has helped reduce operational costs by an average of 13% across major U.S. banks in 2025.

- Back-office operations powered by AI have seen processing errors drop by 40%.

- Implementation of AI in compliance monitoring cut audit preparation times by 50%.

These figures show that deploying AI not only impacts the front end (customer-facing) but also materially transforms middle and back-office functions, a major part of the business case for many banks.

2) Speed & Customer Experience Improvements

- Digital customer onboarding via AI now takes under 4 minutes, compared to 20+ minutes in manual workflows.

- According to the AI in banking market, 92% of banks worldwide will have implemented AI in at least one core function as early as 2025.

- Digital banking statistics show that more than 83% of U.S. adults have utilised digital banking by 2025, as they used mobile apps, AI chatbots and digital onboarding tools.

Speed, convenience, and personalisation; these are the advantages banks claim when they speak about their AI projects.

3) Fraud, Risk & Compliance

- According to digital transformation statistics, AI-driven fraud detection systems saved banks an estimated USD 217 billion globally in 2025.

- The AI in banking Statistics show that banks deploying AI for underwriting improved loan processing times by 25%.

- In risk and compliance, AI supports real-time monitoring, anomaly detection, and regulatory reporting in critical areas for modern banks.

These numbers show that beyond efficiency and experience, AI is increasingly a risk-mitigation tool.

Global AI in Banking Statistics and Adoption Insights

Artificial Intelligence (AI) is changing the way banks operate, enabling them to automate processes more quickly, identify fraud faster and provide customers with more personalized financial services. Below are the seven most important AI in banking statistics that highlight the industry’s rapid growth:

- North America dominates the AI in banking market, with 98% of banks using AI for operations such as risk analysis, customer support, and fraud prevention.

- Asia-Pacific experienced a 21% rise in AI investments, with India and Singapore leading innovations in AI-based financial technologies and automation.

- European banks have integrated AI into 28% of their systems, particularly in fraud detection and regulatory compliance and customer experience functionalities.

- About 60% of banks in Africa utilize AI for mobile banking and digital onboarding, there is a huge move toward inclusive, tech-oriented banking.

- Banks in Latin America saw a 44% increase in AI adoption, focused mostly on credit scoring, chatbots and virtual assistants for customer service enhancement.

- Globally, 65% of financial institutions rely on machine learning algorithms for portfolio management, predictive trading, and investment insights.

- Middle Eastern banks have tripled their AI budgets since 2023, focusing on cybersecurity and Anti-Money Laundering (AML) solutions to enhance security and compliance.

These numbers reflect a booming AI in banking market, where innovation, automation, and intelligent decision-making are reshaping financial services worldwide.

How AI Is Driving Efficiency and Cost Savings in Banking?

Artificial Intelligence is revolutionizing the banking industry by enhancing speed, accuracy as well as customer service and cutting down costs. From streamlining processes to improving customer service, AI is making banks work smarter.

-

Automating Routine Operations

AI is used to automate the routine tasks of data capture, reconciliation and compliance checking that together reduce manual effort by up to 35% .

-

Enhancing Fraud Detection

Machine learning models analyze transactions in real time to detect suspicious patterns, helping banks prevent fraud and save millions in potential losses.

-

Improving Customer Support with Chatbots

AI-powered chatbots in banking handle customer queries 24/7, reducing call center costs by up to 70% while improving response times and overall customer satisfaction.

-

Predictive Maintenance and Risk Management

AI tools analyze system data to predict potential failures or risks before they occur, saving costs on downtime and ensuring smoother banking operations.

-

Personalizing Marketing and Cross-Selling

AI processes customer data to create personalised offers and financial advice, boosting conversions & marketing ROI and reducing wasted ad spend.

Emerging AI Trends in Banking: Top Use Cases Transforming Finance

The adoption of Generative AI in banking has surged rapidly. By 2024, 75% of banking leaders had implemented or were deploying GenAI, a major leap from early 2023 caution.

In 2025, banks highlight AI’s role in improving customer experience, operational efficiency, and fraud detection, showcasing measurable business value and innovation.

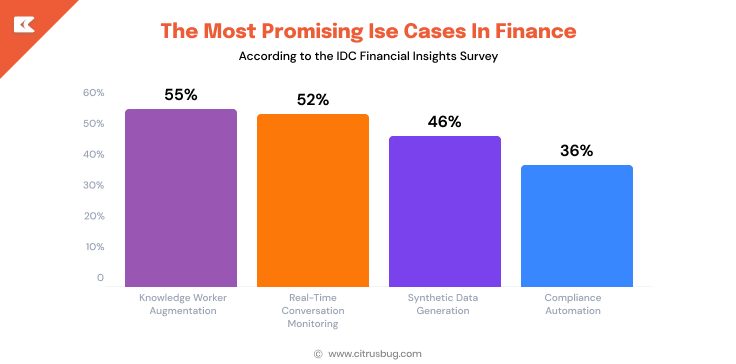

According to the IDC Financial Insights Survey, financial institutions are exploring diverse use cases, from automation and real-time analytics to enhanced compliance and data-driven decision-making.

AI Use Cases in Banking and Finance

- Knowledge Worker Augmentation (55%) – The most attractive use case, which sees AI assisting banking workers in their decision-making activities, analysis of data and management of risk.

- Real-Time Conversation Monitoring (52%) – strengthens compliance and customer service objectives by recording client interactions in real time.

- Synthetic Data Generation (46%) – Aids model training while preserving sensitive data, thereby enabling banks to increase predictive accuracy.

- Compliance Automation (36%) – Reduces the overhead of regulatory reporting and audits, thus increasing operational efficiency.

These top AI trends in banking illustrate how banks are leveraging intelligent systems to improve productivity, accuracy and compliance.

Key Areas Where Banks Are Using AI to Elevate Customer Engagement

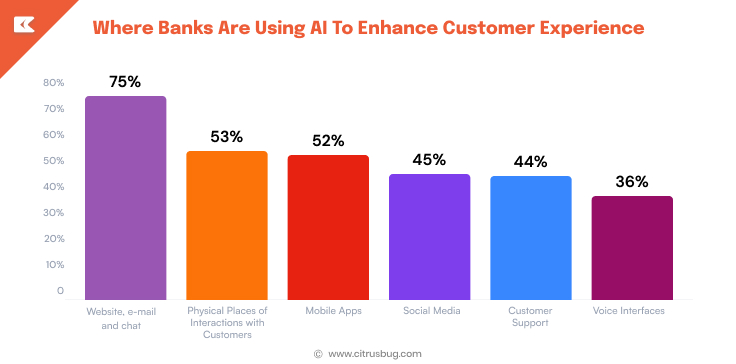

Banks are increasingly integrating AI across multiple customer touchpoints to deliver faster, smarter, and more personalized experiences. Here’s how:

- Digital Channels: Approximately 75% of banks are now using AI to receive instant, customised responses by integrating the technology within websites, emails and chat platforms, thereby ensuring easy internet communication.

- Branch Experience: More than half of banks (53%) are implementing AI in branches, supplementing face-to-face services with digital support tools for swifter and more accurate service.

- Mobile Banking: 52% are using AI to deliver real-time insights, personalized suggestions and a human conversation in mobile applications.

- Social Media Engagement: Nearly 45% of banks use AI for listening to social media messages, engagement and sentiment analysis to enhance brand positioning and customer relationship management.

- Customer Support: 44% of banks use AI-powered chatbots and helpdesk tools to increase the speed of resolutions and ensure accuracy in answers.

- Voice Banking: Approximately 36% of institutions have introduced the use of AI-enabled voice assistants for customers to conduct transactions and services in a natural, conversational way.

In essence, AI is transforming how banks interact with customers, making every touchpoint more efficient, responsive, and human-like.

Recent Developments in AI Applications in Banking

Generative AI is now the most common form of AI used in banks. 75% of banking executives say they have already implemented or are in the process of implementing GenAI solutions.

Broad AI adoption: 92% of banks tell us that they are currently using AI in at least one core function, and global banking is seeing a surge in spending on AI (multi-billion-dollar market).

Fraud & financial crime: AI fraud-detection systems are now routinely achieving detection rates of 87 – 94% with large reduction in false positives, whereas more than 50% of new fraud is committed using AI/deepfakes. Now, banks are implementing GenAI to identify and combat these threats.

Efficiency & cost impact: analysts estimate AI could drive 15–20% net reductions in banks’ cost bases (and certain categories may see up to ~70% gross cuts); some central-bank/industry reports even project efficiency uplifts nearing 46% from GenAI adoption in specific markets.

Risk & realism check: despite heavy investment, 30% of GenAI projects will be junked at PoC (and many agentic AI ones besides), due to data, governance and ROI issues.

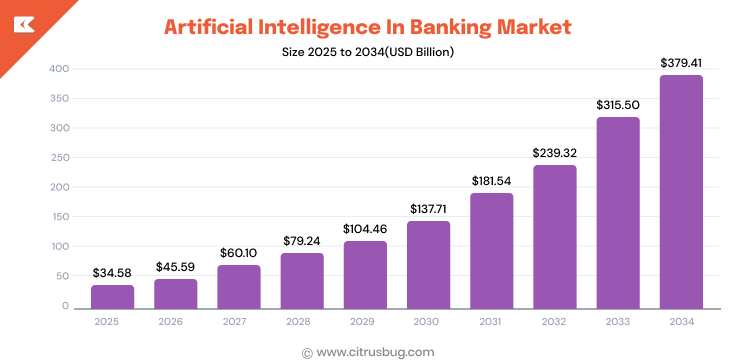

Artificial Intelligence (AI) in Banking Market Size and Forecast 2025 to 2034

The global banking industry is witnessing a major transformation as artificial intelligence becomes integral to operations, risk management, and customer engagement. The chart below highlights the projected market growth, reflecting how rapidly financial institutions are investing in AI-driven innovations.

- The chart illustrates the projected growth of the AI in banking market from 2025 to 2034, showing a steady and rapid upward trend.

- By 2025, the worldwide market of AI in banking industry is anticipated to be USD 34.58 billion, which highlights the beginning of widespread adoption.

- In 2029, the market is predicted to grow three times in size to 104.46 billion, fuelled by the use of technology such as AI in fraud detection, assessing risk, and improving customer satisfaction.

- In the next decade, 2031 is predicted to reach USD 181.54 billion, indicating that AI-driven automation and predictive analytics are changing how banks operate.

- The market is predicted to grow to USD 315.50 billion by 2033 and then to reach USD 379.41 billion in 2034, indicating the growing demand for AI-powered banking solutions.

- These AI in banking statistics clearly demonstrate a strong compound annual growth rate (CAGR), emphasising AI’s central role in reshaping global banking efficiency, security, and personalisation.

( source )

Conclusion

In summary, AI in banking statistics demonstrates the way artificial intelligence is remodelling the financial industry via automation, fraud control and tailored offerings. As AI continues to be leveraged by banks for process automation and customer service, it is cutting costs and transforming financial markets worldwide. With ongoing developments, AI will continue to be a major driver of change in modern banking.

SaaS Development

SaaS Development Web Application Development

Web Application Development Mobile Application Development

Mobile Application Development Custom Software Development

Custom Software Development Cloud Development

Cloud Development DevOps Development

DevOps Development MVP Development

MVP Development Digital Product Development

Digital Product Development Hire Chatbot Developers

Hire Chatbot Developers Hire Python Developers

Hire Python Developers Hire Django Developers

Hire Django Developers Hire ReactJS Developers

Hire ReactJS Developers Hire AngularJS Developers

Hire AngularJS Developers Hire VueJS Developers

Hire VueJS Developers Hire Full Stack Developers

Hire Full Stack Developers Hire Back End Developers

Hire Back End Developers Hire Front End Developers

Hire Front End Developers AI Healthcare Software Development & Consulting

AI Healthcare Software Development & Consulting Healthcare App Development

Healthcare App Development EHR Software Development

EHR Software Development Healthcare AI Chatbot Development

Healthcare AI Chatbot Development Telemedicine App Development Company

Telemedicine App Development Company Medical Billing Software Development

Medical Billing Software Development Fitness App Development

Fitness App Development RPM Software Development

RPM Software Development Medicine Delivery App Development

Medicine Delivery App Development Medical Device Software Development

Medical Device Software Development Patient Engagement Software Solutions

Patient Engagement Software Solutions Mental Health App Development

Mental Health App Development Healthcare IT Consulting

Healthcare IT Consulting Healthcare CRM Software Development

Healthcare CRM Software Development Healthcare IT Managed Services

Healthcare IT Managed Services Healthcare Software Testing services

Healthcare Software Testing services Medical Practice Management Software

Medical Practice Management Software Outsourcing Healthcare IT Services

Outsourcing Healthcare IT Services IoT Solutions for Healthcare

IoT Solutions for Healthcare Medical Image Analysis Software Development Services

Medical Image Analysis Software Development Services Lending Software Development Services

Lending Software Development Services Payment Gateway Software Development

Payment Gateway Software Development Accounting Software Development

Accounting Software Development AI-Driven Banking App Development

AI-Driven Banking App Development Insurance Software Development

Insurance Software Development Finance Software Development

Finance Software Development Loan Management Software Development

Loan Management Software Development Decentralized Finance Development Services

Decentralized Finance Development Services eWallet App Development

eWallet App Development Payment App Development

Payment App Development Money Transfer App Development

Money Transfer App Development Mortgage Software Development

Mortgage Software Development Insurance Fraud Detection Software Development

Insurance Fraud Detection Software Development Wealth Management Software Development

Wealth Management Software Development Cryptocurrency Exchange Platform Development

Cryptocurrency Exchange Platform Development Neobank App Development

Neobank App Development Stock Trading App Development

Stock Trading App Development AML software Development

AML software Development Web3 Wallet Development

Web3 Wallet Development Robo-Advisor App Development

Robo-Advisor App Development Supply Chain Management Software Development

Supply Chain Management Software Development Fleet Management Software Development

Fleet Management Software Development Warehouse Management Software Development

Warehouse Management Software Development LMS Development

LMS Development Education App Development

Education App Development Inventory Management Software Development

Inventory Management Software Development Property Management Software Development

Property Management Software Development Real Estate CRM Software Development

Real Estate CRM Software Development Real Estate Document Management Software

Real Estate Document Management Software Construction App Development

Construction App Development Construction ERP Software Development

Construction ERP Software Development