Digital Wallet App Development: Features, Security, and Cost Insights

- October 14, 2025

-

990 Views

- by Ishan Vyas

Table of Contents

- What Is a Digital Wallet App?

- Challenges Business Owners Face in Digital Wallet App Development

- Key Features of a Successful Digital Wallet App

- Essential Security Practices for Digital Wallet Apps

- How Much Does It Cost to Build an eWallet App?

- How to Create a Digital Wallet App: Steps and Best Practices

- Real-World Digital Wallet App Examples

- Future of Digital Wallet Apps

- Why Choose Citrusbug as Your Digital Wallet App Development Partner

- Conclusion: Powering the Future of Payments with Custom Wallet Apps

The way we pay and manage money is changing fast. Digital wallet is not only a convenience anymore, but a fundamental aspect of daily transactions among millions of people all over the world. In fact, the global market of digital wallets is set to surpass $16 trillion in 2028.

This change is both an opportunity and a responsibility for business owners. On the one hand, a digital wallet allows you to provide more immediate and convenient payment and an enhanced customer experience. On the other hand, building a wallet app comes with its challenges: ensuring robust security, meeting regulatory requirements, integrating multiple payment systems, and gaining user trust.

Creating a successful digital wallet app is not just about coding. It involves intelligent design, stable technology and understanding of what users anticipate. In this blog, we’ll break down the key features, security practices, and cost insights for digital wallet app development, along with best practices that can help businesses launch apps that customers love and trust.

What Is a Digital Wallet App?

A digital wallet app is a mobile application that lets users store, manage, and use money digitally, removing the need for cash or physical cards. Users are able to pay, send money, pay bills, and even store loyalty points, all using their smartphones.

Companies create digital wallet applications to enable quicker transactions, easier payment processes, and easy access to a variety of payment methods within a single application. A well-designed wallet application is also a guarantee of security, compliance and user ease, which creates trust and reliability.

There are different types of digital wallets, each suited for specific use cases:

- Closed Wallets: Can only be used for purchases within a specific merchant’s ecosystem, such as Amazon Pay.

- Semi-Closed Wallets: These wallets can be used in a variety of merchants but cannot be used to withdraw cash, such as Paytm.

- Open Wallets: These can be utilized at any merchant and can be used to withdraw cash through the ATM, such as PayPal.

- Crypto Wallets: Store and transact cryptocurrencies securely using blockchain technology.

Challenges Business Owners Face in Digital Wallet App Development

Digital wallet app development has exciting possibilities, but it also has real challenges. Knowing these hurdles can help you plan smarter and avoid costly mistakes.

Ensuring Security and Compliance

Security is the first on the list of concerns. You have to secure user data through end-to-end encryption, tokenization and multi-factor authentication. Meanwhile, you have to comply with such regulations as PCI DSS, KYC, AML, and GDPR. Even a single slip-up can cost in monetary gains, lawsuits and a tarnished image. It is important to consider security early on to gain user trust and retain the credibility of your app.

Integrating Multiple Payment Systems

Your wallet application must be compatible with banks, payment gateways and third-party financial services. To reliably integrate and accept payments, many digital wallet architectures rely on backend payment infrastructure to manage transaction routing, authorization, and compliance across different systems. The integration can be tricky due to differences in APIs and protocols. In case of failure of connections or delays in transactions, the users will be aware of that. Planning integration carefully ensures your app runs reliably and provides a seamless payment experience.

Managing Costs and Budget

Cost estimation is sometimes a challenge. All these features, security, AI functionality, platform selection, and continued maintenance contribute. Unless properly planned, the development can go beyond the budget or cause a delay in ROI. Having a budget roadmap can assist you in managing the costs and still produce a high-quality product.

Gaining User Trust and Adoption

Even the most advanced app fails if users don’t trust it. You need to ensure fast, reliable transactions, an intuitive design, and responsive customer support. A wallet application that is safe and comfortable to operate on will attract and retain users.

Balancing Time-to-Market

Speed matters, but rushing can compromise quality. Launching too soon can lead to a lack of security, bugs or user experience. Agile development and appropriate testing, used after a gradual rollout, will enable you to find the balance and remain competitive.

By resolving these challenges at the beginning of the development life cycle, you can develop a secure, scalable and easy-to-use digital wallet application and give your business a strong starting point towards success.

Key Features of a Successful Digital Wallet App

The proper digital wallet application is designed to combine the necessary functionality with intelligent, AI-enriched features and deliver a pleasant user experience.

Core Features

- User Registration & KYC: Simple onboarding with quick identity verification to ensure security and regulatory compliance.

- Bank Account/Card Linking: Enable the user to add multiple bank accounts or cards and make payments without problems.

- Fund Transfer and Payment Requests: Provide instant peer-to-peer transfer and convenient payment requests at any time and from any place.

- QR Code Payments: Fast and non-contact payments with the help of QR code scanners at physical stores or online shops.

- Transaction History and Receipts: It is better to have clear and detailed records of transactions and digital receipts.

- Push Notifications: Instantly notify a user about a transaction, offer or security, first-aid, or even app activity.

- Rewards, Cashback, or Loyalty Points: Offer incentives like cashback, discounts, or reward points to boost engagement.

Advanced AI-Powered Features

- Fraud Detection: AI keeps track of transactions in real time to identify any suspicious or abnormal activity.

- Personalized Insights: Offer users spending trends, budgeting recommendations and personalized financial recommendations.

- Voice-Based Payments: Add voice command support via NLP transactions to provide the convenience of voice-free transactions.

- Smart Recommendations: Predictive analytics suggests a personalized recommendation, a promotion or savings suggestion to a user.

Essential Security Practices for Digital Wallet Apps

The foundation of any digital wallet app development is security, and users want to be certain that their money and personal information are not compromised, and companies must be security-conscious.

Key Security Layers

Data Encryption (AES, SSL/TLS)

Storing and transferring encrypted data prevents unauthorized access or interception of sensitive user data, whether account details and transactions, in any country around the globe.

Tokenization for Card Details

In tokenization, card numbers are replaced with secure tokens to mitigate the risk of fraud in international transactions with the help of the digital wallet and reduce the exposure of sensitive information.

Two-Factor Authentication / Biometrics

Multi-factor authentication and biometrics are ways of making sure that only authorized users have access to the account, which is easier to secure and earns the world the trust of the user.

Secure APIs for Payment Integration

Secure API connections with payment gateways, banks, and third-party services provide security against cyberattacks and protect transactions on all platforms and geographic locations.

Role-Based Access Control

The restriction of access based on user roles prevents unauthorized operations and protects sensitive administrative functions used in the digital wallet system across the globe.

Regular Security Audits and Penetration Testing

Frequent audits are used to ensure that vulnerabilities are detected at an early stage and quickly corrected to enable reliability, compliance and trust to the users worldwide.

For readers unfamiliar with this practice, a quick look at penetration testing basics can explain how simulated attacks are used to find vulnerabilities and why they’re valuable for security.

Compliance Checklist

PCI DSS

The adherence to Payment Card Industry standards allows safe transactions with cards, securing users and companies from global financial and legal risks.

GDPR

Adhering to the GDPR ensures the protection of personal data of international users, creating trust and legal regulations in different regions.

KYC Verification

The introduction of the global Know Your Customer standards helps to verify the users, minimize the risk of fraud and build trust in the digital wallet app.

AML Checks

Anti-money laundering policies uncover suspicious transactions blocking illegal transfer of funds and upholding the security and integrity of the apps worldwide.

How Much Does It Cost to Build an eWallet App?

Understanding the digital wallet app development cost can help businesses plan their budget effectively.

The following is a breakdown of development elements and the estimated cost of investment.

| Development Component | Description | Estimated Cost (USD) |

|---|---|---|

| UI/UX Design | Wireframes, interactive prototypes, visual design | $5,000 – $10,000 |

| Frontend Development | iOS/Android screens, app navigation, responsive layout | $8,000 – $15,000 |

| Backend Development | Server setup, database, APIs, payment gateway integration | $10,000 – $20,000 |

| Core Features Implementation | User registration, KYC, bank/card linking, fund transfers | $12,000 – $25,000 |

| AI & Advanced Features | Fraud detection, smart insights, voice-based payments | $10,000 – $20,000 |

| Security Layer Integration | Encryption, tokenization, role-based access, 2FA | $5,000 – $10,000 |

| Notifications & Engagement | Push notifications, rewards, cashback, loyalty points | $3,000 – $6,000 |

| Testing & Quality Assurance | Functional, security, performance, and usability testing | $5,000 – $10,000 |

| Deployment & Launch | App store submission, server deployment, launch support | $2,000 – $5,000 |

| Maintenance & Updates | Ongoing bug fixes, feature updates, security patches | $3,000 – $8,000 per year |

Digital wallet app development varies in prices depending on the complexity of features, to be used, integrations and the security specifications. Investment is added by adding AI-powered functionalities, such as AI for fraud detection or smart insights. A well-planned project of developing a digital wallet into a mobile application will be secure, scalable and user-friendly.

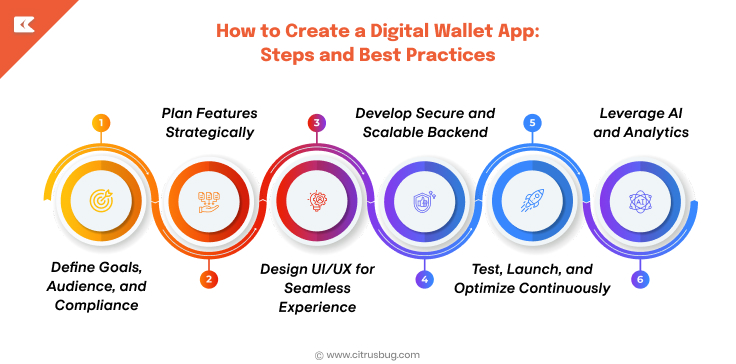

How to Create a Digital Wallet App: Steps and Best Practices

A successful digital wallet app development requires careful planning, secure development, and strategic insights. Following these steps ensures your app is user-friendly, scalable, and compliant with industry standards.

Step 1: Define Goals, Audience, and Compliance

Define your app’s objectives and target users while planning a clear compliance roadmap. The early compliance with such international standards as PCI DSS and GDPR minimizes risks and creates trust.

Step 2: Plan Features Strategically

Apply minimum functionality that includes user registration, KYC, fund transfers and QR payments. But also introduce AI-based applications, like fraud detection, predictive analytics and personalized recommendations, to make it more engaging.

Step 3: Design UI/UX for Seamless Experience

Pay attention to the rapid onboarding and user-friendly navigation and minimum steps of transactions. A user-friendly interface improves user adoption and retention.

Step 4: Develop Secure and Scalable Backend

Install servers, databases, APIs, and payment integrations using well-built security layers- encryption, tokenization and multi-factor authentication. Early scalability focus can offer easy performance as more users are added.

Step 5: Test, Launch, and Optimize Continuously

Carry out effective testing for security and functionality. After launch, keep track of use and add functionalities, new trends such as BNPL, contactless payment and online loyalty programs accordingly.

Step 6: Leverage AI and Analytics

Use AI to prevent fraud, give intelligent insights, predictive analytics, and personal recommendations. Artificial intelligence will increase security, customer experience, and retention.

These are best practices in developing a digital wallet app that can make the app secure, scalable, and easy to use. Begin with a minimal viable product development help businesses build faster and test app features. With the help of a reliable fintech mobile app development service, you can make your vision functional.

Real-World Digital Wallet App Examples

1. PayPal

PayPal is a leader in international online payments, and it provides secure transfer of funds, multi-currency and smooth integrations with merchants, which have become a standard of convenience and confidence.

2. Apple Pay

Building on its contactless payments and close integration with iOS devices, Apple Pay focuses on security by tokenizing and using biometric authentication, which makes mobile payments an effortless task.

3. Google Wallet

Google Wallet is a combination of peer-to-peer payments, loyalty programs, and AI-informed insights to provide a personal user experience, demonstrating how the development of digital wallet mobile apps can engage the user.

4. Venmo

Venmo also aims at social interactions and effortless peer-to-peer payments, providing transaction feeds, split bills, and instant transfers, which proves how UX leads to the adoption of apps.

Future of Digital Wallet Apps

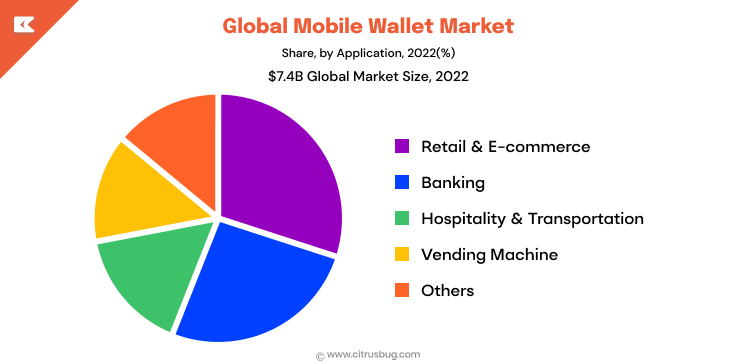

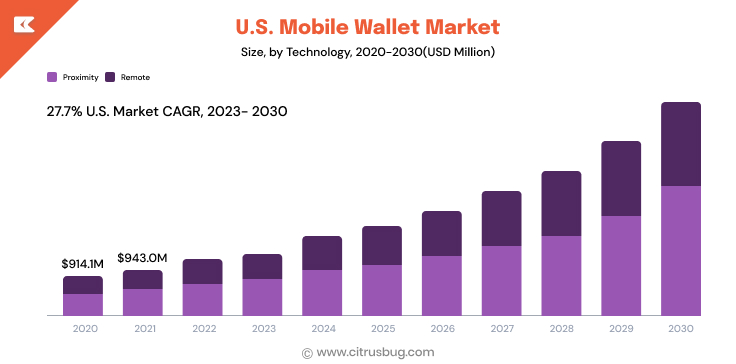

The cashless payment, advancement in mobile technology and changing consumer trends are making the digital wallet industry grow exponentially. The mobile wallet market is estimated at USD 7.42 billion in 2022 and is expected to increase to USD 51.53 billion by the year 2030 with a CAGR of 8.5% between 2023 and 2030.

1. Personalized and Data-Driven Experiences

Future applications will take advantage of digital transformation in fintech to provide smarter suggestions on spending, budgeting, and more personalized financial services to their users.

2. Biometric and Contactless Payments

Fingerprint, facial recognition and contactless payment methods will enhance security and convenience, leading to faster, safer and more convenient transactions.

3. Integration with Emerging Financial Services

Digital wallets will also become more Buy Now, Pay Later (BNPL), investing, and digital lending, providing an all-in-one financial ecosystem to global users.

4. Blockchain and Cryptocurrency Support

The use of decentralized finance and cryptocurrency payments will be more widespread and allow secure and transparent transactions across boundaries in wallet apps.

5. Enhanced Security and Compliance

As cyber threats evolve, applications will become more encrypted, monitored in real-time, and with strong compliance, they will maintain credibility and secure user funds on a global scale.

Why Choose Citrusbug as Your Digital Wallet App Development Partner

The key to creating a successful digital wallet application is collaborating with the appropriate development team. And this is why Citrusbug Technolabs stands out:

Fintech Software Development and Custom AI Expertise

Our focus is on creating safe, scalable, and rich digital wallet applications that use AI in fintech to detect fraud, provide insightful and predictive analytics to improve user trust and engagement.

End-to-End Development Services

From concept and UI/UX design to backend development, security integration, and post-launch maintenance, our team handles the entire digital wallet mobile app development lifecycle with precision.

Focus on Security and Compliance

Citrusbug has enhanced security controls with encryption, tokenization, multi-factor authentication and global compliance criteria to keep your app secure, compliant, and trusted.

Scalable and Future-Ready Solutions

Our apps are performance-focused and scalable, and we add new payment trends, AI-driven functionality, and analytics to keep your digital wallet ahead of the curve in the international fintech market.

Proven Track Record and Client Success

Our experience delivering fintech mobile apps and custom AI development services in different industries ensures your project benefits from best practices, strategic insights, and reliable execution.

Conclusion: Powering the Future of Payments with Custom Wallet Apps

Businesses looking to remain competitive in the quickly changing fintech environment will need to use digital wallet apps. Investing in secure, user-friendly, and innovative solutions can unlock significant growth opportunities.

Starting with basic functions, such as fund transfers, QR payments, and transaction histories and moving to more dynamic functionalities, such as AI-driven insights, predictive analytics and intelligent recommendations, a well-designed digital wallet application can increase customer engagement and operational efficiency. Following proven development steps and best practices ensures scalability, security, and a superior user experience.

Partnering with an experienced team like Citrusbug brings these ideas to life. Having a keen understanding of custom AI software and eWallet app development, Citrusbug provides solutions that are secure, compliant, and future-proof and enabling businesses to benefit from the current digital transformation in fintech.

SaaS Development

SaaS Development Web Application Development

Web Application Development Mobile Application Development

Mobile Application Development Custom Software Development

Custom Software Development Cloud Development

Cloud Development DevOps Development

DevOps Development MVP Development

MVP Development Digital Product Development

Digital Product Development Hire Chatbot Developers

Hire Chatbot Developers Hire Python Developers

Hire Python Developers Hire Django Developers

Hire Django Developers Hire ReactJS Developers

Hire ReactJS Developers Hire AngularJS Developers

Hire AngularJS Developers Hire VueJS Developers

Hire VueJS Developers Hire Full Stack Developers

Hire Full Stack Developers Hire Back End Developers

Hire Back End Developers Hire Front End Developers

Hire Front End Developers AI Healthcare Software Development & Consulting

AI Healthcare Software Development & Consulting Healthcare App Development

Healthcare App Development EHR Software Development

EHR Software Development Healthcare AI Chatbot Development

Healthcare AI Chatbot Development Telemedicine App Development Company

Telemedicine App Development Company Medical Billing Software Development

Medical Billing Software Development Fitness App Development

Fitness App Development RPM Software Development

RPM Software Development Medicine Delivery App Development

Medicine Delivery App Development Medical Device Software Development

Medical Device Software Development Patient Engagement Software Solutions

Patient Engagement Software Solutions Mental Health App Development

Mental Health App Development Healthcare IT Consulting

Healthcare IT Consulting Healthcare CRM Software Development

Healthcare CRM Software Development Healthcare IT Managed Services

Healthcare IT Managed Services Healthcare Software Testing services

Healthcare Software Testing services Medical Practice Management Software

Medical Practice Management Software Outsourcing Healthcare IT Services

Outsourcing Healthcare IT Services IoT Solutions for Healthcare

IoT Solutions for Healthcare Medical Image Analysis Software Development Services

Medical Image Analysis Software Development Services Lending Software Development Services

Lending Software Development Services Payment Gateway Software Development

Payment Gateway Software Development Accounting Software Development

Accounting Software Development AI-Driven Banking App Development

AI-Driven Banking App Development Insurance Software Development

Insurance Software Development Finance Software Development

Finance Software Development Loan Management Software Development

Loan Management Software Development Decentralized Finance Development Services

Decentralized Finance Development Services eWallet App Development

eWallet App Development Payment App Development

Payment App Development Money Transfer App Development

Money Transfer App Development Mortgage Software Development

Mortgage Software Development Insurance Fraud Detection Software Development

Insurance Fraud Detection Software Development Wealth Management Software Development

Wealth Management Software Development Cryptocurrency Exchange Platform Development

Cryptocurrency Exchange Platform Development Neobank App Development

Neobank App Development Stock Trading App Development

Stock Trading App Development AML software Development

AML software Development Web3 Wallet Development

Web3 Wallet Development Robo-Advisor App Development

Robo-Advisor App Development Supply Chain Management Software Development

Supply Chain Management Software Development Fleet Management Software Development

Fleet Management Software Development Warehouse Management Software Development

Warehouse Management Software Development LMS Development

LMS Development Education App Development

Education App Development Inventory Management Software Development

Inventory Management Software Development Property Management Software Development

Property Management Software Development Real Estate CRM Software Development

Real Estate CRM Software Development Real Estate Document Management Software

Real Estate Document Management Software Construction App Development

Construction App Development Construction ERP Software Development

Construction ERP Software Development