The Ultimate Guide to Healthcare IT Statistics

- September 12, 2025

-

1254 Views

- by Ishan Vyas

Introduction

Healthcare is no longer exclusively about hospitals, doctors, and patients, it consists of the technology that links them. Healthcare IT such as electronic health records, telehealth, and AI-driven diagnostic tools, is the foundation of modern-day healthcare.

Why does this matter? Because all the technological advancements change how patients access care, how clinicians provide care, and how health systems define and measure success. Healthcare decision-makers seek updated healthcare software trends to go beyond monitoring market growth and to learn about the future of care delivery.

Market & Adoption

Measuring the size and speed of adoption of a technology is the starting point for healthcare IT statistics. The global healthcare IT market is on a path of increased growth rate, with digital transformation impacting all forms of care delivered.

Global Market Growth

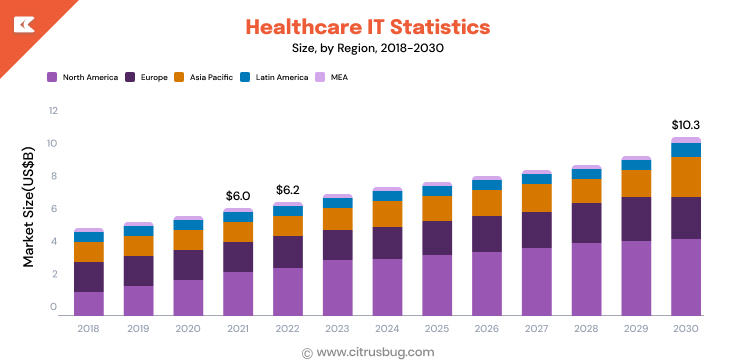

- In 2023, the size of the healthcare IT market stood at USD 663.0 billion, and is projected to be USD 760.2 billion in 2024 and forecasted to be USD 1.834 trillion in 2030 at a CAGR of 15.8%.

- In another study, the healthcare IT market is projected to grow from USD 761.68 billion in 2024 to USD 3.257 trillion in 2034 with a CAGR of 15.6%.

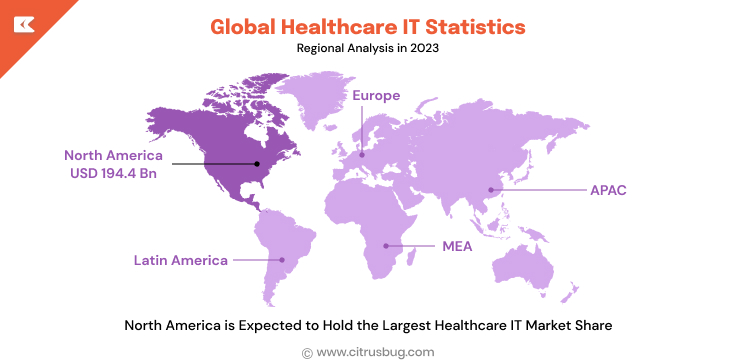

- Market Share by Region: North America had over 40% of the share in 2023, while Asia-Pacific was the fastest growing region in the healthcare IT market.

These statistics indicate that IT is not only an operational enabler and driver, IT is one of the fastest growing areas of healthcare globally.

EHR/EMR Adoption

Electronic Health Records are foundational to the digital health eco-system.

- By 2017, 80% of the hospitals in the U.S. were using certified EHR solutions, a significant jump from fewer than 10% in 2008.

- EHR adoption across the globe varies from nearly 100% adoption in the Netherlands, UK, Sweden, etc. to almost all emerging markets who operate under 50% adoption.

EHRs in the Health IT Statistics continue to be an important metric, as they symbolize the transition from paper to digital-first healthcare systems.

Telehealth & Virtual Care

The use of telehealth was explosive during the COVID pandemic, and it is still a significant channel of digital health.

- During the height of the pandemic, 42% of outpatient visits were done through telehealth compared to pre-2020 where the number was less than 1%.

- Currently telehealth sits around 5% of all outpatient visits for Medicare recipients.

- A regionally specific example may provide further context to current numbers: San Antonio, in 2023, 22% of adults accessed telehealth on a monthly basis (this includes telehealth for specific areas of health – e.g., mental health approximately 33% of visits are virtual visits in some form).

- A 2023 study found 31.3% of primary care visits were made by telephone, 19.5% by video, and 49.2% in person.

Telehealth may be one of the most transparent success stories of healthcare IT statistics, though percentages seem to be stabilizing at current levels of use.

Remote Patient Monitoring (RPM) & Wearables

- The global telehealth and telemedicine market was valued at $214.55 billion in 2023 and will reach a value of $869.22 billion in 2033, growing at 15.5% CAGR, according to the telehealth report.

- Remote Patient Monitoring devices are being increasingly adopted within Electronic Health Record (EHR) systems, allowing for ongoing and real-time monitoring of health, as well as chronic disease management.

- Acceptance in cardiology and diabetes best practices is broad as wearable sensors operate consistently and frequently supply patient-reported data to reduce the burdens of hospital readmission.

RPM and wearables are two rapidly expanding pillars to healthcare IT statistics that are filling the gaps of hospital care and home monitoring.

Technology & Infrastructure

Technology, specifically technology infrastructure, is the foundation of digital transformation in healthcare. The following IT statistics support how artificial intelligence, interoperability, and cloud platforms are redefining how care is provided.

Interoperability & Health Information Exchange (HIE)

Interoperability in hospitals has improved fairly substantially in recent years,

- In 2023, 70% of U.S. non-federal acute care hospitals were interacting with each of the four main domains of interoperability (sending, receiving, finding, and integrating health information) compared to 46% in 2018.

- The study indicated that only 43% of hospitals were using all four domains in interoperability on a regular basis while 27% were using it sometimes.

- According to a recent study, 71% of hospitals have electronic access to clinical information from an external provider at the point-of-care on a regular basis. Of those hospitals that do have access, only 42% of clinicians use it on a regular basis.

Interoperability is still the most prevalent gap in healthcare IT statistics. While there has been a notable increase, it is still not complete.

Artificial Intelligence & Advanced Analytics

Artificial intelligence is one of the fastest growing segments of healthcare IT.

- The global AI in Healthcare market is projected to grow from $20.9 billion in 2024 to $148.4 billion by 2029, representing a CAGR of 48.1%.

- For 2025, 79% of healthcare organizations will be able to report on active use of some form of AI, with the tools being leveraged most often for diagnostics and administrative purposes.

AI is on a steep trajectory of adoption in healthcare both as a market value and organization use.

Imaging Informatics

Medical imaging is at the forefront of Information Technology demand across hospitals.

- In the U.S., early adoption of PACS (Picture Archiving and Communication Systems) rose from 8.5% in 2000 to 76% by 2008.

- Today, all indications according to industry reports show that 100% of health systems use PACS in a clinical setting, highlighting its universal role.

- The global healthcare cloud computing market is expected to increase from USD 39.4 billion (2022) to USD 89.4 billion (2027).

Imaging related healthcare IT statistics point toward near total digital adoption with the impact of AI rapidly transforming diagnostic workflows.

Cloud Adoption & Infrastructure Performance

Cloud-based healthcare IT solutions are quickly supplanting supportable legacy on-premise systems.

- The healthcare cloud computing market is expected to grow from USD 39.4 billion (2022) to USD 89.4 billion (2027), with a CAGR of 17.8%.

- Other estimates indicate similar growth; potentially reaching USD 54.28 billion (2024) and growing to USD 197.45 billion by 2032 with a CAGR of 17.6%.

Cloud adoption in healthcare is moving with speed at all levels to provide flexibility and efficiencies; challenges are most commonly limited to supportable infrastructure and organizational uptime levels.

Patient Engagement & Access

Patient engagement tools are where technology meets the patient experience. These healthcare IT statistics show how patients engage with their health records via portals, apps, and telehealth platforms and show where there are still equity gaps.

Patient Portals & Digital Front Doors

Patient portals are now the primary digital interaction most individuals have with their health records, appointments, and health care providers. However, there is still a gap between access to the portal and patient use:

- In 2022, around 75% of adult US residents were offered access by a provider or insurer to their medical records online, but only 57% actually accessed their medical records. A significant increase from only 38% in 2020.

- By 2024, access and engagement continued to rise. 65% of individuals offered measures and accessed their records, and 75% of those managing a cancer diagnosis engaged the same way.

- Of the individuals using portal access in 2022, 90% accessed test results and 70% accessed clinical notes.

Access to portals is common, but patient use has been mediocre, especially for more engaged use beyond results review.

Digital Engagement Beyond Portals

Healthcare providers are expanding engagement opportunities with their online services through apps and digital front doors.

- As of 2024, more than 65% of adults nationally had been offered and engaged online medical record or patient portals, up from 25% in 2014.

- And for older adults ages 50 to 80, 78% reported they used at least one patient portal in 2023, up from 51% before the pandemic. Among those, 55% used it in the past month.

With statistics indicating that digital engagement is on an upward trajectory, the statistics are still uneven, and seem to also be influenced by the level of investment by the healthcare systems, as well as the patients themselves and their own digital literacy.

Operations & Outcomes

Healthcare IT investments will not only modernize, but also provide quantifiable outcomes relative to cost effectiveness, efficiency, and quality of care. Here are some of the most relevant healthcare IT statistics that emphasize the value:

- The Revenue Cycle Management (RCM) marketplace was valued at USD 135.9 billion in 2023, and will grow to USD 361.9 billion by 2032, at a CAGR of 11.7%. This significant growth shows the contribution to administrative costs and reimbursements made possible through automation and digital workflows.

- The CDC has invested over USD 1 billion since 2020 on its Data Modernization Initiative (DMI) to create the infrastructure needed for real-time, interoperable public health systems. Such an investment demonstrates the potential impact of joining together scalable infrastructure with an improved national health outcome.

- Digital health platforms are affecting patient engagement: 65% of patients accessed their online medical record in 2024, up from 25% in 2014 and increased engagement leads to improved compliance with treatment plans and better outcomes over time.

These numbers tell us that Healthcare IT solutions (from automatic billing to real-time data systems to patient-facing apps) are delivering positively and have quantifiable ROI.

Risks & Compliance

While healthcare IT statistics show growth and innovation, the risk is just as concerning:

Cybersecurity Threats

- In 2023, U.S. healthcare organizations experienced 725 breaches impacting over 133 million records; the highest ever.

- From 2018 to 2023 we realized a 239% growth in hacking-related data breaches and a 278% increase in ransomware attacks.

Financial & Compliance Pressure

- The average cost of a healthcare data breach was USD 9.48 million in the U.S. in 2023, nearly double the global average of USD 4.45 million.

Interoperability Gaps

- By 2023, 70% of U.S. hospitals occasionally participated in all four interoperability domains (send, receive, find, integrate), up from only 46% in 2018.

- However, only 43% of hospitals were participating on a routine basis, and only 42% of clinicians utilized external patient data in their care.

Breaches at staggering levels, costs at insane levels, and improvement in interoperability at variable levels. The best approach combines secure, compliant, and user-centered software with expert healthcare IT consulting to turn risk into opportunities for resilience and trust.

Future Outlook & Forecasts

The story that healthcare IT statistics tells is not just about where the industry is now, it’s about where it is going. In the next decade, healthcare IT will evolve from digitizing records to predicting and personalizing and preventing disease.

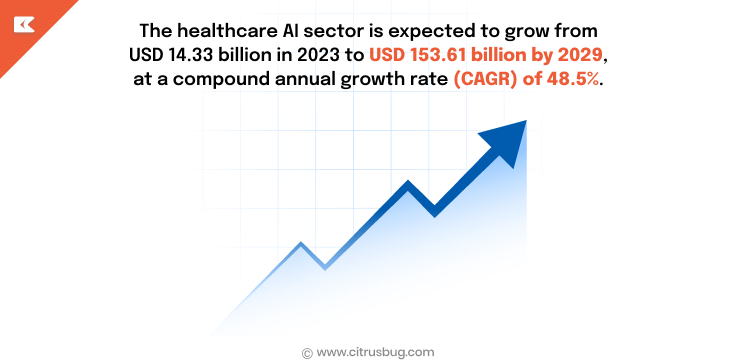

AI in Healthcare

- The healthcare AI sector is expected to grow from USD 14.33 billion in 2023 to USD 153.61 billion by 2029, at a compound annual growth rate (CAGR) of 48.5%.

- An alternative projection indicates growth from $26.57 billion in 2024 to $187.69 billion by 2030, at a CAGR of 38.6%.

Digital Therapeutics

- The global digital therapeutics market is expected to grow from $7.67 billion in 2024 to $32.52 billion by 2030 at a CAGR of 27.8%.

- Another forecast projects it growing to $56.76 billion by 2034 (CAGR ~21.8%).

Healthcare IT Market Size

- Healthcare IT market size is estimated to grow from $663 billion in 2023 to $1.834 trillion by 2030, at a CAGR of 15.8%.

- Another forecast reflects growth from $519.5 billion in 2024 to $1.799 trillion by 2032, at 16.8% CAGR.

Virtual & Hybrid Care

- Almost 90% of health system executives believe that digital tools, connected care delivery and virtual health will influence their strategy by 2025.

- Surveys are projecting that 1 in 4 patient visits will be virtual visits within five years. With 1 in 4 patient visits expected to go virtual, the cost to develop a healthcare mobile app is now a critical consideration for health systems.

The growth trajectory demonstrated in healthcare IT statistics shows the magnitude of opportunity—for providers, payers and technology innovators.

Conclusion

The most recent healthcare IT statistics reflect an industry in a transformative moment: digital systems are no longer just support tools, they now underpin modern care delivery. With billions being invested in AI capabilities, and near universal adoption of EHR systems, it can be concluded that the future of healthcare is data-driven, AI-enabled, and patient-focused.

Sure, challenges like cybersecurity and compliance still exist, but they also represent opportunities for innovation. With intelligent healthcare software solutions, predictive analytics, and secure platforms, our industry can now transition from mere managing illness to predicting, preventing, and personalizing care.

In short: The numbers don’t just measure progress, they point to possibility. For innovators in AI and software, this is the moment to shape not only the future of healthcare IT, but the future of healthcare itself.

SaaS Development

SaaS Development Web Application Development

Web Application Development Mobile Application Development

Mobile Application Development Custom Software Development

Custom Software Development Cloud Development

Cloud Development DevOps Development

DevOps Development MVP Development

MVP Development Digital Product Development

Digital Product Development Hire Chatbot Developers

Hire Chatbot Developers Hire Python Developers

Hire Python Developers Hire Django Developers

Hire Django Developers Hire ReactJS Developers

Hire ReactJS Developers Hire AngularJS Developers

Hire AngularJS Developers Hire VueJS Developers

Hire VueJS Developers Hire Full Stack Developers

Hire Full Stack Developers Hire Back End Developers

Hire Back End Developers Hire Front End Developers

Hire Front End Developers AI Healthcare Software Development & Consulting

AI Healthcare Software Development & Consulting Healthcare App Development

Healthcare App Development EHR Software Development

EHR Software Development Healthcare AI Chatbot Development

Healthcare AI Chatbot Development Telemedicine App Development Company

Telemedicine App Development Company Medical Billing Software Development

Medical Billing Software Development Fitness App Development

Fitness App Development RPM Software Development

RPM Software Development Medicine Delivery App Development

Medicine Delivery App Development Medical Device Software Development

Medical Device Software Development Patient Engagement Software Solutions

Patient Engagement Software Solutions Mental Health App Development

Mental Health App Development Healthcare IT Consulting

Healthcare IT Consulting Healthcare CRM Software Development

Healthcare CRM Software Development Healthcare IT Managed Services

Healthcare IT Managed Services Healthcare Software Testing services

Healthcare Software Testing services Medical Practice Management Software

Medical Practice Management Software Outsourcing Healthcare IT Services

Outsourcing Healthcare IT Services IoT Solutions for Healthcare

IoT Solutions for Healthcare Medical Image Analysis Software Development Services

Medical Image Analysis Software Development Services Lending Software Development Services

Lending Software Development Services Payment Gateway Software Development

Payment Gateway Software Development Accounting Software Development

Accounting Software Development AI-Driven Banking App Development

AI-Driven Banking App Development Insurance Software Development

Insurance Software Development Finance Software Development

Finance Software Development Loan Management Software Development

Loan Management Software Development Decentralized Finance Development Services

Decentralized Finance Development Services eWallet App Development

eWallet App Development Payment App Development

Payment App Development Money Transfer App Development

Money Transfer App Development Mortgage Software Development

Mortgage Software Development Insurance Fraud Detection Software Development

Insurance Fraud Detection Software Development Wealth Management Software Development

Wealth Management Software Development Cryptocurrency Exchange Platform Development

Cryptocurrency Exchange Platform Development Neobank App Development

Neobank App Development Stock Trading App Development

Stock Trading App Development AML software Development

AML software Development Web3 Wallet Development

Web3 Wallet Development Robo-Advisor App Development

Robo-Advisor App Development Supply Chain Management Software Development

Supply Chain Management Software Development Fleet Management Software Development

Fleet Management Software Development Warehouse Management Software Development

Warehouse Management Software Development LMS Development

LMS Development Education App Development

Education App Development Inventory Management Software Development

Inventory Management Software Development Property Management Software Development

Property Management Software Development Real Estate CRM Software Development

Real Estate CRM Software Development Real Estate Document Management Software

Real Estate Document Management Software Construction App Development

Construction App Development Construction ERP Software Development

Construction ERP Software Development