Automation and artificial intelligence are changing the financial world, and the investment software development sits at the heart of this change. Companies, which previously used manual analysis and slow decision-making, can now utilize smart technologies to analyze data instantly, predict trends, and be more accurate with portfolios.

A 2024 Mercer survey found that 91% of asset managers are either already using AI (54%) or planning to use it (37%) within their investment strategies or research. This increasing usage indicates that automation has become an essential part of gaining quicker insights, minimizing risk, and enhancing investment performance in general.

As AI and automation continue to develop, they will keep on transforming the way investment platforms are constructed, the way decisions are made, and the way clients are served.

Understanding Modern Investment Software Development

Modern investment software development plays a central role in how today’s financial ecosystem operates. In the fintech world, it is described as the process of innovation that can assist investors, fund managers and analysts to make smarter, data-driven decisions. These platforms gather and process financial information, automate manual processes and offer real-time insights that were previously hard to bring about using traditional systems.

Before AI and automation, the majority of investment platforms were based on stagnant data and human input. This resulted in slow decision-making, which was error-prone and could not be predictive. As markets became more dynamic, financial institutions needed smarter systems that could process information faster and anticipate changes automatically. That is where modern AI-powered investment software reshaped the landscape.

Some of the most popular varieties of investment platforms on the market today are portfolio management platforms, robo-advisors, trading platforms, and analytics platforms, each targeting a specific audience and application.

Common Investment Platforms and Their AI Opportunities

| Investment Platform Type | Main Purpose | Common Users | AI/Automation Opportunities |

|---|---|---|---|

| Portfolio Management | Track and optimize assets | Fund Managers | Predictive analytics for risk and returns |

| Robo-Advisors | Automate financial advice | Retail Investors | Generative AI-driven investment recommendations |

| Trading Platforms | Execute and manage trades | Traders | Automated trade execution using AI algorithms |

| Analytics Dashboards | Visualize and interpret financial data | Analysts | Real-time pattern detection and anomaly spotting |

All these systems have the advantage of AI analyzing large datasets, identifying patterns and can do so much faster than human analysis could. This has led to investment software development in the present day being more about developing platforms, but it is also about creating smart, adaptable ecosystems that can respond to market behavior.

The Growing Role of AI in Investment Software Development

The AI has already become the foundation of contemporary software development in the investment industry, as it assists the systems to become more customizable, precise, and smart. It allows real-time analysis of the market, recommending specific advice, and making decisions quickly by minimizing the number of errors made manually. Let’s explore how AI applications are shaping the future of investment platforms.

Predictive Analytics for Market Forecasting and Risk Prediction

Predictive analytics enables AI models to process years of historical data and discover patterns and predict future tendencies with higher accuracy. It assists investors in predicting market volatility, evaluating risk, and making wise decisions in portfolios.

Incorporating predictive analytics into investment platforms, companies can shift to proactive strategy development, rather than reactive analysis, and achieve improved performance and risk management.

Natural Language Processing (NLP) for Market Intelligence

NLP or Natural Language Processing, is changing the way investors consume and interpret information. Some of the NLP use cases include predicting market trends even before they occur by examining the contents of news articles, social media sentiments, and financial reports.

Investment platforms apply NLP to interpret how world events, company news, or the sentiment of the people caught their attention may affect the performance of their assets, and thus, investors are provided with a data-driven advantage in their decision-making.

Generative AI for Simulations and Strategy Building

Generative AI development allows for generating virtual market simulations and investment scenarios. These models are capable of testing various strategies under different economic environments to forecast the results and reduce risks prior to the deployment of capital.

It is also used in creating automated reports, portfolio summaries and client-ready AI presentation maker that represent real-time information. Generative AI allows investment platforms to be more interactive, analytical, and forward-looking.

Fraud Detection and Anomaly Tracking

The AI-based fraud detection software constantly watches the trading and transaction-related data to spot suspicious activity. Machine learning algorithms detect anomalies, such as unusual trading patterns or unauthorized account activities, within milliseconds.

This assists investment platforms in building a better security level, minimizing operational risks, and fostering investor confidence by proactively preventing fraud.

Client Personalization with AI-Powered Recommendations

AI recommendation engines deliver hyper-personalized investment recommendations using client profiles, market behavior, and risk tolerance. These systems propose investment opportunities that suit the goals and preferences of the user perfectly.

By combining predictive analytics and behavioral data, investment platforms can improve client retention, boost trust, and deliver a better user experience. This approach ensures that every investor receives insights tailored to their unique journey.

How Automation Enhances Investment Software Performance

Automation is the force behind the scalability and efficiency of investment software development. It minimizes manual efforts, removes human error and enables financial departments to devote time to strategy and not administration. With automation at all levels, investment platforms can now perform more quickly, with greater compliance and greater ROI.

Automated Data Processing for Real-Time Insights

Investment companies depend on high amounts of financial information through various sources like stock exchanges, news alerts, and economic signals. Automated data processing enables systems to gather, clean and analyze this data in real-time.

Through automation, thousands of data points can be processed immediately, and traders and analysts will always make a decision based on the correct and up-to-date information.

Robo-Advisors and Algorithmic Trading for Hands-Free Management

The most obvious examples of the use of automation in finance are robot advisors and algorithmic trading systems. They enable the user to control investments and provide an AI trader on a set of rules or market indicators.

This is a hands-free management that enhances accuracy and minimizes emotional bias in trading. Automated systems also work 24/7, so no opportunities are lost because of time or human capacities.

Workflow Automation for Compliance and Operations

Automation extends beyond trading. It also simplifies the processes of operations such as client onboarding, Know Your Customer (KYC) verification, and compliance reporting. These used to be manual review and documentation areas that frequently slowed down operations.

Through automation of workflows, such processes are made quicker, more predictable and less prone to fault. It also makes sure that companies stay aligned with changing regulatory practices without straining their staff.

Integration Automation with Fintech Ecosystems

Modern investment platforms rarely work in isolation. They integrate with banking systems, payment gateways, CRM tools, and third-party analytics platforms. Integration automation simplifies this process by enabling smooth data exchange through APIs.

Such connectivity enables the firms to have a centralized understanding of client portfolios, transactions and performance metrics, leading to more responsive and data-driven decision making.

How AI and Automation Work Together to Transform Investment Decisions

The real power of investment software development comes from combining AI’s intelligence with automation’s speed. Although AI in fintech offers information-based insights, automation makes sure that the information is implemented with accuracy and consistency. The two together create a feedback loop that continuously enhances the investment strategies with time.

Predictive Insights Meet Process Automation

When predictive analytics and automation work hand in hand, investment platforms can move from analysis to action instantly. For instance, AI models can forecast potential market movements or detect portfolio risks. Once the system identifies an opportunity, automation can execute trades or rebalance assets within seconds.

Companies adopting intelligent automation are already seeing measurable gains. According to a Deloitte survey, organizations implementing AI-driven automation forecast a 15% increase in revenue within specific business units and a 24% reduction in operating costs over three years. This seamless collaboration reduces lag, improves accuracy, and allows firms to respond to market changes faster than ever before.

Learning from Real-World Outcomes

The combination of AI and automation in business does not end at execution. Every automated decision feeds new data back into AI models, helping them learn and improve future predictions. This cyclical learning process improves the level of intelligence of the system as well as efficiency.

As an example, when an automated trading system has shown better returns in certain conditions, the AI engine then learns such patterns and attempts to optimize similar trades in the future.

With time, the platform becomes more informed about such moves, adding value to its strategy projections and enhancing the outcomes of fund managers and individual investors. Firms benefit from consistent optimization, improved portfolio performance, and reduced human intervention in routine processes.

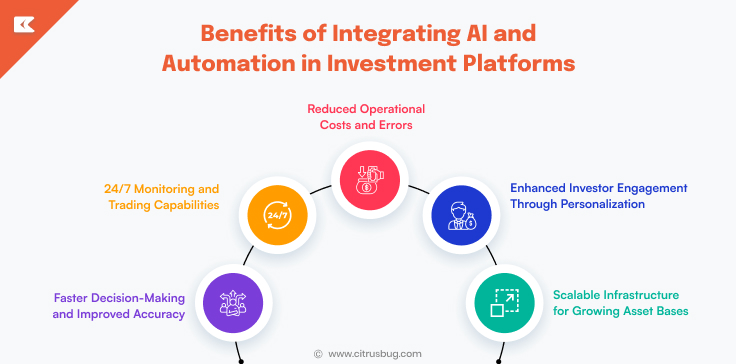

Benefits of Integrating AI and Automation in Investment Platforms

The combination of AI and automation in investment software development provides tangible benefits to both investment institutions and investors. These technologies enhance accuracy, speed of decision-making and help firms become more efficient in quickly moving markets. The result is a more agile, intelligent, and scalable investment ecosystem.

Faster Decision-Making and Improved Accuracy

AI models process huge volumes of data in real-time, whereas automation can be performed immediately. They reduce the aspect of human error and also make sure the investment decision is fast and accurate.

24/7 Monitoring and Trading Capabilities

Automated systems work 24/7, following global markets in time zones. This makes sure that no trading opportunities are lost, even when the teams are offline.

Reduced Operational Costs and Errors

Automation handles repetitive tasks such as data entry, reporting, and trade execution. This saves on manpower, reduces costs, and eliminates frequent human mistakes in high-volume operations.

Enhanced Investor Engagement Through Personalization

The use of AI-driven recommendations and analytics will offer investors personalized recommendations and analytics based on their objectives and preferences. Customized dashboards and intelligent advice improve engagement and satisfaction.

Scalable Infrastructure for Growing Asset Bases

AI and automation make it easy to scale operations as assets under management grow. Cloud-based systems and adaptive algorithms ensure consistent performance, even during rapid expansion.

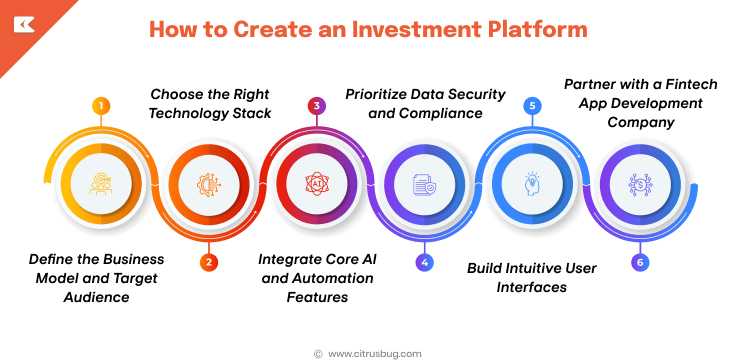

How to Create an Investment Platform

Step 1. Define the Business Model and Target Audience

Begin by determining your core users, like retail investors, fund managers or institutions. Explain the purpose of your platform, be it portfolio management, trading automation, or a robo-advisory platform. An efficient business model assists in aligning your business development roadmap and the requirements of compliance.

Step 2. Choose the Right Technology Stack

Select a tech stack that supports scalability, security, and real-time data processing. TensorFlow or PyTorch AI models used with cloud computing services such as AWS or Azure can be used to effectively conduct algorithmic trading and analytics.

Step 3. Integrate Core AI and Automation Features

The development of modern investment software must involve predictive analytics and AI-powered recommendations as well as automatic workflows. These features boost decision-making, decrease manual operations, and provide a speedy trade execution.

Step 4. Prioritize Data Security and Compliance

Financial software should be in accordance with regulations like the SEC, FINRA or GDPR. Installing end-to-end encryption, multiple-factor authentication and role-controlled access will help in securing sensitive investor data.

Step 5. Build Intuitive User Interfaces

An easy-to-use dashboard is crucial for investor confidence. Focus on interactive charts, performance tracking, and simple onboarding processes that make complex analytics easy to understand.

Step 6. Partner with a Fintech App Development Company

Working with experts like Citrusbug Technolabs ensures you receive complete support from design and architecture to AI integration and compliance testing. Our custom app development services help businesses create intelligent and scalable investment solutions that align with modern market expectations.

Future Trends: The Next Evolution in Investment Software

Generative AI-Powered Advisory and Predictive Modeling

Generative AI is reshaping how financial insights are created. It can process large volumes of data, model market conditions and produce investment strategies that meet the objective of the investor.

AI Agents for Portfolio Management

The next stage of the investment software development will be the autonomous AI agents that will be able to manage the portfolios in real time. These agents can track market dynamics, reorganize resources and conduct trades with a minimum amount of human intervention. According to a report by PwC, in the year 2030, AI automation is expected to add up to $15.7 trillion to the world economy, and finance will be among the biggest gains.

Blockchain Integration for Transparent Trading

Blockchain is expected to make trading more transparent and secure. Incorporating blockchain and AI, platforms can authenticate the transactions immediately and keep an audit trail of investors and regulators. MarketsandMarkets predicts that the blockchain fintech market will increase from $4.5 billion in 2023 to $23.1 billion in 2028, indicating rapid adoption.

Voice and Chat Interfaces for Investor Interactions

As AI-driven conversational interfaces improve, investors will soon interact with their platforms using natural language. Voice and chat assistants will allow people to have immediate access to the performance reports, portfolio recommendations, and individual insights.

Cloud-Based AI Ecosystems for Global Scalability

The future of investment platforms will be based on cloud infrastructure. It allows companies to scale analytics, automate compliance, and manage large asset bases across geographies.

Conclusion: Building the Future of Investment Software with AI and Automation

The future of investment software development is not to replace human expertise anymore, but to empower it. AI and automation introduce accuracy, speed, and intelligence to each phase of the investment life cycle. Collectively, they assist firms to make decisions quickly, increase their forecasting accuracy, and provide highly personalized investor experiences.

At Citrusbug Technolabs, we help financial organizations harness the power of AI and automation through custom fintech app development services. Our team develops secure, scaled-up, and data-driven investment platforms that can meet the changing market requirements. Those businesses that are early adopters of such innovations will not just improve performance, but will also gain a sustainable competitive advantage in the fintech landscape.

For organizations planning to build custom investment software, collaborating with an AI software development firm with years of experience could help speed up the innovation process and have the regulation and technical alignment prepared at the outset.