Robotic Process Automation in Finance: Benefits, Use Cases, and Implementation Guide

- November 3, 2025

-

664 Views

- by Ishan Vyas

Table of Contents

- What Is Robotic Process Automation in Finance?

- How RPA Works in Finance and Accounting

- Key Benefits of RPA in Finance

- RPA Use Cases in Finance and Accounting

- Robotic Process Automation and Artificial Intelligence in Finance

- Implementation Insights: How to Get Started with RPA in Finance

- Future of RPA in Finance: From Automation to Intelligence

- Conclusion

Today, finance teams are trapped in the endless circle of manual entries, reconciliations, and compliance examinations. Such activities are necessary but may take time, leading to delays and human errors that influence decision-making. Robotic process automation in finance has emerged as a viable option as companies seek smarter ways of running businesses.

RPA uses software bots to automate repetitive, rule-based tasks. They replicate human activities to process transactions, authenticate data and produce reports more efficiently and precisely. Gartner estimates that finance departments that have adopted RPA are able to save up to 25,000 hours of unnecessary labour work each year, or a savings of approximately $878,000 to a group of 40 full-time accountants. These numbers highlight how automation significantly improves efficiency and resource utilization.

When paired with AI algorithms, RPA goes beyond simple automation. It helps financial teams uncover insights, predict trends, and respond faster to market changes.

What Is Robotic Process Automation in Finance?

Robotic process automation in finance refers to using software bots that mimic the common actions of a human being in digital systems. These bots also communicate with the financial data, systems, and applications, similar to the employees, they read, copy and input the information more accurately and more quickly.

Simply, RPA processes the routine and algorithmic components of financial operations. For example, it can read data on the invoices, compare them with accounting records, handle transactions, and create reports automatically. This enables the finance professionals to concentrate on the high-value activities like financial planning, budgeting and compliance analysis.

RPA operates on existing systems, unlike conventional automation tools that require deep integration of the systems. It communicates with applications using the user interface, implying that organizations can automate operations without having to alter their core systems. Such flexibility makes RPA an affordable and scalable solution for companies that want to modernize their finances.

RPA also provides the basis of intelligent automation, with such technologies as AI and machine learning improving decision-making. Combined, they develop smarter systems that can forecast risks, enhance accuracy and make long-term financial efficiency.

How RPA Works in Finance and Accounting

Understanding how RPA works is key to realizing its value in finance. RPA fundamentally operates on software bots that operate under a set of rules and consequently perform repetitive operations in various systems. These bots are coded to act in a way to achieve certain tasks like logging in to apps, retrieving information, inputting data, and notifying after any given process has been completed.

In finance and accounting, these tasks might include processing invoices, reconciling transactions, validating data, or generating reports. The bots get the data from different sources, compare them with the established requirements and update the records automatically. All the actions are monitored, which guarantees transparency and conformity in financial activities.

The majority of the RPA solutions are based on three layers:

- Process Recorder: Captures user actions to create an automation workflow.

- Bot Runner: Executes the task according to defined logic.

- Control Panel: Monitors performance, manages updates, and provides analytics for continuous improvement.

RPA does not need significant changes to the systems, as it is integrated with the existing ERP and accounting software. It simply mimics human actions on the existing interface. Such a solution is more affordable and quicker to deploy than conventional automation or full-scale digital changes.

With RPA and analytics tools, finance teams can also attain real-time business insights. This integration helps reduce errors, ensure compliance, and make financial processes more resilient against disruptions.

Key Benefits of RPA in Finance

The use of robotic process automation in finance is gaining momentum as companies are seeking safer and smarter approaches to enhance precision, increase cost savings and efficiency. The following are a few of the most influential advantages of changing financial operations.

Enhanced Accuracy and Reduced Human Error

RPA minimizes manual data entry and automatically validates information across systems. This leads to more precise financial reports, fewer discrepancies, and reduced risk of costly mistakes in processes like reconciliations and invoicing.

Improved Compliance and Audit Readiness

All automated processes are documented and it has a clear audit trail. The finance department can easily prove the adherence to both internal and external regulations, whereas bots make sure that the transactions and reports are executed in accordance with prescribed approval processes.

Cost Savings and Faster Transaction Cycles

RPA reduces the number of repetitive processes and enables financial processes to be completed in a few minutes rather than hours, like vendor payment or reconciliation. Such speed decreases operational expenses directly and improves the efficiency of the entire process.

Increased Employee Productivity

With the automation of routine activities, finance professionals can be engaged in strategic work such as forecasting and financial planning. This not only increases productivity but also enhances job satisfaction among teams.

Better Customer Experience Through Faster Operations

Faster approvals, correct billing and efficient processing enhance client satisfaction and confidence. With finance teams being more responsive, organizations are offering improved service in all departments and external relations.

Financial systems are rapidly moving towards automation as the solution for data accuracy and strategic decision-making. With this revolution ongoing, the synergy between RPA and AI in the fintech sector will bring further change in the industry.

RPA Use Cases in Finance and Accounting

The real worth of robotic process automation in finance is evident when it is implemented on daily processes. The RPA frees up manual operations that previously took hours of work in processes such as invoice processing and compliance checks.

-

Invoice Processing and Accounts Payable

The RPA bots extract, validate and match invoice data to purchase orders automatically. This helps to cut on human intervention, reduce late payments and enhance relationships with the vendors.

-

Financial Reporting and Reconciliation

Bots can retrieve data across the systems, perform a mismatch check and produce correct reports in minutes. Automated reconciliations make sure that books are balanced and financial statements are audit-ready.

-

Payroll Management

RPA also streamlines the payroll cycles by automating payroll printouts, deductions and compliance reporting. It maintains precision and prompt payment even when handling huge amounts of employee information.

-

Expense Management

Expense claim processing often involves repetitive data entry and approval tracking. RPA minimizes the turnaround time through automatic validation of receipts, classification of expenses, and their routing to receive timely approvals.

-

Regulatory and Compliance Reporting

As regulations of the financial industry change every day, automation guarantees that any reports follow the necessary standards. RPA systems can identify inconsistencies and maintain compliance documentation in real-time.

-

Bank Reconciliation

The bank reconciliation process can be automated to help finance teams see mismatched entries sooner. This improves the financial accuracy and minimizes the workload at the end of the month.

-

Data Migration and System Integration

In digital transformation initiatives, RPA maintains data transition between the older and the new systems without any errors or hitches. This enhances the integrity and quality of reporting of financial data.

With increased investment in digital efficiency, combining RPA with AI algorithms will enable predictive analytics, fraud detection, and dynamic decision-making, transforming finance departments into engines of data and intelligence.

Robotic Process Automation and Artificial Intelligence in Finance

Although repetitive tasks in finance are automated using robotic process automation, artificial intelligence (AI) introduces cognitive abilities that transform automation into a smarter process. Together, they create a connected ecosystem where efficiency and intelligence work side by side.

RPA and AI: The Perfect Synergy

RPA performs pre-defined rules without any deviation, whereas AI processes unstructured data, learns and makes decisions based on data. When the two technologies work together, they facilitate automation that not only gets the work done but also knows what is going on. As an example, they are capable of identifying transaction anomalies or forecasting cash flows in real time.

Practically, RPA can be used to extract invoice information, and AI algorithms can be used to detect potential fraud or overpayments based on the pattern of spending. This partnership transforms static automation into intelligent decision-making that improves both accuracy and foresight.

Use Cases Where RPA and AI Work Together

- Fraud Detection: RPA collects and analyzes financial information, and AI models indicate suspicious cases with the help of behavioral data.

- Predictive Forecasting: Machine learning models evaluate historical data to forecast revenue, expenses, and investment risks.

- Customer Support Automation: AI-driven chatbots using AI can be used to address customer questions instantly with the help of RPA processes.

- Regulatory Compliance: AI tracks the policy amendments, whereas RPA recalculates financial operations to observe compliance.

The increasing use of AI and automation in the financial business sector demonstrates that intelligent systems not only streamline the workflow but also transform the way decisions are made. By combining RPA with AI in finance, it is turning the conventional finance models into more intelligent, quicker, and flexible ecosystems.

Implementation Insights: How to Get Started with RPA in Finance

Getting started with robotic process automation in finance doesn’t have to be overwhelming. The gradual, systematic implementation will guarantee a clear adoption, measurable ROI, and the cross-departmental sustained influence.

Step 1. Identify High-Impact Areas

Start by mapping finance processes that are repetitive, rules-based, and prone to human error. Invoice matching, expense reconciliation, and report generation are ideal early candidates for automation because they deliver visible results quickly.

Step 2. Build a Cross-Functional Team

Successful RPA adoption requires collaboration between finance, IT, and compliance teams. Finance experts understand the workflow, while IT ensures technical integration and data security. A unified team prevents operational silos and promotes transparency.

Step 3. Select the Right RPA Platform

Select the tools that can match your financial system structure and security standards Prioritize scalability, governance, and reporting features. Hiring an expert in automation or the development of a custom AI software development firm can assist in tailoring the solutions to your objectives.

Step 4. Develop and Test a Pilot Project

Begin with a pilot focused on one or two key processes. Measure the results, determine possible issues, and receive feedback on the work of end users. An organisation-wide automation has its basis in a well-tested pilot.

Step 5. Scale Gradually and Monitor Performance

Once the pilot succeeds, expand RPA across departments in stages. Monitor the analytics such as speed of processing, reduction of costs and rate of errors. Constant observation is used to maximize performance and sustainability.

The implementation of RPA is not a one-time arrangement. It is a dynamic process that develops with the increasingly connected and smarter financial systems. The correct approach will turn automation into a fundamental source of innovation and sustainable development in the finance ecosystem of your organization.

Future of RPA in Finance: From Automation to Intelligence

The next phase of robotic process automation in finance goes beyond repetitive task execution. It is about combining automation with intelligence to create adaptive, data-driven systems that evolve with business needs.

From Basic Automation to Intelligent Decision-Making

Traditional RPA focuses on task efficiency, while the future lies in intelligent automation powered by AI, machine learning, and predictive analytics. These technologies allow financial systems to anticipate trends, make recommendations, and support decision-making without constant human input.

For example, RPA can process invoices instantly, while AI analyses vendor behaviour to suggest better payment terms. Together, they help financial leaders make smarter choices faster.

Rise of Hyperautomation in Finance

Financial services are already being impacted by “hyperautomation” (the integration of RPA and AI, process mining and low-code/no-code technologies).

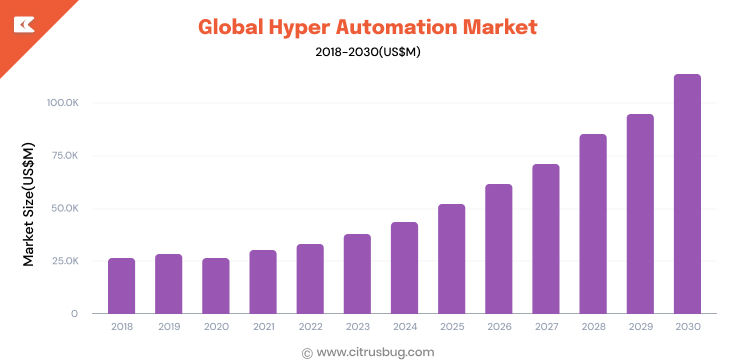

- The worldwide market size of hyperautomation (including finance and accounting software) is approximately US$35 billion in 2022 and is expected to grow to US$118.7 billion by 2030 with a CAGR estimated at circa 16.5%.

- Within the financial sector in particular, the banking, financial services and insurance (BFSI) segment recorded about 28% of the market share of hyperautomation in 2024.

- Firms document that hyperautomation in finance yields an ROI of about 30-200%, and can lower the costs of some specific bank functions by up to 20-30%.

Focus on Governance and Ethical AI

As automation becomes more intelligent, governance and ethics must take centre stage. Transparent algorithms, auditable workflows, and responsible data use will define the success of future RPA initiatives in finance.

Organizations that adopt end-to-end automation will have systems that think, learn and act intelligently. Financial institutions are preparing for this shift that will lead to the next wave of digital transformation across global banking and finance.

Conclusion

Robotic process automation in finance is no longer just used to perform monotonous work in the back office. It has turned out to be the boost of digital efficiency, cost savings and smarter decision-making. Finance teams that embrace RPA today are laying the groundwork for more intelligent, agile, and data-driven operations tomorrow.

At Citrusbug Technolabs, we help businesses unlock the full potential of automation by building secure, scalable, and AI-powered fintech software solutions. Our expertise in custom RPA implementation enables finance teams to streamline workflows, improve accuracy, and make informed decisions with confidence.

With automation converging with AI and predictive analytics, the financial industry will keep shifting towards full-process intelligence. It is not only a change in technology but the establishment of a ground of accuracy, transparency, and quicker growth.

SaaS Development

SaaS Development Web Application Development

Web Application Development Mobile Application Development

Mobile Application Development Custom Software Development

Custom Software Development Cloud Development

Cloud Development DevOps Development

DevOps Development MVP Development

MVP Development Digital Product Development

Digital Product Development Hire Chatbot Developers

Hire Chatbot Developers Hire Python Developers

Hire Python Developers Hire Django Developers

Hire Django Developers Hire ReactJS Developers

Hire ReactJS Developers Hire AngularJS Developers

Hire AngularJS Developers Hire VueJS Developers

Hire VueJS Developers Hire Full Stack Developers

Hire Full Stack Developers Hire Back End Developers

Hire Back End Developers Hire Front End Developers

Hire Front End Developers AI Healthcare Software Development & Consulting

AI Healthcare Software Development & Consulting Healthcare App Development

Healthcare App Development EHR Software Development

EHR Software Development Healthcare AI Chatbot Development

Healthcare AI Chatbot Development Telemedicine App Development Company

Telemedicine App Development Company Medical Billing Software Development

Medical Billing Software Development Fitness App Development

Fitness App Development RPM Software Development

RPM Software Development Medicine Delivery App Development

Medicine Delivery App Development Medical Device Software Development

Medical Device Software Development Patient Engagement Software Solutions

Patient Engagement Software Solutions Mental Health App Development

Mental Health App Development Healthcare IT Consulting

Healthcare IT Consulting Healthcare CRM Software Development

Healthcare CRM Software Development Healthcare IT Managed Services

Healthcare IT Managed Services Healthcare Software Testing services

Healthcare Software Testing services Medical Practice Management Software

Medical Practice Management Software Outsourcing Healthcare IT Services

Outsourcing Healthcare IT Services IoT Solutions for Healthcare

IoT Solutions for Healthcare Medical Image Analysis Software Development Services

Medical Image Analysis Software Development Services Lending Software Development Services

Lending Software Development Services Payment Gateway Software Development

Payment Gateway Software Development Accounting Software Development

Accounting Software Development AI-Driven Banking App Development

AI-Driven Banking App Development Insurance Software Development

Insurance Software Development Finance Software Development

Finance Software Development Loan Management Software Development

Loan Management Software Development Decentralized Finance Development Services

Decentralized Finance Development Services eWallet App Development

eWallet App Development Payment App Development

Payment App Development Money Transfer App Development

Money Transfer App Development Mortgage Software Development

Mortgage Software Development Insurance Fraud Detection Software Development

Insurance Fraud Detection Software Development Wealth Management Software Development

Wealth Management Software Development Cryptocurrency Exchange Platform Development

Cryptocurrency Exchange Platform Development Neobank App Development

Neobank App Development Stock Trading App Development

Stock Trading App Development AML software Development

AML software Development Web3 Wallet Development

Web3 Wallet Development Robo-Advisor App Development

Robo-Advisor App Development Supply Chain Management Software Development

Supply Chain Management Software Development Fleet Management Software Development

Fleet Management Software Development Warehouse Management Software Development

Warehouse Management Software Development LMS Development

LMS Development Education App Development

Education App Development Inventory Management Software Development

Inventory Management Software Development Property Management Software Development

Property Management Software Development Real Estate CRM Software Development

Real Estate CRM Software Development Real Estate Document Management Software

Real Estate Document Management Software Construction App Development

Construction App Development Construction ERP Software Development

Construction ERP Software Development