Warehouse Management Software Market Size, Growth & Trends Report

- November 19, 2025

-

642 Views

- by Ishan Vyas

Table of Contents

- What is a Warehouse Management System (WMS)?

- Why is it a Critical Technology in the Modern Supply Chain?

- Warehouse Management Software Market Size

- Top 5 Key Drivers Fueling WMS Market Growth

- Top 6 Warehouse Management Software Trends Shaping 2026 & Beyond

- Benefits of Warehouse Management Software

- Global Warehouse Management Software Market Regional Analysis

- Future of Warehouse Management Software

- Conclusion

The global warehouse management software market is undergoing a rapid transformation. It’s not just about tracking boxes anymore; it’s about being the command-and-control center for how we buy everything.

In this blog, we analyze the market size, growth, and trends, offering a blueprint for businesses navigating the logistics landscape of 2026 and beyond.

What is a Warehouse Management System (WMS)?

A warehouse management system (WMS) is software that optimizes and controls the day-to-day tasks of a warehouse. In the old days, that just meant basic inventory tracking. That definition is now completely outdated.

A modern WMS solutions serve as the digital spine for the warehouse, managing inventory levels and shipping, as well as labor resources.

Integrating seamlessly with ERP (Enterprise Resource Planning), transportation, and supply chain management systems, a WMS provides real-time visibility into every corner of warehouse activity.

Basically, warehouse management software today is not just about storage; it fuels a more “smart,” automated, and customer-centric warehousing, something you can’t live without in this fast-paced logistics era.

Why is it a Critical Technology in the Modern Supply Chain?

In the era of global trade, e-commerce, and instant deliveries, a warehouse management system (WMS) has become a cornerstone of efficient supply chain operations.

With the growth of logistics networks and customer expectations, businesses are equipped with intelligent mechanisms to keep on top of inventory, processes, and speed to market without sacrificing accuracy.

The modern supply chain runs on real-time data. Warehouse management software provides real-time information on inventory levels, order status, and staff productivity, allowing quick decision-making based on near-perfect parameters.

Additionally, with the rise of e-commerce and omnichannel fulfilment, warehouses are receiving an increasing number of small repeat orders – all while high speed and accuracy is still required.

A robust WMS automates order processing, optimizes picking routes, and synchronizes with shipping systems to meet these demands efficiently.

Also, WMS can smoothly connect with modern technologies such as IoT, robotics, and artificial intelligence to turn the conventional warehouse into an intelligent node on a supply chain.

This digital integration helps businesses respond proactively to market shifts, manage labor shortages, and maintain end-to-end traceability.

Warehouse Management Software Market Size

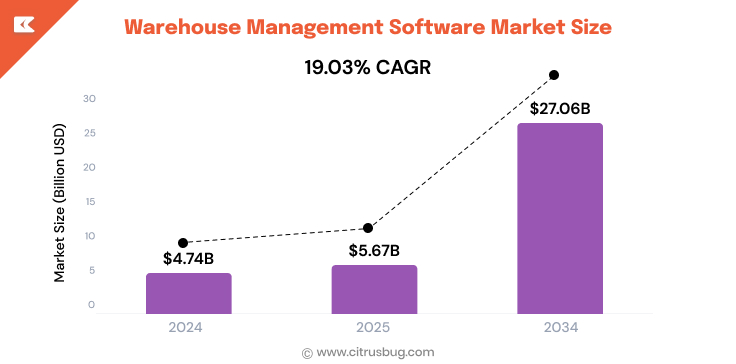

The warehouse management software market growth isn’t just steady; it’s accelerating. The global market size is valued $4.74 billion USD in 2024 and predicted to increase from $5.67 billion USD in 2025 to $27.06 billion USD by 2034, with a CAGR of 19.03% from 2025 to 2034.

Top 5 Key Drivers Fueling WMS Market Growth

1. E-commerce & Omnichannel Revolution

Online shopping has continually reshaped the operations of warehouses. E-commerce sales are projected to reach 23.6% of total retail sales worldwide by 2025, meaning warehouses will need to process larger quantities of smaller orders more frequently.

Order tracking with a WMS leads to greater space utilization and more frictionless fulfilment in all channels. This constant need for speed and efficiency is compelling enterprises around the globe to invest in next-generation WMS solutions.

2. Cloud Adoption & Subscription Models

The move to the cloud-based warehouse management software market is gaining traction as it gives scalability, flexibility, and can save costs. Cloud contributed 55.6% of WMS revenue in 2024 and is expected to grow at a CAGR of 19.6% through 2030.

Cloud-based deployments mean swifter roll-out, less upfront cost, and simpler integration, enabling WMS to reach smaller-scale operations.

3. Automation, Robotics & IoT Integration

Warehouses are quickly becoming tech-driven hubs that are driven by sophisticated technologies, and WMS use is a standard practice at 93% of sites. And that commitment comes with hefty budget increases, as the overall tech budget jumped from a $1.15 million USD average in 2023 to $1.8 million USD in 2024.

These investments are largely in automation. More than 60 % of warehouses are already using some form of automation, and nearly 78 % want to increase these investments by 2025.

In this new environment, the WMS now coordinates with robotics, IoT sensors, and automated storage to streamline picking, inventory tracking, and real-time communication.

4. Need for Real-Time Visibility & Analytics

Data accuracy and real-time insights are critical in today’s logistics. Current WMS systems include the capability to monitor orders, inventory, and the performance of warehouse employees in real time.

Companies using next-gen warehouse management systems report up to 37% fewer picking errors and 21% faster order cycles. This real-time visibility means quicker, data-informed decision-making and enhanced customer satisfaction.

5. Increasing Complexity of Global Logistics

Selling globally is a logistical nightmare. You’re managing multi-country inventory, different compliance rules, new tariffs, and complex billing. A modern WMS is the only way to manage this complexity, providing a scalable framework to run a global network of distribution centers as a single, cohesive unit.

Top 6 Warehouse Management Software Trends Shaping 2026 & Beyond

1. AI & Machine Learning for Predictive Analytics

AI can change how warehouses operate from reactive to predictive. These machine learning systems model sales, demand, and supply patterns to provide forecasts for inventory and labor scheduling.

With predictive analytics, we can reduce stockouts and overstocking while increasing overall supply chain effectiveness. AI-enabled WMS platforms will be the norm for most large logistics companies by 2026.

2. Robotics & AMR Integration

Autonomous mobile robots (AMRs) in tandem with robotics technology within warehouses are changing the game on picking, sorting, and material handling. Robots enhance speed, precision, and worker safety, all while reducing labor costs.

The market for warehouse robotics, which is needed to bring about automation in warehousing and eliminate human intervention because of its higher labor cost, will hit $17.98 billion USD by 2032. Integrate with WMS for a unified human and automation work process to deliver throughput in days.

3. Mobile-First Solutions & Wearable Tech

With mobility becoming a necessity, warehouse managers are shifting to mobile-first WMS platforms that enable real-time task management on smartphones and tablets.

Wearable technology such as smart glasses, scanners, and AR headsets further boosts efficiency and reduces manual errors. These tools enhance communication, enable hands-free operations, and provide instant access to critical warehouse data.

4. Customizable & Industry-Specific WMS Solutions

Companies aren’t willing to accept one-size-fits-all WMS platforms with large, costly customizations. Long term, the movement is towards creating flexible systems that can be composed to deliver value and industry-specific modules.

A WMS for pharmaceuticals will be designed differently regarding compliance than a WMS for apparel. Vendors are providing “WMS for E-commerce” or “WMS for Manufacturing” as separate products, which generate value much more quickly.

5. Automated Inventory Drones

Drones are becoming a practical way to track inventory and perform stock audits. Equipped with scanners and cameras, automated flying drones can perform an inventory count in real time over a whole warehouse area, thereby reducing human effort considerably.

They attain high accuracy, accelerate cycle counting, and reduce total downtime. It is very likely that drone-assisted warehouses will become common in big logistics operations by 2026.

6. AI Chatbots and Voice Assistants for Warehouse Support

AI chatbots and voice assistants are optimizing warehouse communication and operations. They help managers reply to inquiries on inventory, track performance, and assign tasks with a few words.

These automated assistants enhance the speed of decision-making and relieve employees from tasks of higher added value. With further development of natural language processing technology, conversational AI will be integrated into smart warehouse ecosystems.

Benefits of Warehouse Management Software

Improved Inventory Accuracy

- Makes monitoring of inventory movements and places in real time.

- Features barcode or RFID scanning that helps minimize manual operator entry errors.

- Reduces stock mistakes with the help of real-time reporting.

- Helps maintain optimal stock levels and reorder points.

- Lowers the chances of overstock or shortages.

- Guarantees accurate demand and supply.

- Increases trust in inventory data for more intelligent decisions.

Enhanced Operational Efficiency

- Automates the work that is a frequent, manual requirement.

- Reduces time spent on locating items with optimized picking paths.

- Enhances precision metrics when processing and shipping orders.

- Improves communication throughout the warehouse and logistics departments.

- Optimizes productivity while minimizing resource waste.

Real-Time Data & Visibility

- Monitors levels of inventory, orders, and staff movements in real time.

- Enables quick decision-making based on accurate live data.

- Minimizes mistakes and wasted time with real-time feedback loops.

- Permits multi-location warehouses to work normally.

- Provides visibility into supply chain performance metrics.

- Increases visibility for stakeholders and corporate management.

Better Space Utilization

- Optimizes warehouse layout for maximum storage capacity.

- Uses data to direct products where they will be most efficient.

- Saves time in travel and reduces congestion in aisles.

- Supports dynamic slotting for high-throughput products.

- Enhances the organization and accessibility of items that are stored.

- Reduces the requirement for expansion by making the most of the existing space.

- Guarantees the effective usage of every cubic foot in the storage area.

Faster Order Fulfillment

- Automate pick, pack, and ship processes.

- Decreases in the time of order processing for faster delivery cycles.

- Enhances order accuracy through workflow guided by the system.

- Works alongside your carriers to ensure seamless shipping out.

- Enables batch or wave picking to increase efficiency.

- Increases delivery dependability and customer goodwill.

- Reduces human intervention and guarantees stable operation.

Cost Reduction

- Reduces human labor costs by automation and optimization.

- Helps minimize waste, errors, and returns associated with manually cutting cloth.

- Reduce inventory carrying costs by ensuring optimal stock levels.

- Reduces downtime by scheduling and managing tasks more effectively.

- Saves energy by increasing workflow efficiency.

- Provides data-driven operational insights to improve ROI.

Seamless Integration with Other Systems

- Seamlessly integrates with ERP, CRM, and TMS software.

- Maintains the quality and integrity of data across departments.

- It simplifies order management and inventory control.

- Automates the flow of information from sales through procurement to logistics.

- Minimizes duplication of entries and manual copying.

- Improves the coordination and visibility of a supply chain.

- It will allow integration through the cloud and API for scalability.

Improved Labor Management

- Monitors employees’ productivity and the amount of work done in real time.

- Assigns tasks efficiently based on skill level and availability.

- Predicts staffing requirements based upon workloads and makes adjustments accordingly.

- Supplies full reports for performance review.

- Increases employees’ satisfaction thanks to task transparency.

- Automation makes the environment safer and work less stressful.

Scalability for Business Growth

- Quick to deploy in new warehouses, markets, or product lines.

- Scales up for larger amounts of orders without loss of any performance.

- Scales with business growth through modular system design.

- Enables cloud-based access for remote control.

- Serves as a bridging capacity for growing logistics networks.

- Future-ready, with upgradable features and integrations.

Advanced Reporting & Analytics

- Delivers real-time performance reports and dashboards.

- Recognizes inefficient processes and areas to improve.

- It offers customizable reports for management and clients.

- Enhances strategic planning with accurate operational data.

- Supports continuous optimization of warehouse performance.

Global Warehouse Management Software Market Regional Analysis

The warehouse management system software market is a global game, but it is not unfolding exactly the same way in every part of the world.

Every area has a different character, reasons, and a unique growth story. Knowing this division based on geography is very important for realizing the complete picture.

North America

The North American region is still the most advanced in terms of the adoption of warehouse management systems. The market size was estimated to be $1.24 billion USD in 2024 and is expected to grow to $4.03 billion USD by 2032, with a 15.90% CAGR.

Europe

Europe holds 30.8% of the WMS market. The main contributors to the growth of the WMS market in Europe are the improvements in the warehouse management systems and the rising consciousness among companies concerning cloud-based warehouse management systems.

Asia Pacific

In the case of Asia Pacific, according to Research in Markets, the warehouse management systems market is projected to reach $2,524.3 million by 2030 with a CAGR rate of 21.9%.

The logistics business has been getting hotter as retailers and logistics companies swoop on the sites in places such as India, Singapore, Hong Kong, Japan, and Australia. Therefore, increasing e-commerce operations and sales will be a driving factor for the warehouse management system market.

Latin America

Latin America boasts the smallest percentage of share compared to other regions, but is experiencing increasing adoption of warehouse management software. Its market is estimated to grow from $5.9 billion USD in 2025 to $12.7 billion USD by 2031, at a CAGR of 13.6%.

Growth is being driven by e-commerce, SKU proliferation and the need to orchestrate complex multi-node fulfillment. Both small and mid-sized shippers are deploying cloud WMS for rapid time-to-value, while larger enterprises are updating brownfield DCs with robotics-infused platforms.

Future of Warehouse Management Software

- The future of WMS is automated, intelligent, and completely digitally integrated throughout supply chains.

- AI and ML will improve forecasting, inventory management, and order accuracy.

- IoT will enable visibility to warehouse assets and operations in real-time.

- Voice and AR-enabled tools will advance worker efficiency while reducing operational defects.

- Advanced analytics and predictive insights will enable smarter, data-driven decision-making.

- Cybersecurity and data privacy will rise to the top as new priorities in warehouse management software.

Conclusion

The warehouse management software market is now rapidly changing, thanks to growing e-commerce, automation, and data-driven logistics. So long as businesses strive to make the most of their operations, pressure on the market for scalable, cloud-based WMS solutions with AI capabilities will continue to rise.

To succeed in the digital age, businesses need warehouse solutions that optimize workflows and provide real-time visibility. Partnering with a company that develops warehouse management software can help to design tailored solutions that boost efficiency, reduce costs, and ensure long-term operational excellence.

SaaS Development

SaaS Development Web Application Development

Web Application Development Mobile Application Development

Mobile Application Development Custom Software Development

Custom Software Development Cloud Development

Cloud Development DevOps Development

DevOps Development MVP Development

MVP Development Digital Product Development

Digital Product Development Hire Chatbot Developers

Hire Chatbot Developers Hire Python Developers

Hire Python Developers Hire Django Developers

Hire Django Developers Hire ReactJS Developers

Hire ReactJS Developers Hire AngularJS Developers

Hire AngularJS Developers Hire VueJS Developers

Hire VueJS Developers Hire Full Stack Developers

Hire Full Stack Developers Hire Back End Developers

Hire Back End Developers Hire Front End Developers

Hire Front End Developers AI Healthcare Software Development & Consulting

AI Healthcare Software Development & Consulting Healthcare App Development

Healthcare App Development EHR Software Development

EHR Software Development Healthcare AI Chatbot Development

Healthcare AI Chatbot Development Telemedicine App Development Company

Telemedicine App Development Company Medical Billing Software Development

Medical Billing Software Development Fitness App Development

Fitness App Development RPM Software Development

RPM Software Development Medicine Delivery App Development

Medicine Delivery App Development Medical Device Software Development

Medical Device Software Development Patient Engagement Software Solutions

Patient Engagement Software Solutions Mental Health App Development

Mental Health App Development Healthcare IT Consulting

Healthcare IT Consulting Healthcare CRM Software Development

Healthcare CRM Software Development Healthcare IT Managed Services

Healthcare IT Managed Services Healthcare Software Testing services

Healthcare Software Testing services Medical Practice Management Software

Medical Practice Management Software Outsourcing Healthcare IT Services

Outsourcing Healthcare IT Services IoT Solutions for Healthcare

IoT Solutions for Healthcare Medical Image Analysis Software Development Services

Medical Image Analysis Software Development Services Lending Software Development Services

Lending Software Development Services Payment Gateway Software Development

Payment Gateway Software Development Accounting Software Development

Accounting Software Development AI-Driven Banking App Development

AI-Driven Banking App Development Insurance Software Development

Insurance Software Development Finance Software Development

Finance Software Development Loan Management Software Development

Loan Management Software Development Decentralized Finance Development Services

Decentralized Finance Development Services eWallet App Development

eWallet App Development Payment App Development

Payment App Development Money Transfer App Development

Money Transfer App Development Mortgage Software Development

Mortgage Software Development Insurance Fraud Detection Software Development

Insurance Fraud Detection Software Development Wealth Management Software Development

Wealth Management Software Development Cryptocurrency Exchange Platform Development

Cryptocurrency Exchange Platform Development Neobank App Development

Neobank App Development Stock Trading App Development

Stock Trading App Development AML software Development

AML software Development Web3 Wallet Development

Web3 Wallet Development Robo-Advisor App Development

Robo-Advisor App Development Supply Chain Management Software Development

Supply Chain Management Software Development Fleet Management Software Development

Fleet Management Software Development Warehouse Management Software Development

Warehouse Management Software Development LMS Development

LMS Development Education App Development

Education App Development Inventory Management Software Development

Inventory Management Software Development Property Management Software Development

Property Management Software Development Real Estate CRM Software Development

Real Estate CRM Software Development Real Estate Document Management Software

Real Estate Document Management Software Construction App Development

Construction App Development Construction ERP Software Development

Construction ERP Software Development