Banks are rapidly adopting advanced technologies to improve customer experience and streamline operations. One of the most influential innovations is the AI chatbot for banks, which provides immediate assistance, decreases the workload, and provides better customer interaction. These chatbots can complete functions such as balance check, card management and update on transaction functions, enabling the institution to serve customers more quickly and efficiently.

According to the Consumer Financial Protection Bureau (CFPB), approximately 37% of the U.S. population interacted with a bank’s chatbot in 2022. This growing adoption shows how conversational AI is reshaping how banks communicate with customers.

Financial institutions are currently adopting AI-powered chatbots to offer secure, customized, and convenient banking services and promote their digital expansion in the long term.

Why AI Chatbots Are Revolutionizing the Banking Experience

Banking isn’t what it used to be anymore. Instant, intelligent conversations are replacing long phone queues and email backlogs. Modern customers don’t want to wait; they want help right now. That’s exactly what an AI chatbot for banks delivers.

These AI-based assistants are transforming customer relations with financial institutions. They listen, understand, and respond like human agents but with more speed and precision.

Here’s what makes them game-changing:

Instant support, anytime

AI chatbots can be used 24/7, and customers can receive answers whenever they want. They take the load off human support teams and enhance response speed and satisfaction.

Personalized customer experiences

AI for banking chatbots uses data and behavioral inferences to enhance meaningful conversations. These chatbots assist customers in making their finances smarter, including by identifying their spending patterns and sending them payment alerts.

Platforms that support centralized conversations, such as Crisp AI customer support, help banks manage interactions across channels while maintaining consistent and organized customer communication.

Consistency across channels

Chatbots with AI in the banking industry serve as a single interface, whether it is mobile apps, WhatsApp, or a web portal. Customers enjoy the same reliable support, no matter which platform they use.

Smarter operations for banks

Chatbots are capable of managing thousands of conversations at the same time, enabling human agents to work on more valuable tasks. This change enhances productivity, minimizes expenditures, and increases company satisfaction in general.

AI is not exclusively enhancing the way banks interact with consumers. It is redefining the meaning of great service in digital banking today.

Key Use Cases of AI Chatbots in Banking

AI chatbots have developed way beyond responding to simple questions. They have been turned into personal finance advisers, online tellers and even fraud detectors. We are going to discuss some of the most efficient AI chatbot applications in contemporary banking.

Personalized Account Assistance

AI-powered chatbot solutions for banking can instantly handle balance inquiries, transaction history, and account updates. They also minimize the use of manual intervention and provide customers with prompt and precise assistance.

Loan and Credit Support

Chatbots can pre-qualify candidates, calculate loan eligibility, and direct users to their repayment choice. With the help of NLP and AI, they can make a complex process easier and more conversational.

Payment Reminders and Notifications

AI chatbot for banks keep customers financially organized by paying the bills and sending due-date alerts. They can also create proactive notifications and help with the establishment of automated payments.

Fraud Detection and Alerts

AI-powered chatbots can track transactions and identify suspicious behaviors in real time. They enhance trust and minimize the possibility of financial fraud by informing the customers immediately.

Financial Education and Guidance

Chatbots assist banks in informing users about financial literacy, savings targets and investments. This creates a sense of partnership rather than just a transactional relationship.

Through these features, AI chatbots for banking and payments are changing the way customers receive financial services. They do not just stick with automation but develop useful and intelligent interaction that really counts.

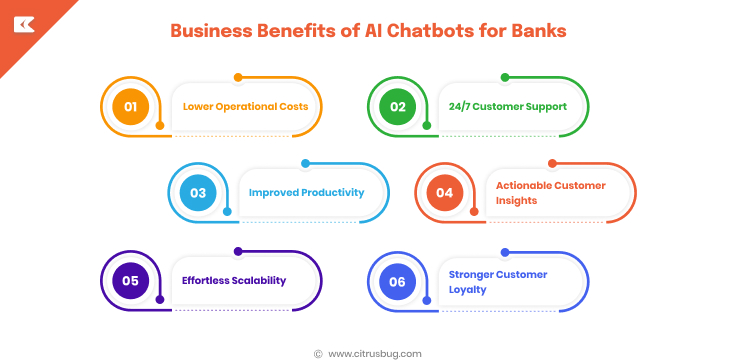

Business Benefits of AI Chatbots for Banks

AI chatbot for banks are more than just digital assistants. They have become core tools for banks looking to boost efficiency, cut costs, and deliver better customer experiences. The following are the key business advantages of AI chatbots in banks.

Lower Operational Costs

Chatbots can handle thousands of customer queries at a time without having to employ additional personnel. This saves customer support expenses and enables teams to work on intricate and high-value interactions.

24/7 Customer Support

The customers require quick responses, and chatbots help to do it. They offer 24-hour services, which brought satisfaction to customers and established trust.

Improved Productivity

AI chatbots streamline routine banking operations such as KYC verification, password resets, and transaction tracking. Banks can automate additional processes and enhance the response time by incorporating them into more advanced AI development services.

Actionable Customer Insights

Each chatbot discussion creates useful information. Banks can use these insights to determine customer behavior patterns and provide appropriate financial products at the appropriate time.

Effortless Scalability

Compared to human support teams, chatbots can expand immediately to support the increasing number of customers without affecting the quality and performance of the services.

Stronger Customer Loyalty

A trained AI chatbot for banks is a personalized, friendly and reliable helper. When customers feel heard and supported, they naturally develop greater trust and loyalty toward the bank.

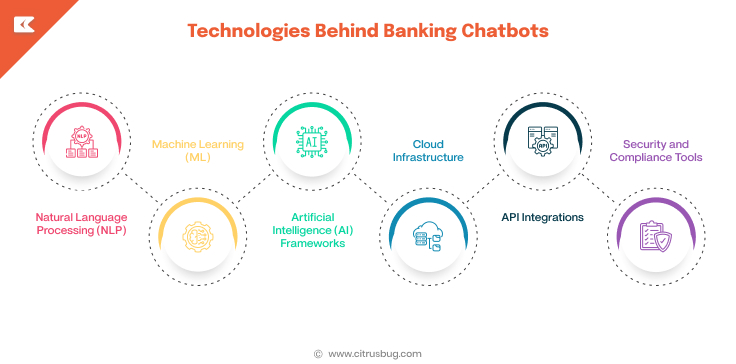

Technologies Behind Banking Chatbots

Behind every intelligent banking chatbot is a strong combination of technologies that produce a feeling of natural, safe, and effective dialogue. These tools are combined to make interactions between customers seamless and human-like to foster trust and reliability.

-

Natural Language Processing (NLP)

At the core of every smart chatbot is NLP. It enables the system to understand the human language, detect the intention and take actions. Banks often use custom NLP services to train chatbots with domain-specific vocabulary like “credit score,” “mortgage,” or “KYC,” ensuring accurate and context-aware responses.

-

Machine Learning (ML)

Machine learning enables chatbots to get better each time. They are able to learn through the behavior of customers with time, adjust to various styles of communication and become more specific in solving queries.

-

Artificial Intelligence (AI) Frameworks

Models developed using AI frameworks such as TensorFlow and PyTorch enable developers to create models to perform activities such as sentiment detection, fraud detection, and transaction monitoring. The capabilities improve user experience and security.

-

Cloud Infrastructure

Most of the AI chatbots used in banking are cloud-based to ensure that they are scalable and performant. The computing power is also provided in cloud services and is necessary to process a considerable amount of information within a short period of time and in a secure manner.

-

API Integrations

Chatbots are connected to core banking systems, CRM and payment gateways through API. This integration makes customers able to check their balance, transfer money or even request loans in the chat interface.

-

Security and Compliance Tools

In banking, security is not negotiable. The encryption, multi-factor authentication, and data masking are employed by chatbots to safeguard sensitive data and guarantee adherence to industry standards.

When combined, the technologies make a modern AI chatbot for banks work, allowing financial institutions to offer quicker customer support, guarantee data security, and deliver superior customer experiences.

Real-World Examples of AI Chatbots in Banking

Several leading banks have adopted AI chatbots and successfully managed to create a better customer experience and increase the efficiency of their operations. The following are three examples of the ways in which conversational AI is changing the modern banking industry.

| Bank | Chatbot Name | Key Features and Impact |

|---|---|---|

| Bank of America | Erica | Helps customers check their balance, credit score, and spending. It has already handled more than a billion customer interactions, which demonstrates the scalability of AI chatbots in banking. |

| Capital One | Eno | Sends proactive notifications on suspicious payments and duplication of payments. Allows customers to monitor their expenditure and operate their accounts with greater security. |

| Wells Fargo | Virtual Assistant | It is built into the mobile app provided by the bank, allowing users to use natural language conversations to pay bills, check balances, and locate ATMs. Continuously learns to provide smarter assistance. |

The following are examples of how AI-based chatbot banking solutions are transforming customer relationships. From fraud prevention to real-time financial advice, chatbots have turned into essential technology to digital-first banks seeking to provide quicker and more dependable service.

Building a Custom AI Chatbot for Your Bank

Creating an AI chatbot for banks that effectively understands your customers and is aligned with your banking goals is a complex and challenging project. Standard or off-the-shelf bots can provide some basic level of service; however, they lack the accuracy, security, and ability to scale that a bot designed for your banks would offer.

Step 1: Define Clear Objectives

Start by identifying what problems the chatbot will solve. It may be improving service, automizing loan applications, or processing payments, but having a set of specified objectives will give you focus throughout the build process.

Step 2: Choose the Right Technology Stack

It is important to identify an appropriate mix of AI, machine learning and NLP tools to integrate into the end Product. The technology should also facilitate secure transactions, real-time analytics and seamless integration with existing systems.

Step 3: Prioritize Security and Compliance

AI chatbot for banks are not supposed to breach data protection and compliance. Use encryption, role access and secure API to safeguard customer data and also guarantee regulatory compliance assurance.

Step 4: Design for Conversational Excellence

A successful chatbot sounds natural and helpful. Developers use NLP models trained specifically for banking to make conversations more engaging and context-aware.

Step 5: Partner with Experienced Developers

Working with a skilled AI fintech app development team can make all the difference. When you hire chatbot developers who have experience in financial and AI systems, you gain pre-existing frameworks, domain expertise, and shorter time-to-deployment.

Step 6: Consider Development Costs

The development costs of AI chatbots in banking vary based on sophistication, integrations, and compliance requirements. Generally, development expenses average between $30,000 and $120,000, depending on the desired functionality and technology stack.

Step 7: Test, Learn, and Improve Continuously

After the launch of the chatbot, track the performance and feedback. Timely updates and retraining will keep the chatbot updated with changing customer needs.

The Future of AI Chatbots in Banking

Banking chatbots are moving from basic assistants to intelligent companions that understand, anticipate, and act. The future of AI chatbots is focused on even smarter automation and conversations with a human face.

Key Trends to Watch

- Chatbots will perform active functions such as sending notifications, suggesting financial operations and making payments automatically.

- According to a survey, 48% of U.S. bank executives intend to apply generative AI and strengthen customer-facing chatbots and virtual assistants.

- AI chatbots reduce costs and response time and increase satisfaction. They can handle 70% of routine questions, releasing human agents to handle more complicated support.

- Chatbots are becoming more integrated in the modern world. They will operate using voice, mobile and web platforms, and link directly to the backend systems to conduct transactions and provide personal advice.

Why It Matters

- Banks that embrace intelligent chatbots can deliver faster, more personalized service.

- Increased automation results in satisfied customers and reduced operational expenses.

- Chatbots will soon become digital advisors that will direct users to make more favorable financial choices.

Next Steps for Banks

- Begin with a pilot chatbot project and plan to expand its capabilities over time.

- Make sure the chatbot works across multiple channels (mobile, web, voice) and connects with core banking systems.

- Collaborate with development professionals who are familiar with banking, AI and compliance to create a solution for the future.

Conclusion: Shaping the Future of Banking with AI Chatbots

AI chatbots are no longer optional for banks aiming to stay relevant in a digital-first world. They increase customer interaction, improve business processes and make financial services more personal and accessible.

At Citrusbug Technolabs, we assist financial institutions in designing and developing fintech apps and intelligent chatbot solutions to suit their business objectives. From custom NLP solutions to AI-powered automation, our experts create chatbots that deliver secure, scalable, and compliant digital experiences.

If you’re ready to reinvent the way customers communicate with your bank, then you should hire chatbot developers who know technology as well as finance. Together, we will develop a customer-friendly, smart banking process that will generate loyalty and growth over time.

FAQs (Frequently Asked Questions)

Do banks use chatbots?

Yes. Most banks are currently automating their customer service, transactions and product suggestions by use of the AI chatbots. These chatbots enhance efficiency, minimize waiting times and provide 24/7 services.

Which is the best chatbot for banks?

There is no one-size-fits-all chatbot for banks. The right solution ultimately depends on your objectives, tech stack and customer requirements. Often, the best choice for leading banks is a custom AI-powered banking chatbot solution designed specifically for banking workflows and compliance.

What are the risks of using AI in banking?

The largest threats are the data privacy concerns, security risks, and compliance. To overcome them, banks need to embrace strict governance, encryption and testing structures.

What makes a banking chatbot successful?

A successful chatbot is one that is able to perform conversational accuracy, along with compliance, and integrate well with the backend systems. It must be driven with sophisticated custom solutions to NLP and should be capable of evolving with customer feedback.

How can AI be used in banking?

AI improves almost all the areas of banking, such as fraud detection, credit scoring, predictive analytics and engaging customers. One of the most apparent applications of AI is chatbots that make the process of user interaction easier and provide immediate help.