How Digital Transformation in Fintech is Reshaping Financial Services

- October 8, 2025

-

1601 Views

- by Ishan Vyas

Table of Contents

- What is Digital Transformation in Fintech?

- The Driving Technologies Behind Fintech Transformation

- The Business Impact of Digital Transformation in Fintech

- Fintech & Digital Transformation in Financial Services: Real-World Examples

- Challenges in Fintech Digital Transformation

- Fintech Transformation Roadmap: From Vision to Execution

- The Future of Fintech – Where Digital Transformation Leads Next

- Conclusion: Turning Technology into Business Value

- FAQs

Financial services are changing faster than ever. Tasks that used to take days or weeks before, like loan approval, payment or customer service, can be carried out within minutes with the help of digital platforms. This is changing due to the digital transformation of fintech, a blend of AI, automation, cloud, and data analytics to revolutionize financial services, making them faster, smarter, and more customer-centric.

The numbers tell the story. KPMG states that, in 2021, the world fintech investment reached $210 billion, which is evidence of the enormous growth of digital banking and mobile payments and AI-based solutions. Those companies that are adopting these technologies are not just keeping pace. They are developing new customer service approaches, lowering expenses, and innovating in fraud detection and customized financial guidance, and hassle-free digital experiences.

From neobanks offering fully digital services to AI systems that flag suspicious transactions in real time, the financial landscape is being reshaped. This blog will discuss how the digital transformation in fintech sector is redefining the game, the technologies that are driving it, and the current strategies that organizations are implementing to remain on the leading edge of the game in a world where speed, security, and customer experience are becoming more critical than ever.

What is Digital Transformation in Fintech?

Digital transformation in fintech does not only involve replacing paper-based processes with digital processes. It is strategically applying technology to make the financial services industry fast, intelligent and customer-focused. At root, it is about developing intelligent, connected financial ecosystems that drive efficiencies, facilitate better decisions, and offer seamless experiences.

This change is inspired by four pillars:

1. Process Automation

Daily operations like processing payments, granting of loans and maintenance of accounts can be automated to reduce errors and accelerate operations. Through AI and robotic process automation (RPA), teams can focus on more valuable work and deliver a uniform service.

2. Data-Driven Decision Making

Data analytics provide fintech companies with an opportunity to understand consumer behavior, risk control, and create individualized financial products. Live data can provide organizations with the knowledge of how they can respond faster to market changes and make smarter decisions regarding business.

3. Customer Experience Optimization

Customers are demanding instant, seamless and personalized experiences. ACompanies can address these expectations and build trust and interaction with the aid of a mobile application, chat robots, and AI-based suggestions.

4. Integration Through APIs and Cloud Systems

APIs and cloud platforms connect various services and systems, creating a digital financial ecosystem. This provides the opportunity to be more rapid in the innovation cycle, collaborate with partners, including neobanks and payment gateways, with fewer difficulties, and exchange information in real-time.

Companies that are responsive to these pillars are capable of modernizing their operations and extending their operations as well as competing effectively in a dynamic financial environment. Digital transformation in fintech helps organizations streamline their operations, expand risk management, and provide improved and more individualized customer experiences.

The Driving Technologies Behind Fintech Transformation

There are major technologies that are driving digital transformation in the fintech industry, transforming the way financial services are delivered. These tools not only make work easier, but also make it possible to innovate, increase security and make the customer experience better.

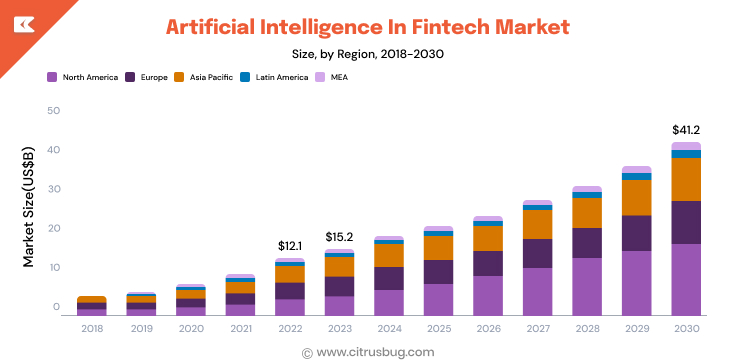

1. Artificial Intelligence and Machine Learning

The future of fintech is AI and machine learning. They are commonly applied in fraud detection, credit scoring and customer service with the help of AI-powered chatbots. AI can lower the operational expenses of organizations and provide personalized financial advice by processing a huge amount of data in real time.

Source: https://www.grandviewresearch.com/industry-analysis/artificial-intelligence-in-fintech-market-report

2. Blockchain and Smart Contracts

Blockchain offers a sense of transparency, security, and quicker settlement of transactions. Smart contracts decrease the involvement of middlemen and compliance risks. Financial institutions using blockchain can streamline payments, simplify cross-border transfers, and enhance trust across digital ecosystems. This makes blockchain a foundational technology for any cross-border payment platform aiming to deliver faster settlements, lower costs, and transparent international transactions.

3. Cloud Computing

The cloud technology enables fintech firms to grow and create new services in a shorter period. It helps in storing data, collaborating or integrating with third-party applications. The cloud deployment increases cost-efficiency and enables rapid innovation without spending on infrastructure.

4. Data Analytics and Predictive Insights

Advanced data analytics assist institutions in making data-driven decisions, optimize product offerings and segmenting customers well. The predictive insights enable companies to foresee the market, act proactively to manage the risks and tailor financial solutions to the customer. Implementing whitelabel agentic AI can further enhance these predictive capabilities by enabling customized automation tailored to specific institutional needs.

5. API Economy and Open Banking

Through APIs, it is possible to integrate different platforms and the fintechs can interface with banks, payment providers and third-party applications. Open banking allows collaboration, secures new sources of income, and gives customers greater access to data related to their finances.

Together, these technologies create a formidable digital ecosystem where fintech organizations can be more innovative, faster and offer improved customer experiences.

The Business Impact of Digital Transformation in Fintech

Digital transformation is not just a technology upgrade. It directly influences the physical business value through increased efficiency of the operations, greater customer experience and innovation in financial services.

Key Areas of Impact

Operational Efficiency

Routine operations such as payments, loan approvals and account management are automated to decrease the workload on manual operations and increase the speed of service delivery. Organizations do not have to concentrate their human resources on routine activities, instead, the human resources can work on strategic projects.

Customer Experience

The online platforms offer 24/7 connectivity, customized suggestions, and uninterrupted communications. This enhances customer satisfaction, loyalty and trust, which are vital in the current competitive financial environment.

Revenue Growth

The fintech companies are able to launch digital products and microservices more quickly and enter new customer markets and commercialize innovative applications like AI-based advisory products or personalized lending systems.

Risk Management

An improved system of advanced analytics and AI-based monitoring assists in detecting fraud, managing credit risk, and being regulatory-compliant. Real-time data aids in quicker, smarter decision-making.

By investing in these aspects, the organizations can update operations, scale effectively and stay competitive in an environment where the speed, precision, and customer-centricity are the pillars of success.

Fintech & Digital Transformation in Financial Services: Real-World Examples

Digital transformation in fintech is no longer theoretical. Many organizations have already transformed the concept of financial services, using technology to enhance effectiveness, improve customer experience, and generate new business models.

1. Neobanks and Challenger Banks

These are entirely digital banks, which offer complete banking services without branches. Neobanks provide faster and personalized services through mobile applications, AI-powered chatbots, and real-time analytics. Customers can open accounts, transfer and perform other financial management within a few minutes, as opposed to traditional banks taking days to offer those facilities.

2. InsurTech Platforms

AI and automation are helping insurance technology platforms simplify the process of claims, spot fraud and customize insurance products. Digital-first processes allow the insurers to lower the cost of doing business, increase customer satisfaction and remain compatible with the regulatory standards.

3. Lending Platforms

Digital lenders use alternative data and AI to determine creditworthiness in seconds and in a more precise manner. By automating underwriting and approval processes, these platforms provide faster loan disbursals, reach underserved segments, and minimize risk exposure. By automating underwriting and approval processes, these platforms provide faster loan disbursals, such as a flexible small business line of credit, reaching underserved segments and minimising risk exposure.

These are examples of how fintech and digital transformation of financial services are producing quantifiable business impact. Firms that embrace such strategies are not only becoming more efficient but also achieving better customer engagement and creating new sources of revenue.

Challenges in Fintech Digital Transformation

The advantages of digital transformation in fintech are enormous, yet in many cases, organisations encounter barriers that may slow the process. The following are the main issues and how they can be addressed:

-

Regulatory Compliance

Financial institutions have to deal with complicated regulations, including GDPR, PCI DSS, and regional financial governance frameworks.

- Solution: Introduce strong compliance procedures, active surveillance and governance policies. Regular audits and training of the employees can be used to ensure that innovation does not disrupt adherence to the regulations.

-

Cybersecurity Threats

Digital platforms handle sensitive customer data, which is a significant victim of cyberattacks.

- Solution: Strengthen the security with multi-factor authentication, encryption and periodic penetration testing. Develop specific incident response procedures and train personnel on cybersecurity.

-

Integration Complexity

Older systems may not be easy to integrate with new cloud services and APIs, and it slows transformation.

- Solution: Resolution: Use staged integration plans, emphasize interoperability and take advantage of middleware systems. Migration should be planned carefully to reduce disruption and facilitate the process of digital operations.

-

Talent Gap

Digital transformation requires highly skilled professionals like AI engineers, data scientists and cybersecurity experts.

- Solution: Invest in training, recruit specialized talents and collaborate with technology providers in order to fill in gaps. Fostering a learning culture helps in keeping skilled professionals.

Addressing those issues in a strategic manner, fintech organizations can facilitate the process of digital transformation, mitigate the risk, and maximise the potential of technological financial services.

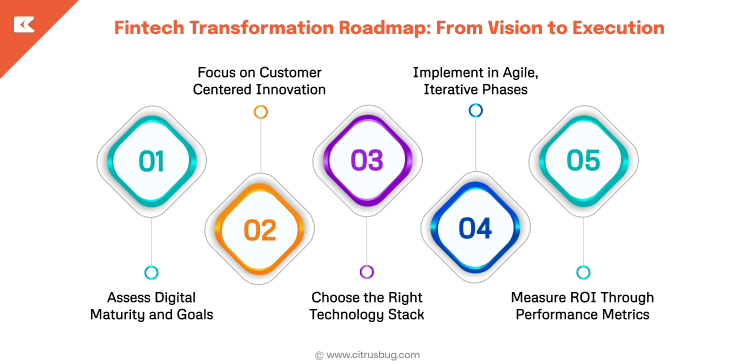

Fintech Transformation Roadmap: From Vision to Execution

Fintech digital transformation requires a clear roadmap. A stepwise model gives organizations a chance to create the greatest value and reduce the risk.

Step 1: Assess Digital Maturity and Goals

Begin with the analysis of the prevalent systems, procedure and technology readiness. Establish a set of targets of change, be it operational efficiency, better customer experience or the introduction of new digital products.

Step 2: Focus on Customer-Centered Innovation

Find out the areas where the digital solutions will be most effective for the customers. It can be accelerated payments, customized services or artificial intelligence-based advisor services or mobile solutions without hassles.

Step 3: Choose the Right Technology Stack

Choose technologies that are in line with goals and current infrastructure. This could be AI, cloud computing, data analytics, APIs and blockchain. Ensure the stack supports scalability and integration with partner platforms.

Step 4: Implement in Agile, Iterative Phases

Divide the transformation into smaller and manageable stages. Evaluate solutions, gather feedback and streamline the processes through agile approaches. The risk is reduced in the iterative implementation and this is in addition to ensuring quantifiable progress.

Step 5: Measure ROI Through Performance Metrics

Measure KPIs like operational efficiency, customer satisfaction, cost reduction and increase in revenue. Constant measurement enables organizations to streamline their operations and show the business contribution of the digital endeavors.

Through this roadmap, and with the right AI development Services provider, fintech organizations can implement digital transformation in a systematic way, leading to quicker outcomes and developing a long-term, technology-based benefit.

The Future of Fintech – Where Digital Transformation Leads Next

Fintech is an emerging industry that is rapidly developing due to changes in consumer expectations and the growing influence of technology. Some of the trends that are shaping the future include the following:

-

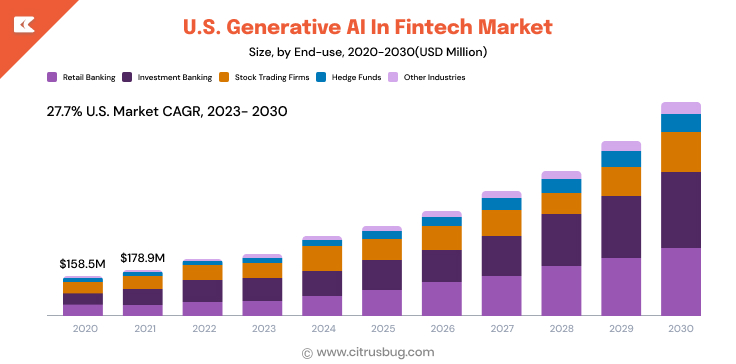

Generative AI and Hyper-Personalized Finance

The generative AI in fintech is changing the relationships with customers by providing personalized financial advice, predictive insights, and automatic decision-making. In the fintech industry, the global market size of generative AI was projected to reach USD 888.8 million in 2022, and USD 9.87 billion in 2030, with a CAGR of 36.1% between 2023 and 2030.

-

Sustainability and ESG-Driven Finance

Digital transformation is making organizations incorporate environmental, social, and governance (ESG) measures into their financial activities. Fintech solutions are contributing to the monitoring of ESG performance, the provision of green finance products, and the appeal to customers with a sense of social responsibility.

-

Global Interoperability and Cross-Border Digital Transactions

The latest developments in the blockchain, APIs, and cloud technology are transforming the speed, cost, and security of cross-border payments. This interoperability on a global scale enables fintech firms to go global and provide smooth international financial services.

-

Predictive Finance and Embedded Banking

Predictive analytics will enable institutions to predict market trends and manage the risk ahead, as well as provide context-based financial services. Embedded banking involves financial products that are embedded into non-financial platforms to offer users in-app financial experiences.

Conclusion: Turning Technology into Business Value

Fintech organizations that fail to use modern technologies run a risk of falling behind as customers anticipate that their financial services should be faster, smarter, and more personalized. Technology is changing how financial services are delivered, generate value and how customers are engaged, be it via AI-enabled personalization, cloud migration, blockchain or embedded finance. The result of such innovations is that companies can become more efficient, risk management is more effective, and the creation of customer experiences that result in customer loyalty and growth.

Citrusbug Technolabs is one of the foremost fintech app development companies that help financial institutions to speed up the process of digital transformation. With the help of AI, cloud, and custom software development, we are able to deliver secure and scalable and innovative financial application solutions to satisfy new market demands and raise customer confidence.

FAQs

What is digital transformation in fintech?

Digital transformation in fintech means using modern technologies like AI, cloud computing, blockchain, and data analytics to improve financial services. It helps in making operations quicker, services more custom, and products more innovative.

What is the best example of digital transformation?

Neobanks are a great example. Their digital banking services are entirely digital, as they use mobile applications and AI-based customer care. This enables quicker, convenient and more personal banking with no physical branches.

How does digital transformation benefit financial institutions?

It increases efficiency, lowers expenses, improves customer experiences, accelerates product launches, and manages risks and compliance more effectively.

What technologies are driving fintech transformation?

The major technologies that are driving transformation in fintech are AI and machine learning, cloud computing, blockchain, open banking APIs, and data analytics. These technologies help in automating activities, making better decisions and developing new financial products.

How does digital transformation improve customer experience?

With the help of AI and data analytics, fintech companies can provide personalized recommendations, expedited services, and 24/7 online support. Customers receive easier, quicker and more personalized financial experiences.

SaaS Development

SaaS Development Web Application Development

Web Application Development Mobile Application Development

Mobile Application Development Custom Software Development

Custom Software Development Cloud Development

Cloud Development DevOps Development

DevOps Development MVP Development

MVP Development Digital Product Development

Digital Product Development Hire Chatbot Developers

Hire Chatbot Developers Hire Python Developers

Hire Python Developers Hire Django Developers

Hire Django Developers Hire ReactJS Developers

Hire ReactJS Developers Hire AngularJS Developers

Hire AngularJS Developers Hire VueJS Developers

Hire VueJS Developers Hire Full Stack Developers

Hire Full Stack Developers Hire Back End Developers

Hire Back End Developers Hire Front End Developers

Hire Front End Developers AI Healthcare Software Development & Consulting

AI Healthcare Software Development & Consulting Healthcare App Development

Healthcare App Development EHR Software Development

EHR Software Development Healthcare AI Chatbot Development

Healthcare AI Chatbot Development Telemedicine App Development Company

Telemedicine App Development Company Medical Billing Software Development

Medical Billing Software Development Fitness App Development

Fitness App Development RPM Software Development

RPM Software Development Medicine Delivery App Development

Medicine Delivery App Development Medical Device Software Development

Medical Device Software Development Patient Engagement Software Solutions

Patient Engagement Software Solutions Mental Health App Development

Mental Health App Development Healthcare IT Consulting

Healthcare IT Consulting Healthcare CRM Software Development

Healthcare CRM Software Development Healthcare IT Managed Services

Healthcare IT Managed Services Healthcare Software Testing services

Healthcare Software Testing services Medical Practice Management Software

Medical Practice Management Software Outsourcing Healthcare IT Services

Outsourcing Healthcare IT Services IoT Solutions for Healthcare

IoT Solutions for Healthcare Medical Image Analysis Software Development Services

Medical Image Analysis Software Development Services Lending Software Development Services

Lending Software Development Services Payment Gateway Software Development

Payment Gateway Software Development Accounting Software Development

Accounting Software Development AI-Driven Banking App Development

AI-Driven Banking App Development Insurance Software Development

Insurance Software Development Finance Software Development

Finance Software Development Loan Management Software Development

Loan Management Software Development Decentralized Finance Development Services

Decentralized Finance Development Services eWallet App Development

eWallet App Development Payment App Development

Payment App Development Money Transfer App Development

Money Transfer App Development Mortgage Software Development

Mortgage Software Development Insurance Fraud Detection Software Development

Insurance Fraud Detection Software Development Wealth Management Software Development

Wealth Management Software Development Cryptocurrency Exchange Platform Development

Cryptocurrency Exchange Platform Development Neobank App Development

Neobank App Development Stock Trading App Development

Stock Trading App Development AML software Development

AML software Development Web3 Wallet Development

Web3 Wallet Development Robo-Advisor App Development

Robo-Advisor App Development Supply Chain Management Software Development

Supply Chain Management Software Development Fleet Management Software Development

Fleet Management Software Development Warehouse Management Software Development

Warehouse Management Software Development LMS Development

LMS Development Education App Development

Education App Development Inventory Management Software Development

Inventory Management Software Development Property Management Software Development

Property Management Software Development Real Estate CRM Software Development

Real Estate CRM Software Development Real Estate Document Management Software

Real Estate Document Management Software Construction App Development

Construction App Development Construction ERP Software Development

Construction ERP Software Development