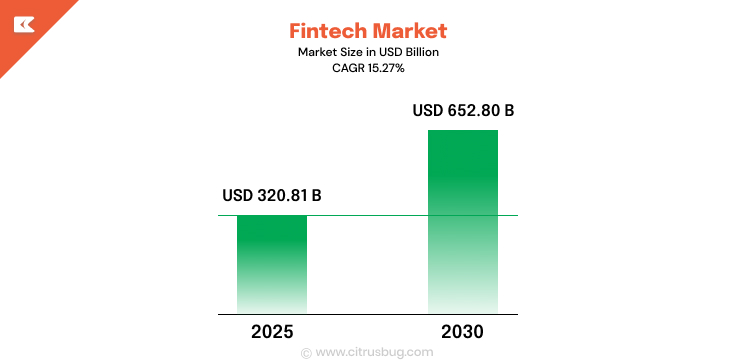

The financial technology sector is growing faster than ever. From AI-powered robo-advisors and digital wallets to blockchain-based lending platforms, fintech is changing how people save, invest, and make payments. Users now demand smarter, faster and more secure financial services, which has increased expectations on the businesses.

Cost is one of the initial questions to consider if you are considering developing a fintech app. The price is highly diverse considering features, technology, and compliance requirements. Being aware of what influences the cost is likely to save time, money, and effort in the long term.

This guide will describe all about fintech app development costs. You will get to know the key drivers of pricing, the common cost lines, and the viable approaches to strategize your investment in a proper way. At the end, you would have a clear roadmap of how to develop a fintech app that would meet your business objectives and user requirements.

Understanding Fintech App Development in 2025

A fintech application is a digital software application that delivers financial services. It is inclusive of mobile banking, digital wallets, lending, investment tools, and insurance management. These applications simplify and streamline the process of money management and make it more secure.

Fintech applications are revolutionizing the financial industry in 2025. The users anticipate quick, customized, and dependable services. This provision demands sophisticated technology, planning and compliance with regulations. The growth of mobile payments is huge. Mobile payment market has reached USD 88.50 billion in 2024 and is projected to have USD 587.52 billion in 2030 with an annual growth of 38%. Due to the rising number of individuals moving towards online and mobile payments, there is also a surge in the demand for fintech mobile applications.

Source: https://www.fortunebusinessinsights.com/fintech-market-108641

Fintech app development is not just a question of coding. It includes the creation of user-friendly interfaces, the implementation of secure payment services, and adherence to the financial regulations. Contemporary fintech applications tend to utilize AI, machine learning, and blockchain. The technologies enhance efficiency, user experience, and operations risk reduction in operations.

To manage your fintech app development cost, it is critical to understand how it is developed and what drives its costs.

What Is the Average Cost of Fintech App Development in 2025

The price of creating a fintech application varies based on its complexity, features, technology, and compliance needs. Apps can be as simple as an MVP or as complex as an enterprise app, and every element adds to the overall price. Being aware of the approximate cost per feature is helpful in business planning budgets and preventing surprises.

| Feature / Component | Description | Estimated Cost (2025) |

|---|---|---|

| UI/UX Design | Wireframes, prototypes, user interface, and user experience design. | $5,000 – $15,000 |

| Front-End Development | Mobile app interface, responsiveness, animations, and interactive features. | $10,000 – $30,000 |

| Back-End Development | Server-side logic, databases, APIs, authentication, and integrations. | $20,000 – $70,000 |

| Payment Gateway Integration | Secure payment processing, multi-currency support. | $5,000 – $15,000 |

| Security & Compliance | Data encryption, KYC/AML, PCI DSS compliance. | $10,000 – $25,000 |

| AI & Machine Learning Features | Predictive analytics, chatbots, recommendation engines. | $15,000 – $50,000 |

| Blockchain Integration | Smart contracts, decentralized ledger, secure transactions. | $20,000 – $60,000 |

| Testing & QA | Functional, performance, security, and usability testing. | $5,000 – $15,000 |

| Maintenance & Updates | Post-launch support, bug fixes, and feature updates. | $5,000 – $15,000 per year |

Note: The cost of a basic MVP can be approximately $40,000-70,000, and the cost of a full-rounded enterprise application can be more than $300,000. The cost of fintech app development directly relates to feature selection and the complexity of the app. Focusing on the core features in an MVP will protect the process of cost control without affecting the quality.

Key Factors That Influence Fintech App Development Cost

There are various factors that define the fintech app development cost, and understanding them assists businesses in making the right choices and budget well.

1. App Complexity and Feature Set

The more features your app includes, the higher the development effort. Basic applications that deal with basic payments or account management are faster to develop. Such innovations as AI-based analytics, personalized suggestions, or blockchain transactions need further development, testing, and maintenance.

2. Technology Stack and Integrations

The adoption of modern technologies can enhance performance, but it can be costly. AI, machine learning, and blockchain are sophisticated in functionality and need skilled developers. The inclusion of third-party services like payment gateways, banking APIs or cloud services introduces complexity and affects the budget.

3. UI/UX Design

An easy-to-use design is essential for use and maintenance. Custom interfaces, interactive elements, and smooth animations enhance user experience but demand additional design and development hours. High-quality design means that your app is unique in a competitive market.

4. Security and Regulatory Compliance

Fintech applications are required to comply with financial requirements, such as KYC/AML, PCI DSS, and GDPR. It is necessary to implement secure authentication, data encryption, and security against fraud. Compliance adds complexity to the development, yet it is important in the establishment of trust and to avoid legal risks.

5. Development Team and Project Management

The expertise and structure of your development team influence cost and quality. Skilled developers can provide better quality apps, but can prove to be more expensive. Each of the in-house teams, outsourcing or a hybrid has its benefits. Delays and unwarranted costs can also be minimized through efficient project management.

Tip: When wanting to keep the costs down without affecting the quality, begin with a minimum viable product that concentrates on the core functions. Progressively expand the application according to user response and market need.

Fintech App Development Cost by Type

Different types of fintech apps come with varying levels of complexity and development requirements. Knowing these differences also enables businesses to estimate the cost of developing a fintech app better.

| App Type | Key Features | Estimated Cost (2025) |

|---|---|---|

| Mobile Banking App | Account management, funds transfer, transaction history, push notifications | $80,000 – $250,000 |

| Digital Wallet App | Payment processing, QR code payments, peer-to-peer transfers, multi-currency support | $60,000 – $180,000 |

| Investment / Trading App | Portfolio tracking, real-time stock data, AI-based recommendations, analytics dashboards | $100,000 – $300,000 |

| Lending / Credit App | Loan applications, credit scoring, repayment tracking, KYC/AML compliance | $70,000 – $200,000 |

| Insurance / Insurtech App | Policy management, claims processing, document uploads, premium calculation | $90,000 – $220,000 |

The Fintech App Development Process Explained

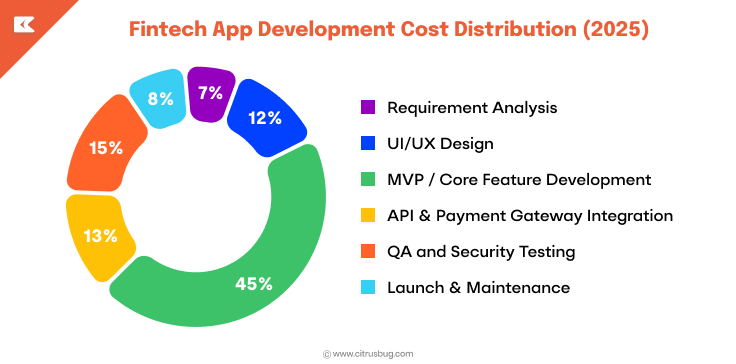

The development of a fintech app is a set of organized processes, and each process has an impact on the fintech app development cost. Knowing these phases assists companies in thinking logically and not making expensive errors.

1. Requirement Analysis

This is what your fintech app is based on. It entails the knowledge of your business objectives, intended users, functionality and regulatory necessities. The careful analysis is the guarantee that the app meets the needs of users and the standards of compliance.

2. UI/UX Design

Design is concerned with developing an interface that is easy to use and attractive to the eye. The wireframes, prototypes, and final designs are made in such a way that they offer easy navigation and an enjoyable user experience.

3. MVP Development

A Minimum Viable Product (MVP) is an excellent place to start because it allows the business to build fast and test essential functionality. An MVP allows testing the ideas, collecting user feedback and lowering the risk on the development and then scales up to a full-fledged app.

4. API & Payment Gateway Integration

It is essential to incorporate APIs and secure payment gateways with fintech apps. The integration allows the sharing of data and financial transactions with other services and integration with third-party services, making the user experience smooth and secure.

5. QA and Security Testing

FinTech apps are sensitive and require testing because they have to work with sensitive financial information. To avoid post-launch problems, QA and security testing encompass functional tests, optimization of performance and compliance.

6. Launch and Maintenance

After successful testing, the app is deployed to app stores or enterprise platforms. Constant updating guarantees security, bug fixes and improvements in features, making the app competitive and reliable.

Advanced Technologies Shaping Fintech App Costs in 2025

Emerging technologies are significantly influencing fintech app development costs in 2025. The adoption of innovative solutions increases functionality and user experience, but also affects the development budgets.

-

Artificial Intelligence (AI) and Machine Learning

AI and machine learning are dominating the new fintech applications. These technologies allow individualization, automating regular processes, and conducting fraud prevention. AI-driven apps need experienced programmers and more computing power, which might add to the development expense. As an example, predictive analytics or chatbots powered by AI can be used to improve user experience substantially at the expense of the complexity of the backend.

-

Blockchain and Smart Contracts

The blockchain technology is secure, transparent, and tamper-proof. Smart contracts enable the automation of agreements and the dependency on mediators. Implementation of blockchain in a financial technology application enhances trust and compliance, but may raise the development time and costs, particularly when developing enterprise-quality products.

-

Cloud Infrastructure and APIs

Cloud infrastructure enables fintech applications to scale effectively while controlling operational expenses. Using APIs for banking services, payment processing, and third-party integrations speeds up development but can also impact cost depending on the number and complexity of integrations. The use of cloud platforms would make it highly available, maintain high performance and flexibility for future expansion.

How to Choose The Right Fintech App Development Partner

Choosing an appropriate development partner is essential when developing a secure, high-quality, and cost-effective fintech application. The correct team can guide you on complicated regulations, the progressive adoption of technology, and the cost of creating fintech applications is minimized.

Expertise and Experience

Seek out a business partner who already has experience in the development of a fintech application, read reviews and ratings on popular sites, such as Google, Clutch, etc. They are supposed to be aware of financial regulations, security standards and best practices in the industry. Experience with AI, blockchain, and cloud-based APIs can also add value to your project.

Custom Solutions and Flexibility

Every fintech app is unique. A partner should have the capacity to offer customized software development solutions to suit your business goals. Agile methods of development are flexible development methods that permit iterative development and faster time to market.

Security and Compliance

Fintech cannot afford to compromise security. Make sure that your partner adheres to such security measures and compliance rules as KYC/AML, PCI DSS, and GDPR. An effective partner focuses on data security and risk management.

Transparent Communication and Support

A good development partner maintains clear communication and provides ongoing support. Regular updates, detailed reporting, and post-launch maintenance are essential for a successful fintech app.

Choosing an experienced team like Citrusbug Technolabs can provide you with expert guidance, innovative solutions and dependable development tailored to your fintech business, helping you balance cost, functionality and compliance.

Future Trends Affecting Fintech App Development Cost

The trends in fintech development in 2025 are driven by the strong technology and market trends that directly affect the budgets of a project. The following are the main factors that affect the cost of developing a fintech app in the current era

1. Artificial Intelligence and Machine Learning

The use of AI-based personalization, fraud detection, and chatbots is becoming the main characteristic of modern fintech apps. These demand quality data, model training, and AI expertise, which increase the development costs.

According to McKinsey, software developers can complete coding tasks up to twice as fast using generative AI, showing how fast AI integration is advancing.

2. Rise of Embedded Finance

From digital wallets to buy-now-pay-later (BNPL) options, embedded finance is now a key driver of user engagement. Nonetheless, using APIs to integrate these features and ensure compliance with various partners raises the cost and effort of development.

3. Growing Focus on Compliance

With the financial regulations becoming tighter in various regions, compliance is not an option any more. Complying with your app with KYC, AML, and GDPR requirements implies extra costs on auditing, information security, and legal regulations.

4. Real-Time Payment Ecosystems

Users demand instant transfer, live update of their accounts and real-time notifications. Fintech apps require scalable cloud infrastructure and real-time processing systems to support this, which may increase infrastructure and testing expenses.

5. Stronger Data Security Standards

Due to the increasing number of financial data breaches, fintech applications need to invest in cybersecurity, including encryption, multi-factor authentication, and ongoing monitoring. It increases the initial expenses, but it guarantees reliability in the long run and user confidence.

According to Accenture, 97% of organizations have seen an increase in cyber threats since the start of the Russia-Ukraine war in 2022, highlighting the growing urgency for robust security measures.

Conclusion

Developing a fintech app in 2025 will require thorough planning, intelligent budgeting, and exploitation of the appropriate technologies. Knowing the consideration of primary aspects and evolution steps to the integration of modern technologies, such as blockchain and AI in fintech, each decision has an effect on the cost of fintech app development. Focusing on MVPs, prioritizing essential features, and designing for scalability can help you manage costs without compromising quality.

Citrusbug Technolabs, a reliable fintech app development company, assists companies in transforming their concepts into safe, scalable and user-friendly financial programs. We have been involved in the development of custom software, so we can help you in all the steps of development, planning and design, deployment, and support, making sure that your app is as per the expectations of the users and the requirements of the regulations.