Introduction

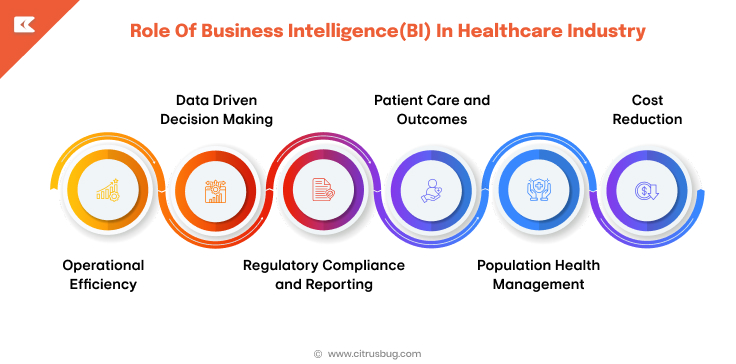

Healthcare organizations increasingly use data to aid in clinical, financial, and operational decision-making. With a growing amount of patient records, claims and administrative information, decision makers need context rather than data. The trend has positioned the healthcare business intelligence market as a component of modern healthcare analytics strategies.

Business intelligence platforms help manage costs, outcome tracking, and efficiency in the workflow across healthcare organizations. They are central to wider digital transformation in healthcare where data platforms are used to improve efficiency, transparency and accountability across care delivery and management.

What is Healthcare Business Intelligence?

Healthcare business intelligence is the adoption of analytics tools to gather, process, and analyze healthcare data for decision making. It serves three broad areas of the healthcare business intelligence:

- Clinical BI: Tracks outcomes, quality measures and care quality.

- Financial BI: Manages revenue cycles, claims analysis, and cost monitoring.

- Operational BI: It improves the efficiency of staffing, gives better visibility to the supply chain, and optimizes the use of the facilities.

Healthcare BI, unlike the traditional BI, deals with highly sensitive clinical data and therefore, is under strict regulatory compliance. It also includes a variety of data from different systems such as EHRs, labs, and claims platforms. A HIMSS & Arcadia report found that 57% of healthcare organizations’ data is used to make informed business decisions, suggesting that the analytics use and data integration needs are low.

The key users of healthcare BI are:

- Healthcare providers (hospitals, clinics) for quality and workflow insights

- Payers (insurers) for risk, utilization, and cost analysis

- Pharmaceutical and life sciences companies for research and commercial analytics

- Public health agencies for population health planning and surveillance

In addition, while more than 60% of health system data is available, the use of this data for informed business decision making is limited, making BI platforms specifically designed for the healthcare sector an issue.

WHO frameworks for analytics in healthcare and digital health recognize the role of structured data and analytics systems to inform policy and system performance at the national and international scale.

Healthcare Business Intelligence Market Size Overview

Global Market Size (Current vs Projected 2026)

The healthcare business intelligence market is generally on an upward trajectory, with the widespread use of data analytics tools for improved decision-making and operational planning in the healthcare sector being one of the main reasons.

The market, according to different accounts, was valued at about USD 10.55 billion in 2024 and is anticipated to continue growing.

One forecast sees the market going up to approximately USD 13 billion by 2026, a consistent expansion in line with the increasing adoption of analytics in the industry by care providers, payers, and the life sciences sector.

[Source]

Historical Growth Snapshot (Past 3–5 Years)

Over the last few years, the healthcare business intelligence market has shown steady growth as digital health adoption increased:

- In 2023, the global market value was around USD 8.96 billion, with healthcare data analytics being more frequently used in hospitals and health systems.

- By 2024, industry sources reported a rise to an estimated USD 10.05 billion, reflecting continued investment in analytics platforms and BI tools.

- Growth from 2022 to 2024 was supported by demand for data-driven insights to improve operational efficiency, clinical performance measurement, and financial outcomes.

This historical trend shows the market scaling up in response to digital health initiatives, increased EHR use, and the need for integrated data solutions across care settings.

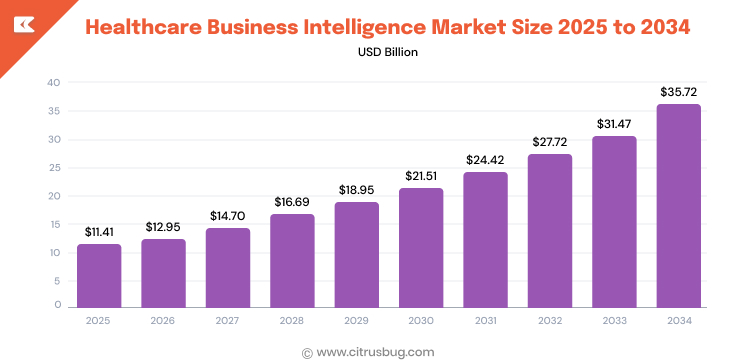

Market Valuation Healthcare Business Intelligence in USD

The following is a summary of the healthcare BI market size and value trend based on consolidated industry figures:

| Year | Estimated Global Market Size (USD) |

|---|---|

| 2023 | $8.96 billion |

| 2024 | $10.05 billion |

| 2025 | $11.5 billion |

| 2026 | $13 billion |

| 2030 | $22.81 billion |

| 2034 | $35.72 billion |

| 2035 | $40.8 billion |

Beyond 2026, multiple forecasts anticipate continued growth. The global market could reach approximately USD 35.72 billion by 2034 at a compound annual growth rate (CAGR) of 13.52% from 2025 to 2034.

In general, the market is expected to steadily grow till 2026, with the growth being backed by healthcare organizations’ worldwide investments in analytic platforms, data integration solutions, and digital transformation.

Healthcare Business Intelligence Market Growth Rate and Forecast (2024–2026)

CAGR Projections (2024–2026)

- The market for business intelligence in healthcare is expected to grow at a moderate to fast pace through 2026. According to major market research reports, consistent double-digit growth is expected.

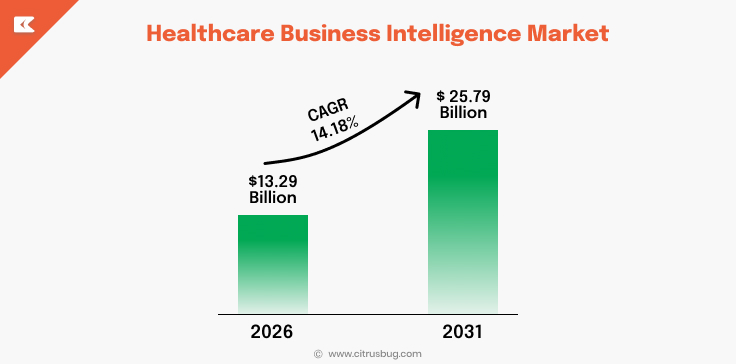

- According to SNS Insider’s projection, the market is expected to achieve a CAGR of 14.0% during 2024–2032, signaling near-term strong momentum which also covers 2024–2026.

- A further assessment from Mordor Intelligence sees the market expanding beyond 2026 at roughly 14.18% CAGR during 2026–2031, thus supporting the idea that the principal factors for the continued growth, such as EHR data, cloud adoption, and analytics investments, still kept the move.

Given these broader forecasts, the 2024–2026 CAGR is likely in the 13–15 % range, supported by analytics demand, digital transformation efforts, and data growth.

Key Assumptions Behind Growth Estimates

Several central assumptions form the basis of the growth forecasts of healthcare BI market:

- More healthcare data volume: Ever greater reliance on electronic health records (EHRs), claims data, digital imaging, and remote monitoring devices shall undoubtedly produce new data for analytics platforms.

- Utilization of analytics and BI solutions: Healthcare organizations are likely to utilize analytics and BI instruments to achieve cost savings, improve care quality, and boost business performance.

- Cloud infrastructure expansion: Cloud deployments are assumed to accelerate adoption of scalable BI solutions with lower upfront costs.

- Regulatory incentives: Industries and reimbursement models related to value-based outcomes will foster the need for real-world performance insights.

- Technical integration: Innovations in AI, analytics, and machine learning profoundly influence BI capacities thus raising the purchase of analytics platforms.

These assumptions determine the market’s expected CAGR and are consistent with the general trends in healthcare digitization.

Best and Worst-Case Growth Scenarios

Best-Case Scenario

- Accelerated digital transformation: If healthcare systems rapidly adopt analytics and AI tools, growth could exceed forecasts. Expansion of cloud BI, edge analytics, and predictive modeling could push the CAGR toward 15%+ annually through 2026.

- Policy support: Data interoperability regulations and value-based care incentives may encourage analytics adoption among providers and payers.

- Technology advancements: If AI augmented analytics were rolled out on a broader scale, the need for BI platforms would thus be significantly increased.

Worst-Case Scenario

- Slow IT modernization: Healthcare providers might postpone analytics investments due to budget issues or slow EHR integration, which would cause a lower penetration rate.

- Data governance hurdles: Privacy regulations and data sharing issues might slow down the rollout of BI.

- Economic challenges: Broader economic downturns could reduce spending on non-core technology infrastructure, leading to CAGR outcomes closer to single digits.

After all, the majority of market research points to a growth trend remaining well above single digits, aside from major disruptions because of economic or regulatory factors.

Key Healthcare Business Intelligence Market Statistics

Below are key data points showing how this is being used, adopted, and expanded across the healthcare ecosystem, based on recent healthcare IT statistics. These stats are organized for easy scanning and come with direct source links for credibility.

Adoption Rates Across Healthcare Organizations

- BI adoption in hospitals:

Approximately 32% of hospitals are using business intelligence (BI) tools in their analytics, dashboard, and reporting functions. - Cloud BI adoption:

About 48% of healthcare organizations who run analytics workloads have moved their platforms to the cloud in some form. - Payers using analytics for fraud detection:

More than 60% of payers use analytics systems to detect fraud and suspicious claims with high accuracy.

Percentage of Healthcare Organizations Using BI Tools

- Hospitals & health systems:

Healthcare providers are the largest segment among the end-users of healthcare business intelligence, which demonstrates the extensive use of BI tools for clinical quality tracking, cost control, and operational analytics. - Healthcare payers:

Payers represented around 27.6% of the BI end-user segment in 2023, using analytics for claims management and risk stratification.

ROI and Cost-Reduction Statistics

- Operational improvements & cost savings:

One of the main reasons for healthcare BI adoption is operational efficiency gains such as bed management and scheduling, which in some cases can reduce administrative costs by 14%. - Cloud analytics savings:

Switching to cloud analytics, hospitals were able to save up to 40% on infrastructure costs compared to traditional on-premise setups.

Data Volume Growth in Healthcare

- Global healthcare data growth:

According to some estimates, the amount of data generated by the healthcare industry has grown so fast that the total healthcare data now exceeds 2,300 exabytes annually, which is a combination of both clinical and operational data.

Cloud vs On-Premise BI Usage

- Cloud BI usage:

Scalability, ease of access, and reduced maintenance drive the almost 49% share of the healthcare BI software market being cloud-based analytics and BI platforms in 2023. - On-premise BI usage:

Typically, on-premise solutions still have about 32.5% of the market share, mainly in large systems with very strict data sovereignty and security standards. - Hybrid models:

Around 18.2% of BI implementations are via hybrid models, and it is the fastest-growing segment as it combines the advantages of cloud and local infrastructure.

AI and Predictive Analytics Adoption

- Predictive analytics growth:

Predictive analytics in healthcare BI has gone up by 30% mostly due to requests for patient load forecasting, resource planning, and clinical outcome prediction. - In 2024, 71% of non-federal U.S. hospitals indicated they had predictive AI tools that were integrated with their EHR systems, up from 66% in 2023. This demonstrates an increase in dependence on machine learning for clinical risk prediction and operational forecasting.

Major Drivers Fueling the Healthcare Business Intelligence Market

The healthcare BI market growth is mainly due to the fundamental changes in the dynamics of healthcare data generation, regulation, and usage for decision-making, as well as the increased incorporation of AI solutions for healthcare that are based on business intelligence platforms.

Rise in Healthcare Data Generation

Healthcare entities have been producing data through various channels, such as:

- Electronic Health Records (EHRs)

- Medical imaging systems

- Remote patient monitoring devices

- Wearables and IoT-enabled medical equipment

This growth is largely driven by EHR adoption. In the United States, 96% of non-federal acute care hospitals had implemented certified EHR systems by 2023, resulting in a significant increase in structured clinical data that requires analysis and reporting.

In 2024, 71% of non-federal acute care hospitals reported using predictive AI integrated with their EHR systems, a reflection of growing data analytics use across clinical operations.

The World Health Organization also highlights digital health technologies, including connected devices and data platforms, as a major contributor to rising healthcare data volumes globally.

Regulatory Reporting and Compliance Requirements

Regulatory reporting is another major factor driving BI adoption in healthcare. Providers and payers are required to submit accurate and timely data for quality programs, reimbursement models, and audits. Manual reporting processes are increasingly difficult to maintain at scale.

In the U.S., programs administered by the Centers for Medicare & Medicaid Services (CMS), such as Hospital Value-Based Purchasing and MIPS, require continuous performance measurement and standardized reporting. Business intelligence platforms help organizations automate data aggregation, track compliance metrics, and reduce reporting errors.

Value-Based Care and Population Health Management

The adoption of value-based care models is gaining momentum. In line with the annual survey, value-based care arrangements out of total payments grew from 41.3% in 2022 to 45.2% in 2023, which demonstrates the healthcare industry’s overall move towards outcome-linked reimbursement.

Healthcare BI tools help these models by providing population-level reporting, predictive risk analysis, and outcome measurement.

Need for Real-Time Insights

Healthcare leaders require real-time insights to maintain a balance between clinical outcomes and operational performance.

- Real-time dashboards help manage workflows, monitor resource utilization, and analyze financial performance such as claims denials or revenue cycle trends.

- Analytics use is a tangible support for planning and operations in a fast and dynamic care environment.

What makes this important: Bi systems equipped with real-time reporting and analytics functionalities shorten decision-making times and enable proactive rather than reactive management.

Challenges and Restraints Impacting Market Growth

The healthcare market faces several ongoing challenges that slow adoption, increase costs, and complicate implementation. These obstacles relate to data, costs, security, and workforce readiness — and many are interlinked.

Data Silos and Interoperability Issues

Healthcare data in various forms like EHRs, billing platforms, and lab systems are often kept separate, leading to data silos that complicate the whole picture when it comes to analysis.

- A 2024 report shows that 70% of healthcare firms have silos of data which means they face challenges in collecting patient details from various departments or systems.

- Another obstacle for integration is the lack of standardization in data formats, and inconsistent support for interoperability standards such as FHIR and HL7.

With such compatibility challenges, the speed of advancement in analytics projects are being pulled down and it’s tough for BI tools to offer credible, holistic analysis.

Data Privacy and Security Concerns

Health care data is extremely sensitive and breaches can be costly, financially and reputationally. One of the major challenges is ensuring privacy and regulatory compliance.

- In 2023, more than 540 healthcare organizations reported data breaches affecting over 112 million individuals, demonstrating the scale of security risks.

- Although a large proportion of breaches are due to human error, deliberate attacks and infrastructure faults also feature in the threat landscape.

Fearing these threats, enterprises might be reluctant to share and integrate data and so wait to implement BI.

Lack of Skilled Analytics Professionals

There is a significant market restraint that lies in the lack of available professionals to configure, maintain, and maximize value from BI systems.

- Nearly 40% of health care technology leaders say that a lack of capability to deploy AI and advanced analytics is one of the top barriers.

- Plenty of organizations also have difficulties training clinicians and administrative staff to understand and putting insights from analytics into action.

It is this skills gap that slows the rate at which BI platforms can be rolled out and adopted across the business.

Segmentation Analysis of the Healthcare Business Intelligence Market

Below is a data-backed breakdown of the healthcare BI market by key segments, so readers can clearly see where demand is strongest and how adoption varies across components, deployment modes, and end users.

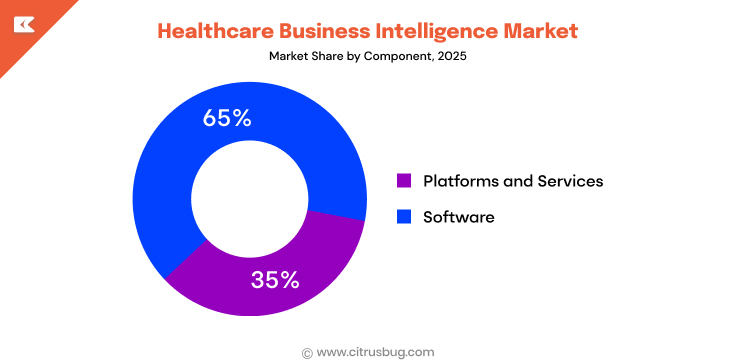

By Component

BI solutions in healthcare are delivered as software or services:

- Software: In 2025, software accounted for about 35.02 % of its revenue, reflecting continued demand for analytics platforms, visualization dashboards, and reporting tools across clinical and administrative domains.

- Services: Taking up a smaller portion of revenue share in 2025, services such as consulting, integration, implementation and support are growing faster than average and will continue to expand as healthcare entities look for help with their BI platforms.

This suggests that, while software remains to be key, services are increasingly providing help in how organizations use BI tools.

By Deployment Mode

Healthcare BI solutions are implemented in varying manner as per organizational security cost scalability requirements.

- Cloud-based: Cloud BI is now the leading mode of deployment and will represent about 48.3% of the market in 2024 as vendors offer scalable solutions with remote access and cross-facility collaboration.

- On-Premise: Traditional on-premise deployments remain important for organizations with strict security policies or data residency requirements, though growth is slower compared to cloud options.

- Hybrid Models: Hybrid deployments are on the rise as businesses look to improve service while protecting cloud and on-premise access for its cost savings. Hybrid is also about 18.2% of BI deployments, with one of the largest CAGRs as a result this equilibrium based on market analysis.

By End User

The market is also classified, based on type of organisations that utilise BI tools:

Hospitals and Clinics

- Hospitals continue to represent the largest end-user segment for healthcare BI solutions. In 2025, healthcare providers (hospitals and large clinic networks) market share was approximately 51.95% in the BI market.

This continues demonstrates providers’ ongoing commitment toward analytics for clinical value, operational effectiveness, revenue cycle and compliance reporting.

Healthcare Payers

- Payers, including insurance companies and government programs, represent a significant portion of BI market demand, using analytics for claims management, cost control, risk adjustment, and utilization review.

Pharmaceutical and Life Sciences

- BI adoption by pharmaceutical and life sciences companies is growing as these organizations use analytics for drug development insights, real-world evidence, clinical trial analytics, and market performance metrics. Life sciences firms are projected to expand at higher growth rates compared to other segments through 2031. (Source)

Public Health Agencies and Others

- Public health agencies and research institutions make up the remainder (roughly 14.4%) of the BI end-user base, leveraging analytics for disease surveillance, policy planning, and public health reporting.

Key Takeaways

- Software is still a bedrock of the healthcare BI ecosystem, though services have become more important for successful deployment.

- The preference for cloud-based BI is prevalent, but hybrid approaches are gaining traction as interop and control of data rise in priority.

- Usage was more dominated by hospitals and payers but higher growth rates for BI adoption were seen in pharmaceutical and life sciences companies.

- Public health and research organizations are expanding their use of BI for analysis on population health and policy influence.

These segmentation insights highlight where market opportunities lie and how the market is evolving through 2026 and beyond.

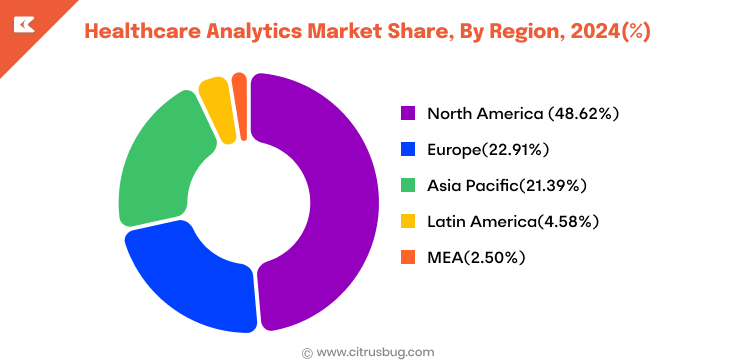

Regional Analysis of the Healthcare Business Intelligence Market

The healthcare BI market shows distinct regional patterns in adoption, growth rates, and market strategy. These differences are shaped by digital health infrastructure, regulatory environments, healthcare spending, and technology penetration.

North America: Market Size and Dominance Factors

North America has the highest market share of the global healthcare BI market and is the dominant leader owing to its strong digital health infrastructure and high penetration rate of analytic instruments.

- In 2025, North America accounted for approximately 45.97% share of the global healthcare business intelligence market and is the dominant regional market.

Factors driving this dominance include:

- Scale of EHRs and advanced analytics.

- Digital and cloud BI investments are strong.

- Value-based care initiatives requiring real-time clinical, financial, and operational insights.

These elements make North America a mature and high-revenue contributor.

Europe: Market Trends

Europe is the second-largest regional market for healthcare BI and exhibits steady, long-term growth.

- According to recent market insights, Europe holds a major regional share in the healthcare BI market with countries including Germany, UK and France.

Key trends in Europe include:

- Robust regulations encouraging secure analytics systems — such as GDPR.

- National E-health programmes centred on care integration and effectiveness.

- BI implementation for benchmarking between hospitals in a network of hospitals.

Healthcare providers in Europe use BI to measure clinical quality and control costs/management along the public/private spectrum.

Asia-Pacific: Growth Potential

Asia Pacific appears to be the fastest growing region in the healthcare BI market.

- Recent reports estimate the Asia Pacific BI in healthcare market to grow at a 16.61% CAGR through 2031, the highest globally.

The growth of the market in the region is driven by:

- Fast pace of growth in healthcare infrastructure and digitization in China, India, and Japan.

- Government initiatives for digital health and BI from the cloud.

- Big and growing patient populations demand for effective analytics tools.

Asia-Pacific opportunity represents significant investments for vendors and service providers looking to target new markets.

Overall, regional patterns in the healthcare business intelligence market reflect a mix of mature markets with high adoption rates (like North America and Europe) and emerging regions with rapid growth potential (like Asia-Pacific and MEA). Market participants can tailor strategies based on infrastructure maturity, regulatory environments, and digital health priorities in each region.

Use Cases Driving Adoption in 2026

In 2026, adoption within the healthcare business intelligence market is driven by practical use cases that deliver measurable clinical, financial, and operational value.

Clinical Decision Support

By enabling measurement and reporting on patient records, diagnoses and therapeutic patterns, BI tools can inform care decisions.

- Phy BI platforms with clinical data enable physicians to make data-driven decisions by synthesizing patient records, test results, and clinical guidelines in real-time, with growing use of conversational AI in healthcare interfaces.

- Clinical analytics comprises up to 45% of all health care analytic use in large provider groups or systems.

Revenue Cycle Optimization

Healthcare companies leverage BI to limit claim denials, track billing performance and enhance cash flow and AI chatbots for healthcare are playing an increasing role in revenue cycle workflows.

- Revenue cycle and financial analytics still make the list of hot BI buying spots for hospitals and payers in 2026.

- BI tools consolidate financial, claims, and operational data to identify billing bottlenecks, reduce claim denials, and predict revenue patterns.

Population Health Management

BI platforms aggregate clinical and demographic data to identify high-risk populations and improve outcomes.

- Predictive and population health analytics adoption continues to grow as value-based care expands globally.

- Population health management tools identify at-risk populations, track disease trends, and support targeted interventions.

Fraud Detection and Risk Analytics

BI tools help payers and providers detect abnormal claims and financial risks using pattern analysis.

- Predictive analytics and AI are being deployed more to detect fraud and billing irregularities earlier in the claims process.

Supply Chain and Resource Planning

BI contributes to stock control, staff allocation and utilisation of instruments.

- Operational and supply-chain analytics account for about 25% of healthcare analytics programs in big systems.

- Analytics for supply chain and resource planning has become more critical in 2026 as healthcare systems respond to ongoing workforce shortages and supply disruptions.

Future Outlook: Where the Healthcare Business Intelligence Market Is Headed

In the next two to three years, healthcare business intelligence tools will shift from being primarily static reporting tools to decision-ready insights that are predictive and real time across health systems.

Key Trends Shaping the Next 2–3 Years

- Analytics embedded into workflows: BI tools are being embedded within EHRs and claims or operational systems, rather than represented as standalone dashboards.

- AI-enabled insights: Predictive and prescriptive analytics are becoming standard features within healthcare BI platforms.

A 2025 market forecast predicts healthcare analytics adoption is being fueled by the integration of AI and access to real-time data, while analytics platforms will become more central to operational and clinical decision support.

Greater Focus on Real-Time and Predictive BI

As healthcare systems become even more dynamic in managing capacity, staffing and patient flow, the need for real time analytics is increasing.

- Predictive BI is increasingly used for risk stratification, utilization forecasting, and financial planning, alongside emerging use of AI agents in business for automated decision support.

- Hospitals and care coordination are increasingly reliant on real time dashboards.

Health IT data briefs show that predictive analytics adoption within hospitals continues to increase year over year, reflecting a shift toward proactive decision-making.

Expected Impact on Healthcare Delivery Models

As BI capabilities mature, healthcare delivery models are becoming more data-driven and performance-focused, with many organizations relying on healthcare AI consulting for business to align analytics initiatives with clinical and financial goals.

- Analytics are used by providers to further value-based care, population health efforts and outcomes reporting.

- Payers depend on BI for controlling cost, usages, and risk.

- Public health agencies increasingly use BI for surveillance and policy planning.

This shift supports more coordinated, outcome-oriented care models where data guides both clinical and business decisions.

Conclusion

The healthcare business intelligence market is evolving, as providers depend more and more on data to control costs and quality and improve operating performance. Demand is being fueled by increasing volumes of data, regulatory requirements, the shift to value-based care and real-time analytics.

In the future, BI platforms and tools will likely become more semantic, predictive, and user friendly to non-technical users. Companies concentrating on developing healthcare business intelligence software that is scalable, secure, and analytics-driven will be better positioned to improve decision-making and adapt to changing healthcare delivery models through 2026 and beyond.