In the digital-first century, mobile banking applications are the most common gateway that bridges banks and their customers. People no longer visit branches for everyday transactions. They use apps to transfer money, balance checks and investments. But there comes caution with convenience. The only way users have confidence in a banking app is when it is secure, intuitive, and reliable.

The challenge is real. According to a 2024 survey by the American Bankers Association, 55% of U.S. bank customers use mobile apps as their top method for managing accounts, surpassing online banking via laptop or PC at 22%. This demonstrates that mobile banking is widely used and it is important that the banks should concentrate on creating secure, trustworthy and user-friendly apps that satisfy the expectations of their customers.

Earning user trust goes beyond strong encryption or a smooth interface; it requires an approach. Security, compliance, performance, and user experience combined create a cohesive digital ecosystem.

In this guide, we will outline the components and steps to a mobile banking app development that is secure, compliant and user-friendly – which means it will build customer trust.

Step-by-Step Process for Mobile Banking App Development

Developing a mobile banking app from scratch requires careful planning and execution. Organized process guarantees the security, ease of use of the app and scalability. These are the seven steps of banking mobile app development.

Step 1: Requirement Analysis and Planning

Starting with identifying user needs and app goals. Get clear about your end users, what your app will do and what regulatory requirements it needs to meet. Bring into the conversation your development expectations around budget, scope and time. Proper planning before app implementation will help avoid wasting your time and not incur unexpected costs later down the line.

Step 2: Choosing the Right Technology Stack

The technology selection determines performance, security and scalability of your application. Most mobile banking apps are built in native on iOS (Swift) and Android (Kotlin). Cross-platforms such as Flutter or React Native can minimize development time, but must be carefully planned in terms of security.

Step 3: Designing UI/UX

An easy-to-understand and clean design enhances user trust. Focus on simple navigation, clear transaction flows, and visually reinforcing security features. Use consistent branding and feedback prompts to guide users. Studies show that confusing interfaces lead to higher app abandonment rates.

Step 4: Developing Core Features

Essential features for trustworthy mobile banking apps include:

- Multi-factor authentication and biometrics

- Instant transaction monitoring and notifications

- Fund transfers and account management

- Customer service is incorporated in the application

- Business insight analytics dashboards

The inclusion of AI-based capabilities, such as fraud detectors and customized deals, can also increase the level of trust and user interaction.

Step 5: Security and Compliance Implementation

Security is non-negotiable. Implement end-to-end encryption, secure APIs, and regular vulnerability assessments. Ensure that regulations like PCI DSS, ISO 27001, and financial laws are followed. Users trust the application most that clearly communicates these regulations.

Step 6: Testing and Quality Assurance

Extensive testing will ensure that the app is functional under all circumstances. Conduct functional, performance, usability and security tests. Apps with rigorous testing have fewer post-launch issues, which keep users happier and retain them better.

Step 7: Deployment and Continuous Improvement

After launch, monitor user feedback and app performance. Regular updates for security patches, feature enhancements, and compliance changes maintain user trust. The banking mobile app development has to be continuously enhanced as users demand a safe and seamless experience. Hiring a custom software development firm can help achieve your development goals smoothly.

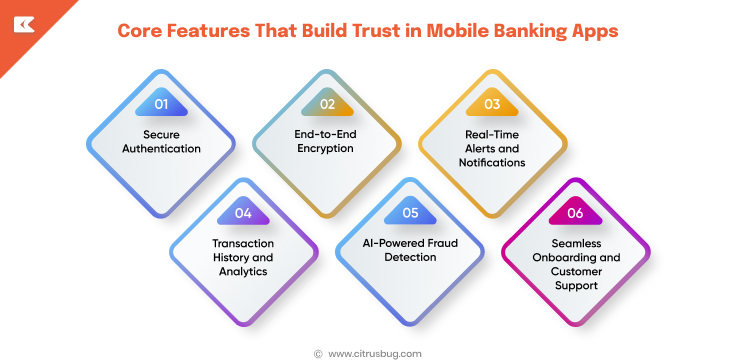

Core Features That Build Trust in Mobile Banking Apps

An effective mobile banking application is not just one that carries out simple transactions. It gives confidence to the user with its high level of security, effective communications, and ease of use.

Secure Authentication

Multi-factor authentication (MFA) and biometric logins are used to block access by unauthorized users and ensure that users’ information is secured. Secure authentication is the foundation of mobile banking app development.

End-to-End Encryption

To protect sensitive financial information, all user data and transactions should be encrypted. Transparent communication about encryption practices enhances user trust.

Real-Time Alerts and Notifications

Real-time solutions on account balances, withdrawals, and deposits keep the customers updated and aware. These timely alerts improve transparency and reduce fraud risks.

Transaction History and Analytics

Dashboards and spending insights are interactive and assist users in spending their money efficiently. This visibility fosters confidence and long-term engagement.

AI-Powered Fraud Detection

Integrating AI to monitor suspicious activity provides proactive protection. Smart fraud alerts reassure their users that their accounts are under active protection.

Seamless Onboarding and Customer Support

A smooth onboarding process combined with responsive in-app support ensures users feel guided and cared for from the very first interaction.

All these essential characteristics make a fintech app development project both efficient and credible. Apps that combine such factors lower the rate of abandonment, enhance interaction, and become trusted financial management tools.

Security and Compliance Implementation in Mobile Banking App Development

The compliance regulation and security at the back end are significant factors in developing the trust of mobile banking applications. The users must be assured that their financial information has been secured and that the application meets the required industry standards.

Regulatory Compliance

Mobile banking applications have to be in line with industry and financial provisions. The payment processing standards, like PCI DSS and information security management standards like ISO 27001, offer guidelines on how sensitive information should be handled safely. Compliance demonstrates responsibility and builds confidence in the app.

Data Governance and Privacy Policies

Transparent privacy policies and clear consent mechanisms allow users to understand how their data is collected, stored, and used. Proper governance ensures personal and financial information is managed responsibly, reinforcing trust.

Backend Security and Infrastructure

Data is safeguarded against breach through secure server architecture, encrypted databases, and access controls. The backend security is used to avoid unauthorized access, data leaks, and possible vulnerabilities in the system.

Regular Security Audits and Monitoring

Constant checking and periodic security audits assist in detecting the weak points before they impact the users. Regular system reviews and penetration testing will ensure that the security standards that are changing are adhered to.

Incident Response Preparedness

A clear incident response plan allows the teams to respond fast to breaches or security threats. Proactive risk management reassures users that their financial data is in safe hands.

UI/UX and Design Best Practices for Trust in Mobile Banking Apps

While an app must be secure, users also search for trust in the bank’s app look and feel. Intuitive design, good branding, and simple navigation help create a level of confidence in the user and enhance engagement. Here are the best practices for mobile banking app development.

Easy and User-friendly Navigation

Users should find features easily without confusion. Group related functionality, make menus clear in their navigation, and put recognizable icons to represent the actions. A user-friendly interface makes the entire process less frustrating while also developing trust.

Clear Visual Cues for Security

The use of these visual signals, like lock icons, locked badges, and confirmation messages, reminds end users that their transactions are secure. These cues reinforce the perception of safety without being intrusive.

Consistent Branding and Design Language

Use consistent colors, fonts, and design patterns on each of your screens. Consistency looks professional and is familiar to the user, which helps build trust. To further reinforce a cohesive brand identity, businesses can use an AI name generator to create a memorable and aligned brand name that complements their design aesthetics.

Responsive Design Across Devices

Make sure the app functions properly on different screen sizes and resolutions. Responsive design ensures the experience for the user is the same whether it is a smartphone or tablet.

Transparent Feedback and Error Handling

Provide feedback in real time for actions such as fund transfers or submitting a form, etc. Easy-to-understand error messages and recommendations allow users to recover quickly from an error, thus eliminating frustration.

Accessibility Considerations

Be proactive in terms of accessibility and support features such as screen readers, adjustable font size, and color contrast options. Accessible apps can enhance user-friendliness for all and indicate that the app is accessible.

Minimal Cognitive Load

Don’t give users too much information or steps that are complicated. Break tasks down into simple steps and use progressive disclosure to show advanced features if the user’s experience requires it.

Planning Budget and Timeline for Mobile Banking App Development

The development of a mobile banking app needs to be planned well in terms of cost, schedule and development tradeoff. Each choice can impact security, functionality, and user trust.

Estimated Cost Breakdown

Mobile banking app development cost depends on the complexity of the app, features, and security requirements. On average:

- Basic banking app (MVP): $40,000-$70,000

- Mid-level app with standard security and analytics: $80,000-$120,000

- Advanced app with AI, real-time alerts, and enhanced fraud detection: $150,000-$250,000

The areas of cost are backend development, frontend UI/UX, security implementation, testing, and post-launch maintenance. The introduction of AI-based app development costs can be raised, but they could increase user trust greatly.

Common Development Timeline

Timeline depends on the scope of a project:

- MVP app: 4-6 months

- Mid-level app: 7-9 months

- Advanced full-feature app: 10-12 months

A phased development approach is employed to control timelines while affording an early test, a feedback cycle, and iterative enhancements.

Balancing Speed, Security, and Features

Speeding up the development process may shorten time-to-market, but may also lessen the user experience or security. If you are pursuing advanced features, that can lengthen the time frame. A good balance assures that the app is secure, functional, and easy to use.

Maintenance and Updates

Ongoing maintenance is a critical aspect of the budget. Security updates, regulatory compliance updates, and new features act to preserve the security and performance of the app over time.

Long-Term Considerations and Trends in Mobile Banking App Development

The development of mobile banking apps should consider more than launch when planning. Long-term aspects can affect costs, scalability, and user satisfaction. Including emerging trends will keep the app competitive and up to date with the current digital transformation in fintech.

Scalability and Future-Proof Architecture

With the expansion of users, the app should be able to support more traffic without any performance problems. Modular architecture and scalable cloud can easily update and integrate with new features. Planning for scalability upfront reduces future redevelopment costs.

AI and Machine Learning Integration

AI can increase personalization, fraud detection, and give predictive financial information. Although the incorporation of AI and ML raises the cost of development, users feel more trusted and involved.

Open Banking and API Integration

Open banking enables the safe exchange of data between third-party services and financial institutions. Open APIs improve functionality, providing end users with improved financial management tools. Nonetheless, integration involves investment in secure development practices and compliance.

Regulatory Evolution and Compliance Updates

Finance laws keep changing. The idea of remaining compliant can involve high costs in terms of security patches, audits, and reporting capabilities. Long-term planning makes it possible to introduce these updates without redesigning significant apps.

Continuous User Feedback and Feature Updates

Regularly analyzing user behavior and feedback helps prioritize updates and new features. Investing in ongoing improvements ensures the app remains user-friendly and maintains high trust levels.

Cost Considerations for Long-Term Success

Long-term costs include:

- Cloud hosting and infrastructure scalability

- Security and compliance updates

- Feature enhancements and AI integration

- Maintenance and monitoring

Strategic investment in these areas not only future-proofs the app but also ensures sustained user engagement and trust. In fact, 72% of the U.S. adult population now uses mobile banking applications in 2025, compared to 65% in 2022 and 52% in 2019. These fintech market trends reveal the increasing demand for constant innovation and trustworthiness of the mobile banking experience.

Case Studies: 3 Mobile Banking Apps That Users Trust

Here’s how top apps combine security, usability, and innovation to win user trust:

| App | Key Strengths | Why Users Trust It |

|---|---|---|

| Chase Mobile | Multi-factor authentication & biometric login Real-time alerts Intuitive navigation |

Security meets simplicity. Users can manage accounts and transactions confidently. |

| Bank of America Mobile App | AI assistant (Erica) for personalized insights Fraud alerts Transparent privacy policies |

Smarter banking experience. Automation and clarity keep users engaged. |

| Ally Mobile Banking | Simple interface Real-time notifications Responsive support |

Transparency and convenience. Easy navigation and instant support enhance trust. |

Successful mobile banking apps focus on security, simplicity, and continuous improvement. These examples provide a blueprint for developing apps that users genuinely trust.

How to Choose the Right Development Partner for Mobile Banking App Development

Choosing an appropriate development partner for your custom app can be the difference between the success and failure of your mobile banking app development project. Here’s what to look for:

1. Proven Expertise in Banking Apps

Choose a partner who has prior knowledge of safe, compliant and user-friendly banking applications. See their portfolio, case studies and Clutch reviews to ensure that they are conversant with the financial requirements and increased security requirements.

2. Strong Security and Compliance Knowledge

A trusted partner would focus on PCI DSS, ISO 27001, and other financial standards. They should employ a strong level of security, conduct frequent audits, and keep up with developing compliance requirements. Data is safeguarded through secure server architecture, encrypted databases, and access controls often running on reliable infrastructure such as Linux VPS hosting.

3. Technical Skillset and Technology Stack

Check if the partner is proficient in native development (Swift, Kotlin) and modern frameworks like Flutter or React Native. Experience with cloud infrastructure, APIs, AI integration, and analytics adds significant value.

4. Transparent Communication and Project Management

Select a partner that maintains clear communication, regular updates, and iterative feedback cycles. Agile methodology and project management tools help track progress and ensure deadlines are met.

5. Support and Maintenance Capabilities

A strong partner provides ongoing support, updates, and troubleshooting. Long-term maintenance ensures security patches, feature enhancements, and sustained user trust.

6. Client-Centric Approach

A partner who is reliable knows your business objectives, target audience and user expectations. They provide bespoke solutions as opposed to templates.

Citrusbug is a leading mobile banking app development company that has deep technical expertise in developing safe and compliant banking applications with a client-centric approach. Our team provides custom AI solutions, strong security and seamless user experience to help businesses build apps that users trust.

Conclusion

To create a mobile banking application that users trust, it needs to be secure, user-friendly, and keep improving. There are considerations from the planning and feature design stage to backend security, regulatory compliance, and user-centered interface/user experience design.

Partnering with the appropriate mobile banking app development agency, such as Citrusbug Technolabs, helps you develop applications that are not only secure and compliant but also user-friendly and scalable. No matter whether you are looking to launch an MVP or a full-featured app, the right partner assures you of a strong and secure banking app. It builds trust, drives engagement, and stands out in the competitive financial services landscape.

Take the next step: Start your mobile banking app development journey today with a trusted partner who can transform your ideas into a secure, reliable, and engaging digital experience.

FAQs

How do I start a mobile banking app?

To begin your mobile banking application, identify your target market, user needs and application functionalities. Then choose the fintech app development partner with a wide variety of experience in designing, developing and testing your application, considering the security and usability.

What is the difference between a banking app and mobile banking?

The banking app is a software application that is installed on mobile devices and is used to receive banking services. Mobile banking is a wider service that lets users do banking tasks through mobile devices. It includes apps, web portals or SMS based solutions.

Which features are essential for a trustworthy banking app?

Its main features include safe access, real-time notices, account management, transaction history, fraud detection with the help of AI, and responsive customer service. Transparency and privacy are also significant factors in building trust.

Can small banks or startups develop a mobile banking app?

Yes. Smaller banks or fintech startups can launch scalable apps that earn user trust by focusing on core features, usability and security.