How AI Is Redefining Wealth Management Software Development

- October 17, 2025

-

795 Views

- by Ishan Vyas

Table of Contents

- The Evolution of Wealth Management Software

- How AI Is Redefining Wealth Management Software Development

- Key Features of an AI-Powered Wealth Management Software

- Business Benefits of AI in Wealth Management

- Challenges in AI-Driven Wealth Management Software Development

- How to Build an AI-Powered Wealth Management Software

- Future of AI in Wealth Management Software

- Conclusion: Empowering Advisors with Intelligent Software

Modern wealth management today is extremely different from what it was before. Investors no longer desire advice or portfolio updates every few months. They want fast insights, real-time information and customized suggestions that align with their financial ambitions. The change has compelled financial institutions to employ smarter technology to satisfy increasing expectations.

Artificial Intelligence contributes a lot to this change. It assists wealth managers in analyzing vast amounts of data, comprehending the customers and enabling quicker and more precise investment choices. AI does not substitute human advisors. Rather, it assists them to save time, minimize errors, and concentrate more on establishing good client relationships.

According to a report, over 70% of financial service leaders believe that AI will be the source of remaining competitive in the upcoming years.. This is why numerous companies are currently investing in AI-based wealth management software development to create a smarter and more efficient advisory response.

The Evolution of Wealth Management Software

Wealth management software has come a long way. Previously, advisors used to be heavily dependent on spreadsheets, manual calculations and offline records. There was a slow reporting process, limited client insight and decisions were frequently made based on experience rather than data.

As digital technology rises, financial companies have begun to use cloud-based solutions. These systems facilitated easier storage of data of clients, the tracking of the portfolios and the creation of reports within a short period of time. But even these forums were limited. They were able to process information effectively, but not to predict trends, automate complicated tasks, and give personalized recommendations on a large scale.

This is where AI and modern wealth management software development are involved. Solutions today are a combination of automation, analytics and machine learning to provide smarter insights and faster decision-making. Not only do they make operations easier to an advisor, but they also enhance the client experience, enabling firms to remain competitive in a rapidly changing financial environment.

How AI Is Redefining Wealth Management Software Development

The AI is influencing the way wealth management software is designed and used. It makes financial advisors work smarter and not harder because it automates routine work, offers data-driven insights, and forecasts market trends. Let us examine the most important ways AI is transforming the industry.

Personalized Investment Recommendations

AI analyzes client behavior, risk appetite, and market conditions to deliver tailored investment advice. This personalization improves client engagement and increases trust. Advisors can work on strategy, and AIs process large volumes of data.

Predictive Analytics for Smarter Decisions

Machine learning algorithms can be used to predict market trends and determine possible risks. Predictive models enable wealth managers to make effective investment decisions and actively change portfolios before losses occur, and enhance returns.

Intelligent Client Onboarding and Compliance

AI makes the process of client onboarding easier by automating document verification and identity checks. It guarantees that it does not go against the rules and regulations, and the time the advisors spend on paperwork is minimized so that they can concentrate on relationship building. CMI says that companies that used AI to help their advisors witnessed a 20-25% improvement in productivity in 2024 alone.

Robo-Advisors and Hybrid Advisory Models

AI-based robo-advisors support clients in the daily routines of portfolio management. In hybrid models, human advisors combine their expertise with AI insights to deliver a more efficient and personalized service.

Automated Risk Management

AI tools assist in detecting possible compliance violations and real-time fraud. Machine learning and Natural language processing (NLP) continuously analyze transactions and portfolio operations to indicate risks at an early stage.

The use of AI in the development of wealth management software is no longer an option. It leads to efficiency, enhances customer satisfaction, and assists companies in remaining competitive in a highly dynamic environment.

Key Features of an AI-Powered Wealth Management Software

AI shapes the features that make wealth management software both efficient and user-friendly. The following are the most significant capabilities that are provided by modern platforms:

Portfolio Performance Analytics

The AI tools monitor investments in real time and present detailed reports. Advisors can easily view the assets that are performing and those that require improvement. This makes the clients familiar with their portfolio and gives them confidence in the advisory process.

Predictive Investment Modeling

Machine learning forecasts market trends and could result in investments. Through simulation, advisors will be better placed to plan. This is in line with expanded AI in fintech developments.

Risk Profiling and Scenario Simulation

AI automatically assesses the risk preferences of clients and does what-if scenarios. The advisors can create a portfolio that optimizes the client’s objectives and reduces the exposure to possible losses.

AI-Driven Client Insights

AI algorithms and behavioral analytics give a better idea of what clients need. Advisors develop practical information, including investing preferences, for life events that can influence financial planning. It is a strong example of AI automation in business, delivering real value.

Secure Data Encryption and Access Control

The AI-based systems use role-based access, data security, and encryption measures. The sensitive information of clients remains safe, which creates trust and compliance with industry regulations.

Integration with CRMs and Fintech APIs

Contemporary software integrates with the customer relation management systems, trading platforms, and financial APIs. This guarantees smooth operation and expands the fintech activities.

Client Onboarding and KYC Automation

Automated onboarding reduces manual work and speeds up verification. AI can be used to verify documents, identify irregularities and guarantee adherence to laws effectively.

Reporting and Compliance Dashboards

AI dashboards create regulatory reports, monitor KPIs and compliance. Advisors can quickly respond to audits and regulatory updates, making the system reliable and transparent.

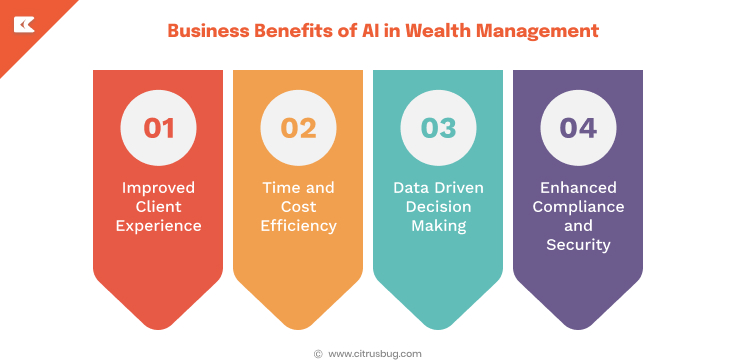

Business Benefits of AI in Wealth Management

AI is not a simple upgrade of technology. It provides both advisors and clients with clear benefits, thus making investment management a smarter, faster, and efficient process.

-

Improved Client Experience

Individual recommendations and live analysis make clients feel acknowledged and respected. Advisors can be more strategic and relationship-oriented, whereas AI does data analysis and is more routine.

-

Time and Cost Efficiency

Automation reduces manual work in the onboarding, compliance checks, and reporting. Companies save man-hours and costs in operations, as teams are able to concentrate on value activities.

-

Data-Driven Decision Making

AI provides advisors with a predictive, analytical and scenario-based approach to making informed investment decisions. This minimizes risk and improves portfolio performance.

-

Enhanced Compliance and Security

AI continually monitors transactions, identifies fraud and ensures control of regulations. This minimizes the chances of penalties, and the client’s trust is preserved.

Scalability and Growth

AI-based systems have the capacity to manage an increasing number of clients without the need to hire new employees. Fintech statistics show that companies that embrace AI experience more rapid growth in client interactions and assets under management, which demonstrates the actual impact of intelligent automation on a business.

The introduction of AI in the development of wealth management software enhances the efficiency of the operation and establishes a competitive advantage. Companies that adopt AI benefit in terms of client satisfaction, risk management, and performance.

Challenges in AI-Driven Wealth Management Software Development

Although AI has several advantages, developing and deploying AI-based wealth management software does not come without its challenges. Knowing these pitfalls assists the companies in planning more efficiently and avoiding expensive mistakes.

-

Data Privacy and Regulatory Compliance

The use of sensitive financial information must comply with strict rules, including GDPR, SEC, and other regional laws. Protecting the privacy of data and using AI analytics may be a complicated task that requires strong systems.

-

Bias in AI Models

The AI algorithms are based on historical data, which can be biased. Lack of skilled models leads to faulty recommendations or bias risk evaluation. Constant monitoring and continuous model improvement are necessary.

-

Integration with Existing Systems

Many companies have old platforms that do not support AI. A well-integrated system would take a lot of planning and, in many cases, a bespoke interface to make the new system compatible with the workflow.

-

Skilled Development Resources

The design of AI-based wealth management systems needs both expertise and knowledge in the domain of wealth management and technical skills. Collaborating with companies providing AI development services guarantees the correct implementation and maintenance.

-

Cost and Maintenance

Developing AI-based software may be costly. Other than development, the constant training of models and their updates and security need constant investment. This is where the experienced custom software development teams come into play to offer value through scalable solutions and the maintainability of these solutions.

Nevertheless, AI is a valuable investment despite such challenges because of its business and operational advantages. With careful planning, the right expertise, and proper safeguards, firms can build AI-driven systems that improve efficiency, compliance, and client satisfaction.

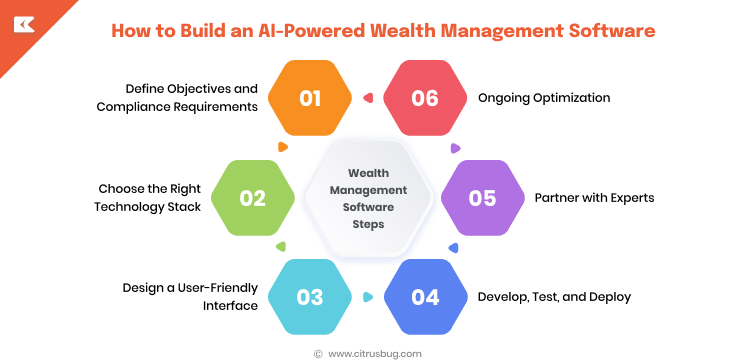

How to Build an AI-Powered Wealth Management Software

The development of AI-driven wealth management software needs proper planning, correct technology, and professional development. Companies with a systematic strategy can provide solutions that are safe, expandable, and customer-oriented.

Step 1: Define Objectives and Compliance Requirements

Start by identifying business goals, target clients, and regulatory standards. Having clear objectives helps in shaping the features development and adhering to the law, such as the GDPR and SEC rules.

Step 2: Choose the Right Technology Stack

Select tools for AI, machine learning, NLP, and data analytics that fit your needs. The stack should facilitate predictive analytics, automated reporting and smooth integration with financial APIs.

Step 3: Design a User-Friendly Interface

The system should be easy to use by advisors and clients. Focus on intuitive admin dashboards, clear reporting, and smooth navigation. A well-designed UX improves adoption and engagement.

Step 4: Develop, Test, and Deploy

Adhere to the principles of agile development to develop features and resolve bugs in the shortest time possible. Strict testing makes sure that the software is reliable and secure to roll out completely.

Step 5: Partner with Experts

Collaboration with a qualified fintech app development company can assist companies in finding the necessary skills in AI, compliance, and financial software. Their expertise makes the system innovative and practical.

Step 6: Ongoing Optimization

AI models need to be trained and optimized on a regular basis. The system should be kept up to date and useful with regular updates that are informed by new information, market trends and user feedback.

Through these steps, companies can develop AI-based custom wealth management software, which increases the services of advisors, boosts customer experience, and can grow the business over time.

Future of AI in Wealth Management Software

AI will transform the wealth management process by providing opportunities to innovate, be effective, and personalized. As the industry evolves, several key trends are emerging.

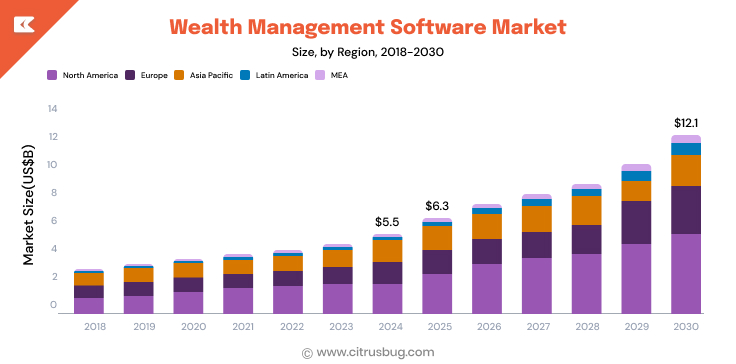

The global wealth management software industry was estimated at USD 5.5 billion in 2024 and is expected to be USD 12.07 billion in 2030, with a CAGR of 14.0% between 2025 and 2030. This quick development indicates that companies that are implementing AI-based solutions are poised to achieve success in the long term.

Generative AI for Personalized Financial Advice

Generative AI is changing the process of providing financial advice. Through the review of huge volumes of data, AI can produce custom investment plans and financial recommendations to customers. This change enables wealth managers to provide more personalized services at scale and improve customer satisfaction and engagement.

Integration of AI with Emerging Technologies

The combination of AI with new technologies, including blockchain and IoT, opens up new opportunities in wealth management. AI can process data across a variety of sources to give real-time data, which can be used to make informed decisions ahead of time.

Enhanced Risk Management and Compliance

Risk management and compliance monitoring can be effectively managed and monitored by AI processing and analyzing large datasets. AI can assist companies in identifying trends and irregularities to alert to possible risks and compliance with regulations.

Democratization of Wealth Management Services

AI is making wealth management more accessible. Robo-advisors and AI-based platforms will enable persons with smaller portfolios to access personalized advice, which will foster financial inclusion.

Continuous Learning and Adaptation

AI systems learn and adapt over time. These systems get increasingly accurate and efficient as they receive more data and feedback and make sure that clients get the latest and most relevant advice.

Conclusion: Empowering Advisors with Intelligent Software

AI is transforming wealth management by enabling smarter decisions, personalized client experiences, and more efficient operations. Companies using AI-based software have a competitive edge and they fulfil the increasing demands of contemporary investors.

At Citrusbug, we offer fintech app development services and tailored AI-powered solutions to assist financial institutions in the development of intelligent wealth management platforms. We are skilled in seamless integration, compliance, and upscale client experience to enable advisors to concentrate on strategy and leave data analysis and automation to AI.

As the global wealth management software market grows rapidly, the adoption of AI is no longer a choice. By leveraging advanced algorithms, predictive analytics, and automation, firms can unlock efficiency, accuracy, and innovation in their advisory services. Investing in AI-based wealth management software today is a way to get financial institutions set up to face the future of digital finance.

SaaS Development

SaaS Development Web Application Development

Web Application Development Mobile Application Development

Mobile Application Development Custom Software Development

Custom Software Development Cloud Development

Cloud Development DevOps Development

DevOps Development MVP Development

MVP Development Digital Product Development

Digital Product Development Hire Chatbot Developers

Hire Chatbot Developers Hire Python Developers

Hire Python Developers Hire Django Developers

Hire Django Developers Hire ReactJS Developers

Hire ReactJS Developers Hire AngularJS Developers

Hire AngularJS Developers Hire VueJS Developers

Hire VueJS Developers Hire Full Stack Developers

Hire Full Stack Developers Hire Back End Developers

Hire Back End Developers Hire Front End Developers

Hire Front End Developers AI Healthcare Software Development & Consulting

AI Healthcare Software Development & Consulting Healthcare App Development

Healthcare App Development EHR Software Development

EHR Software Development Healthcare AI Chatbot Development

Healthcare AI Chatbot Development Telemedicine App Development Company

Telemedicine App Development Company Medical Billing Software Development

Medical Billing Software Development Fitness App Development

Fitness App Development RPM Software Development

RPM Software Development Medicine Delivery App Development

Medicine Delivery App Development Medical Device Software Development

Medical Device Software Development Patient Engagement Software Solutions

Patient Engagement Software Solutions Mental Health App Development

Mental Health App Development Healthcare IT Consulting

Healthcare IT Consulting Healthcare CRM Software Development

Healthcare CRM Software Development Healthcare IT Managed Services

Healthcare IT Managed Services Healthcare Software Testing services

Healthcare Software Testing services Medical Practice Management Software

Medical Practice Management Software Outsourcing Healthcare IT Services

Outsourcing Healthcare IT Services IoT Solutions for Healthcare

IoT Solutions for Healthcare Medical Image Analysis Software Development Services

Medical Image Analysis Software Development Services Lending Software Development Services

Lending Software Development Services Payment Gateway Software Development

Payment Gateway Software Development Accounting Software Development

Accounting Software Development AI-Driven Banking App Development

AI-Driven Banking App Development Insurance Software Development

Insurance Software Development Finance Software Development

Finance Software Development Loan Management Software Development

Loan Management Software Development Decentralized Finance Development Services

Decentralized Finance Development Services eWallet App Development

eWallet App Development Payment App Development

Payment App Development Money Transfer App Development

Money Transfer App Development Mortgage Software Development

Mortgage Software Development Insurance Fraud Detection Software Development

Insurance Fraud Detection Software Development Wealth Management Software Development

Wealth Management Software Development Cryptocurrency Exchange Platform Development

Cryptocurrency Exchange Platform Development Neobank App Development

Neobank App Development Stock Trading App Development

Stock Trading App Development AML software Development

AML software Development Web3 Wallet Development

Web3 Wallet Development Robo-Advisor App Development

Robo-Advisor App Development Supply Chain Management Software Development

Supply Chain Management Software Development Fleet Management Software Development

Fleet Management Software Development Warehouse Management Software Development

Warehouse Management Software Development LMS Development

LMS Development Education App Development

Education App Development Inventory Management Software Development

Inventory Management Software Development Property Management Software Development

Property Management Software Development Real Estate CRM Software Development

Real Estate CRM Software Development Real Estate Document Management Software

Real Estate Document Management Software Construction App Development

Construction App Development Construction ERP Software Development

Construction ERP Software Development