How AI in Accounting Software Is Redefining Financial Management

- October 7, 2025

-

800 Views

- by Ishan Vyas

Table of Contents

Accounting has always been the backbone of financial decision-making. Yet, traditional accounting systems often struggle to handle the growing complexity of financial operations. Manual processes, delayed reporting, and limited data insights can lead to inefficiencies and missed opportunities. The rise of AI in accounting software development is addressing these challenges by enabling smarter, faster, and more accurate financial management.

This is where AI in accounting software development is making a difference. Businesses are no longer restricted to fixed systems. Instead, they are resorting to AI-based, customized solutions that automate complicated operations, enhance forecasting, and strengthen compliance.

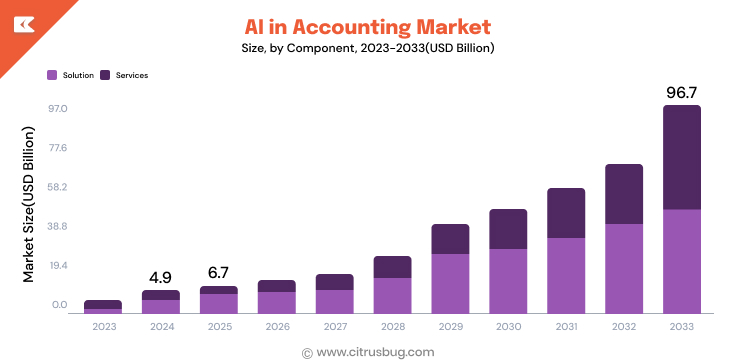

It is estimated that the global AI in accounting software market was estimated at USD 4,872.7 million in 2024 and is projected to reach USD 96,686.1 million by 2033, growing at a CAGR of 39.6% from 2025 to 2033. Such expansion points to an obvious change from one-size-fits-all platforms to AI-powered software that is consistent with certain workflows and industries.

In this blog, we will talk about how AI is reshaping accounting software development, and how this will impact businesses and the need to develop AI solutions to operate business finances in the future.

What Is AI in Accounting Software?

AI in accounting software refers to the use of artificial intelligence technologies such as machine learning, natural language processing (NLP), and predictive analytics in financial management systems. These capabilities allow accounting tools to automate repetitive tasks, analyze data patterns, and generate meaningful insights in real time.

Traditional systems depend heavily on manual input and static reporting. In contrast, AI-powered accounting platforms learn from data trends to improve accuracy and streamline decision-making. They can automatically categorize transactions, forecast cash flow, and detect anomalies, which reduces human errors and improves efficiency.

A custom software development company can design AI-driven accounting solutions that align with your business goals. These solutions integrate seamlessly with existing systems, maintain regulatory compliance, and scale as your business grows.

The Role of AI in Accounting Software Development

AI in accounting software is revolutionizing the way accounting software is built and used. Bringing intelligence to financial systems allows businesses to automate certain repetitive functions such as data entry, reconciliation, and reporting. This helps reduce the errors and allows the finance teams to do strategic activities that can drive up growth.

Some of the key ways AI enhances custom accounting software include:

- Automation of routine tasks: Reduce manual efforts of bookkeeping, invoicing, and payroll.

- Predictive analytics: Anticipates the cash flow, trends, and makes the financial planning more productive.

- Anomaly detection: Notifies about unusual transactions to avoid errors and possible fraud.

- Smart reporting: Generates real-time dashboards of data and actionable insights to make quicker decisions.

- Regulatory compliance support: Assists in ensuring compliance with the financial regulations and auditing requirements.

Such capabilities enable the accounting to be more efficient, accurate and transparent. Business can better understand their financial position and react more quickly to difficulties.

The inclusion of AI into the custom accounting software is no longer a choice. It enables organizations to take evidence-based decisions to reduce risks and enhance operational efficiency.

How to Develop an AI Accounting Software?

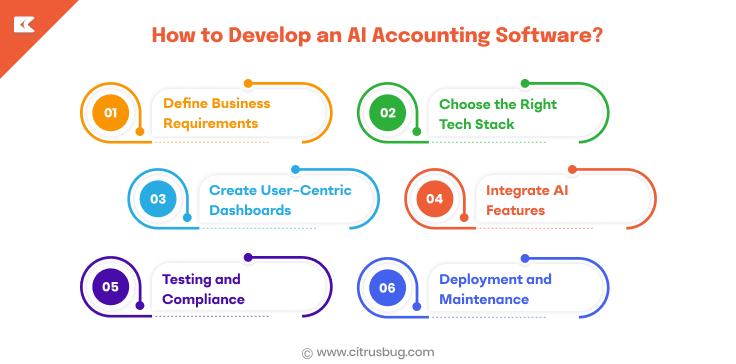

The creation of AI-based accounting software needs a clear roadmap. These steps make sure that the end product is effective, safe and customized in meeting the needs of your business.

Step 1: Define Business Requirements

Begin by mapping out all accounting workflows, reporting requirements and compliance requirements. Knowing these needs helps to make sure that the software fits perfectly with your organization and does not restructure your processes.

Step 2: Choose the Right Tech Stack

Choose technologies that can facilitate cloud deployment, AI, machine learning, and natural language processing. The selection of an appropriate stack forms the basis of scalability, high-speed and sophisticated analytics functions.

Step 3: Create User-Centric Dashboards

Any software system will only be helpful when teams find it simple to navigate. Create dashboards that are easy to understand, take action, and are easy to see. Include real-time reporting for faster decision-making.

Step 4: Integrate AI Features

Add AI-driven automation to reduce repetitive tasks, anomaly detection to spot unusual transactions, and forecasting tools to predict cash flow and financial trends. These capabilities make software a smart system.

Step 5: Testing and Compliance

Make sure that the software is secure and compliant with financial requirements. A test should be performed on usability, performance, and compliance to avoid mistakes and protect sensitive information.

Step 6: Deployment and Maintenance

Deploy the software with continuous monitoring and updates. It is also important to constantly train and improve AI models to ensure accuracy and efficiency.

This can be made easier by teaming up with a fintech software development agency. Agencies combine the knowledge to unify AI, create security, and provide a comprehensive solution that suits your business objectives.

Following these steps results in accounting software that automates tasks, enhances accuracy, and provides actionable insights for smarter financial management.

7 Key Benefits of AI in Accounting Software

1. Enhanced Accuracy

AI in accounting software automates data entry, reconciliations, and reporting, and reduces human errors. This makes the financial statements accurate, dependable and consistent, which helps in making improved decisions and enhancing confidence in the financial activities throughout the organization.

2. Real-Time Insights

AI-based custom dashboards give real-time visibility to financial metrics. Management teams can monitor the performance and track the cash flow and easily spot the trends or deviations, and make quick decisions based on the data rather than wait till manual reports come in.

3. Predictive Analytics

AI is used to predict revenue, cost, and cash flow trends using past transactional records. This forecasting ability enables companies to forecast financial difficulties, strategize the budget and adopt strategies that reduce risks and maximize profit.

4. Fraud Detection

Machine learning models can identify abnormal behavior, requesting possibly fraudulent or faulty transactions. Early detection assists organizations in ensuring compliance, cuts down on the financial risks, and protects sensitive data against both internal and external risks.

5. Automation of Routine Tasks

AI development services can be used to automate repetitive accounting processes such as invoicing, payroll, and reconciliations. This saves manpower on the field, enhances efficiency in operations, and gives the finance teams an opportunity to concentrate on activities that are more valuable such as analysis and strategy.

6. Scalability

AI accounting applications expand as your business grows. AI solutions can process increasing volumes of transactions, multiple entities accounting, and updated compliance needs without compromising performance or demanding significant software upgrades.

7. AI-Driven Decision Support

Application of AI in fintech offers practical information and suggestions. This enables businesses to make smarter business choices, streamline business operations, and enhance business performance, making financial operations competitive and business-ready.

How Much Does It Cost to Build an AI-rich Accounting Software?

The price of AI accounting software is extremely different based on complexity, functionality, AI connectivity, and scalability. Breaking it down by features can help businesses estimate their budgets and see where their investments are the most beneficial.

Cost Breakdown by Feature

| Feature / Module | Estimated Cost Range (USD) | Description |

|---|---|---|

| Frontend Development | $8,000 – $25,000 | Includes dashboards, navigation, and interactive elements that allow users to access and interpret financial data easily and efficiently. |

| Backend Development | $15,000 – $50,000 | Covers database setup, APIs, server logic, and integrations supporting core accounting functionalities and ensuring smooth operations. |

| UI/UX Design | $5,000 – $15,000 | Wireframes, responsive design, and prototyping to create an intuitive, visually appealing interface for all user types. |

| AI & Predictive Analytics | $10,000 – $40,000 | Automation, forecasting, and anomaly detection features improve accuracy and provide actionable insights for financial decision-making. |

| Security & Compliance | $8,000 – $25,000 | Encryption, audits, and regulatory adherence safeguard sensitive data and ensure the system meets industry compliance standards. |

| Testing & Quality Assurance | $5,000 – $15,000 | Functional, performance, and security testing ensure the software operates reliably and safely under real-world conditions. |

| Deployment & Maintenance | $3,000 – $10,000 per year | Cloud setup, updates, and AI model retraining maintain performance, scalability, and long-term software efficiency. |

Average cost of custom AI accounting software Development: Approximately $40,000 – $200,000, depending on features, complexity, and AI integration.

Key Considerations

- The costs depend on the size of a team, location and technology stack.

- The high functionality, such as AI, multi-entity, and real-time dashboards, enhances investment.

- A custom solution guarantees ROI in the long term as efficiency and errors can be mitigated and AI automation in business is possible.

Knowing the cost by feature enables organizations to plan budgets and develop accounting programs that offer maximum operational efficiency, precision, and strategic information.

Future of AI in Accounting Software Development

Predictive Financial Planning

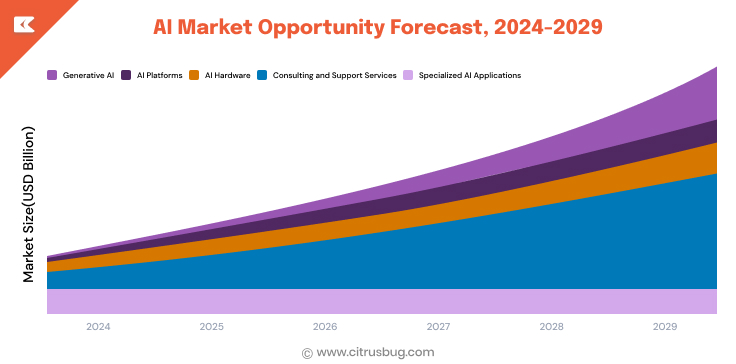

AI-based analytics predict a cash flow, revenue trends, and financial risks to make proactive predictions. It is estimated that the global market of AI in financial planning will increase by USD 48.86 billion between 2024 and 2029, with a CAGR of 26.9%.

Blockchain + AI to Secure Transactions

A combination of blockchain and AI increases the effectiveness of transactions in security and transparency. To facilitate secure financial activities, AI can be used to analyze trends to find anomalies and fraud. The use of blockchain in accounting will continue to increase over the next few years.

Generative AI

Generative AI is used to automate the preparation of reports, generate insights, and process documents, enabling accountants to engage in strategic decision-making. The generative AI in the financial services market is expected to be USD 16.02 billion by 2030.

Real-Time Decision Support

AI can offer continuous data tracking and real-time information so that businesses can react to market dynamics in time and enhance their financial plans.

AI Trends

To remain competitive, companies must adopt the newest AI trends, including predictive analytics and automation.

Conclusion

AI is changing the face of custom accounting software development. Today, businesses can be more accurate, efficient, and strategic in their financial operations through predictive financial planning, blockchain integration and generative AI.

At Citrusbug Technolabs, we have more than 12 years of experience in building custom accounting software. Our expertise in AI development guarantees that your custom solutions offer real-time actionable insights, automate manual processes and enhance compliance, which help prepare your finance operations for the future-ready.

FAQs

What is AI in accounting software development?

⇒ AI in accounting software development uses machine learning, predictive analytics, and NLP to create intelligent financial systems that automate tasks, detect errors, and deliver real-time insights.

Can AI improve accounting accuracy?

⇒ Yes. AI improves the precision with automation of repetitive activities, detection of fraud, predictive understanding, and real-time decision-making. This minimises human mistakes and contributes to smarter financial activities.

What are the benefits of AI accounting software development?

⇒ AI accounting software improves efficiency and accuracy. It automates repetitive tasks, reduces manual errors, and provides predictive insights that help businesses make informed financial decisions.

Is my financial data secure in AI-powered accounting software?

⇒ Yes. AI-based custom accounting solutions include encryption, role-based access and financial regulations compliance, keeping sensitive data secure and taking advantage of AI capabilities safely.

How is AI software different from traditional accounting software?

⇒ Traditional accounting software depends on manual input, while AI-driven tools learn from data, automate tasks, and offer predictive insights for smarter and faster financial management.

SaaS Development

SaaS Development Web Application Development

Web Application Development Mobile Application Development

Mobile Application Development Custom Software Development

Custom Software Development Cloud Development

Cloud Development DevOps Development

DevOps Development MVP Development

MVP Development Digital Product Development

Digital Product Development Hire Chatbot Developers

Hire Chatbot Developers Hire Python Developers

Hire Python Developers Hire Django Developers

Hire Django Developers Hire ReactJS Developers

Hire ReactJS Developers Hire AngularJS Developers

Hire AngularJS Developers Hire VueJS Developers

Hire VueJS Developers Hire Full Stack Developers

Hire Full Stack Developers Hire Back End Developers

Hire Back End Developers Hire Front End Developers

Hire Front End Developers AI Healthcare Software Development & Consulting

AI Healthcare Software Development & Consulting Healthcare App Development

Healthcare App Development EHR Software Development

EHR Software Development Healthcare AI Chatbot Development

Healthcare AI Chatbot Development Telemedicine App Development Company

Telemedicine App Development Company Medical Billing Software Development

Medical Billing Software Development Fitness App Development

Fitness App Development RPM Software Development

RPM Software Development Medicine Delivery App Development

Medicine Delivery App Development Medical Device Software Development

Medical Device Software Development Patient Engagement Software Solutions

Patient Engagement Software Solutions Mental Health App Development

Mental Health App Development Healthcare IT Consulting

Healthcare IT Consulting Healthcare CRM Software Development

Healthcare CRM Software Development Healthcare IT Managed Services

Healthcare IT Managed Services Healthcare Software Testing services

Healthcare Software Testing services Medical Practice Management Software

Medical Practice Management Software Outsourcing Healthcare IT Services

Outsourcing Healthcare IT Services IoT Solutions for Healthcare

IoT Solutions for Healthcare Medical Image Analysis Software Development Services

Medical Image Analysis Software Development Services Lending Software Development Services

Lending Software Development Services Payment Gateway Software Development

Payment Gateway Software Development Accounting Software Development

Accounting Software Development AI-Driven Banking App Development

AI-Driven Banking App Development Insurance Software Development

Insurance Software Development Finance Software Development

Finance Software Development Loan Management Software Development

Loan Management Software Development Decentralized Finance Development Services

Decentralized Finance Development Services eWallet App Development

eWallet App Development Payment App Development

Payment App Development Money Transfer App Development

Money Transfer App Development Mortgage Software Development

Mortgage Software Development Insurance Fraud Detection Software Development

Insurance Fraud Detection Software Development Wealth Management Software Development

Wealth Management Software Development Cryptocurrency Exchange Platform Development

Cryptocurrency Exchange Platform Development Neobank App Development

Neobank App Development Stock Trading App Development

Stock Trading App Development AML software Development

AML software Development Web3 Wallet Development

Web3 Wallet Development Robo-Advisor App Development

Robo-Advisor App Development Supply Chain Management Software Development

Supply Chain Management Software Development Fleet Management Software Development

Fleet Management Software Development Warehouse Management Software Development

Warehouse Management Software Development LMS Development

LMS Development Education App Development

Education App Development Inventory Management Software Development

Inventory Management Software Development Property Management Software Development

Property Management Software Development Real Estate CRM Software Development

Real Estate CRM Software Development Real Estate Document Management Software

Real Estate Document Management Software Construction App Development

Construction App Development Construction ERP Software Development

Construction ERP Software Development