Certified Health Insurance Software Developers By

Our Custom Health Insurance Software Development Services

-

Health Insurance Platform Development

We build secure, scalable platforms that streamline policy administration, billing, member management, and claims processing. Every solution is tailored to your operational goals and designed to support long-term growth.

-

Claims Automation Systems

Automate complex claims workflows with configurable rules, AI-assisted validation, and transparent audit trails. Our systems help reduce manual errors, improve processing speed, and boost overall operational efficiency.

-

Enrollment & Policy Software

We create intuitive enrollment solutions that simplify plan selection, eligibility checks, employer group management, and subsidy logic. Your teams get flexible configuration options and your members enjoy a seamless onboarding experience.

-

Member & Provider Portals

Deliver modern, user-friendly portals that centralize benefits, claims, documents, and communication. We focus on secure access, responsive design, and frictionless navigation to enhance satisfaction for both members and providers.

-

AI-Driven Insurance Enhancements

We use AI to streamline the underwriting process, identify fraud, read documents, and produce insights. These features reinforce decision-making and significantly reduce processing times across your insurance operations.

-

Legacy Modernization & Cloud Migration

Transition from outdated systems to modern, cloud-ready architectures without disrupting daily operations. We provide a seamless migration, better performance, and scalability for future digital projects.

We’re an AI-powered Health Insurance Software Development Company

Citrusbug develops smart health insurance solutions, simplifying complex processes, such as claims adjudication and policy management. Our solutions lower operational overhead and guarantee accuracy and compliance across every process.

We leverage AI to optimize fraud detection, data mining, and predictive analytics and provide an insurer with the actionable information to make more intelligent decisions. Integrations with EHRs, CRMs, and payment systems ensure seamless connectivity across your ecosystem.

Our custom software also focuses on member and provider experiences, offering intuitive portals, self-service tools, and real-time notifications. Our ability to integrate regulatory compliance and innovative technology allows insurance companies to transform operations, enhance engagement, and grow effectively in the future.

Looking for the best health insurance software development companies in India and the USA?

Connect with our experienced health insurance software developers for expert guidance and custom solutions designed to meet your business needs efficiently.

Features to Look for in Health Insurance Management Software

Automated Claims Workflows

Look for platforms that support rule-based validation, smart routing, and automated adjudication. This reduces manual work, speeds up reviews, and improves accuracy across the entire claims lifecycle.

Flexible Benefit Configuration

Your system should allow quick updates to plan benefits, coverage limits, eligibility rules, and pricing without heavy development effort. This flexibility ensures faster adaptation to regulatory or market changes.

AI-Powered Fraud Detection

The modern health insurance software must contain AI models to identify anomalies, notice suspicious patterns, and conduct automatic analysis of documents. This assists the insurers in minimizing the losses and enhancing risk management.

Member & Provider Portals

Self-service portals provide users with easy access to benefits, claim status, coverage information, documents, and communication tools. A good portal improves engagement and reduces support workloads.

Premium Billing & Payment Processing

Automated premium billing, invoicing, reminders, and multi-method payment options are used to simplify financial operations and enhance payment accuracy across individual and group policies.

Comprehensive Analytics & Reporting

Analytics dashboards deliver insights into claims trends, financial performance, member utilization, risk scoring, and operational bottlenecks. Actionable data helps teams make faster, more informed decisions.

EDI Support

Health insurance platforms should support secure EDI transactions, enabling seamless communication with clearinghouses, providers, and partners for claims, eligibility checks, and remittance advice.

Secure Document Management

An encrypted centralized storage is used to maintain all policy, claims, and compliance records in a well-organized and accessible manner. This improves traceability and supports regulatory audits.

Seamless Enrollment Management

Efficient enrollment workflows enable quick member onboarding, eligibility checks, group management, and plan selection. A smooth enrollment experience reduces errors and improves satisfaction.

How Much Does it Cost to Develop a Health Insurance Software?

Developing custom health insurance software can cost between $30,000 and $250,000, depending on platform complexity, features, and integrations.

Submit your requirements to receive a personalized, accurate estimate tailored to your business needs.

Compliance and Regulatory Readiness for Medical Insurance Software

Developing medical insurance software requires strict compliance with legal, regulatory, and security requirements. Our solutions guarantee your platform to be in compliance with the requirements and protect sensitive member and provider data.

HIPAA-Compliant Architecture

All patient health information (PHI) is transmitted, accessed and stored securely in compliance with HIPAA standards. Role-based access control, encryption and detailed audit trails secure sensitive data within your systems.

ACA & CMS Guidelines Support

Our software supports the Affordable Care Act (ACA) and the Centers for Medicare and Medicaid Services (CMS), such as plan filing, subsidies, reporting, and eligibility compliance to both individuals and groups.

Data Security & Privacy Controls

To maintain data integrity and privacy in all workflows, we use end-to-end encryption, secure APIs, multi-factor authentication, and backup protocols that are compliance-ready.

Regulatory Reporting & Audit Trails

Automated reporting tools maintain detailed audit logs and track all transactions, ensuring transparency and facilitating timely regulatory submissions.

Role-Based Access & User Management

Granular access permissions enable secure operations, allowing only authorized personnel to access claims, policy, or member data, minimizing risk of unauthorized exposure.

Ongoing Compliance Monitoring

Our team ensures your software stays up-to-date with evolving U.S. regulations, providing regular updates, patches, and compliance checks to maintain operational and legal integrity.

Essential Integrations for Health Insurance Software

Modern health insurance platforms rely on smooth integrations to guarantee the correct data flow, quicker processing, and better experiences by members.

-

EHR & EMR Systems

Access real-time clinical data through EHR & EMR integrations to verify patient information, streamline claims, enhance care coordination, and improve accuracy across member health records.

-

Eligibility & Benefits Verification (EDI 270/271)

Automate member eligibility and benefits checks, minimize manual errors, quicken the onboarding process and confirm proper coverage verification.

-

Claims Processing (EDI 837/835)

Enable HIPAA-compliant claim submission and remittance advice to enhance accuracy, ease administrative burden, and shorten the claims process.

-

Payment Gateway Integration

Secure premium collection, automation of billing, and online payments, streamline financial operations and increase the efficiency of payment reconciliation.

-

Provider Network Management

Sync provider directory, credentialing information and contracts to manage the network properly, guaranteeing a smooth interaction between the members and providers and network adherence.

-

CRM & Member Engagement Platforms

Introduce integrated CRM systems to improve communication, notifications, and case management and increase member engagement, satisfaction, and retention.

Process We Follow for Health Insurance Software Development

We begin by learning about your health insurance business and operations. Research and analysis can help us to determine the obstacles, possibilities and compliance requirements to develop a clear roadmap to your software solution.

Our team design user-friendly, intuitive layouts for members, providers, and internal teams. We streamline complicated insurance operations and make dashboards, portals, and mobile interfaces safe, interactive, and user-friendly.

We create scalable and secure compliance-ready health insurance software using modern technologies and best practices. Our solutions combine AI, claims automation, and third-party systems to streamline operations and improve decision-making.

We use an iterative, agile method to develop quality software. Continuing tests, feedback, and controls make sure that your platform is complete, safe, and supportive of the business objectives.

Why Choose Citrusbug Technolabs as Your Health Insurance Software Development Agency?

Our health insurance software development services are rated 4.7 on Clutch with 30+ client reviews, and we’re a top-rated plus agency on Upwork. We proudly maintain a 97% job success rate and have successfully delivered 500+ projects, showcasing our commitment to quality, reliability, and client satisfaction.

Transparency & Integrity

We prioritize integrity and transparency by securing your sensitive insurance information, practices, and intellectual property using our strict NDA standards and safe development.

On-Time Delivery

Our health insurance software developers follow a structured schedule to deliver each milestone promptly, ensuring your custom platform is completed on time without compromising quality.

Cost-Efficient Solutions

Citrusbug offers quality and compliance-friendly health insurance software at cost-effective prices so you can get the best value and operate within a budget.

Deep Technical Expertise

Our developers bring extensive experience in building insurance platforms, integrating AI, automating claims, and creating member portals to provide cutting-edge, scalable solutions.

QA and Testing Excellence

We provide rigorous QA and testing services to ensure your health insurance software is secure, reliable, bug-free, and fully compliant before deployment.

24x7 Support

Our experts are available around the clock via email, call, or chat to resolve queries, provide technical guidance, and ensure your platform runs smoothly.

Client Testimonials (We're Rated 4.7 on Clutch)

Some Top Healthcare Software We Developed

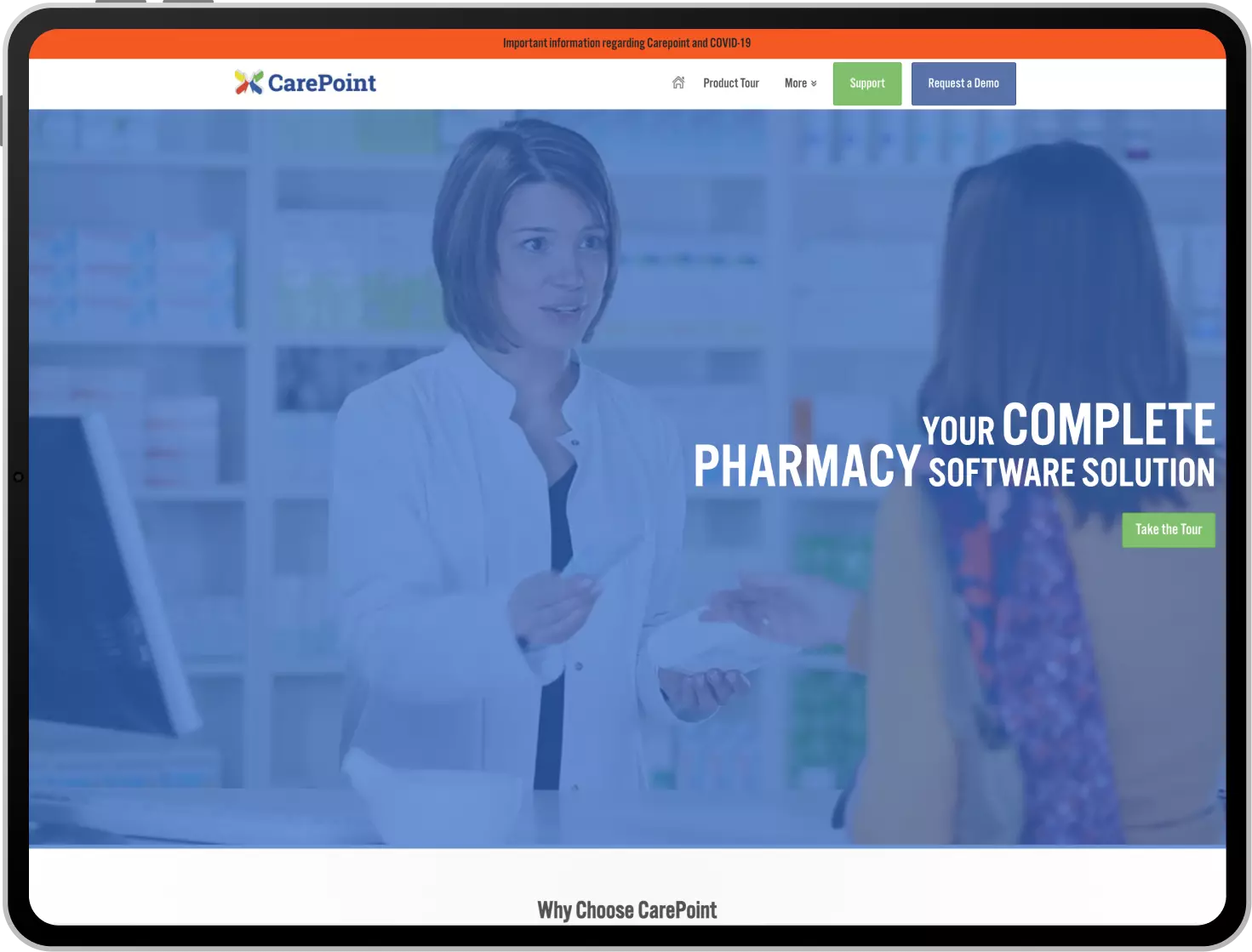

Carepoint is a solution dedicated to the pharmacy industry with a variety of tools needed to manage any pharmacy. This pharmacy management solution also offers integral support to manage dispensing, medication therapy, compounding support, A/R & reconciliation, and perpetual inventory.

Furthermore, this tool provides the ability to manage different virtual or real inventories with minimum effort. This platform also offers a range of customization for flexibility for any individual pharmacy. Users can make the most out of this tool and resolve any of the challenges that they generally face.

Advinow is an AI-driven healthcare platform that automates patient engagement and consultation processes, helping healthcare providers deliver efficient, on-demand services while improving operations for urgent care.

Phelix is a no-code, virtual assistant designed for healthcare workflows by automating patient communication, scheduling, and payment processes. With advanced AI features like OCR, generative AI, chatbot functionality, and SMS automation, Phelix enhances efficiency, reduces administrative burden, and ensures good patient experiences. Phelix supports over 31 million patients across Canada and helps healthcare providers to focus on delivering quality care.

Platform leverages AI to analyze brain imaging data, providing insights into brain health. Designed for healthcare providers and researchers, the platform enhances early detection of neurological conditions, enables predictive analytics, and optimizes treatment planning. The platform empowers clinicians with accurate and data-driven decision-making capabilities.

Latest Insights On Health Insurance Software Development

FAQs on Health Insurance Software Development

Health insurance software development involves the construction of custom software to handle policies, claims, enrollment, billing and contact with members and providers effectively.

AI improves the process of claims, fraud detection, risk prediction, underwriting and document data extraction, which assists insurers in making fewer mistakes and increasing their operational efficiency.

The medical insurance software platform development usually requires 3-6 months to design a simple solution, and it may take up to 9-12 months or more to create an enterprise-level solution.

Yes, we offer continual support, updates, bug fixes and compliant monitoring to ensure that your software stays secure, scalable and runs well upon the launch.

Our solutions are compatible with EHR/EMR systems, CRM platforms, payment gateways, PBM systems and other insurance tools to provide a smooth workflow.

Essential capabilities include automated claims processes, customizable benefit plans, AI-based fraud identification, member and provider portals, premium billing, analytics and reporting, EDI service and safe document handling.

Share your requirements with our experts to receive a tailored development plan, timeline, and cost estimate. We handle the project end-to-end from discovery to deployment.

Our solutions comply with HIPAA, ACA, and CMS requirements, include secure data management, audit trails, and periodic compliance audits, and meet the requirements of U.S. insurance.

When it comes to finding a trustworthy insurance software development firm, research their past insurance software projects, their capability of creating secure and compliant software, their technical capabilities, their reviews on Clutch and Good Firms, and their transparency throughout the project and post-launch support.

SaaS Development

SaaS Development Web Application Development

Web Application Development Mobile Application Development

Mobile Application Development Custom Software Development

Custom Software Development Cloud Development

Cloud Development DevOps Development

DevOps Development MVP Development

MVP Development Digital Product Development

Digital Product Development Hire Chatbot Developers

Hire Chatbot Developers Hire Python Developers

Hire Python Developers Hire Django Developers

Hire Django Developers Hire ReactJS Developers

Hire ReactJS Developers Hire AngularJS Developers

Hire AngularJS Developers Hire VueJS Developers

Hire VueJS Developers Hire Full Stack Developers

Hire Full Stack Developers Hire Back End Developers

Hire Back End Developers Hire Front End Developers

Hire Front End Developers AI Healthcare Software Development & Consulting

AI Healthcare Software Development & Consulting Healthcare App Development

Healthcare App Development EHR Software Development

EHR Software Development Healthcare AI Chatbot Development

Healthcare AI Chatbot Development Telemedicine App Development Company

Telemedicine App Development Company Medical Billing Software Development

Medical Billing Software Development Fitness App Development

Fitness App Development RPM Software Development

RPM Software Development Medicine Delivery App Development

Medicine Delivery App Development Medical Device Software Development

Medical Device Software Development Patient Engagement Software Solutions

Patient Engagement Software Solutions Mental Health App Development

Mental Health App Development Healthcare IT Consulting

Healthcare IT Consulting Healthcare CRM Software Development

Healthcare CRM Software Development Healthcare IT Managed Services

Healthcare IT Managed Services Healthcare Software Testing services

Healthcare Software Testing services Medical Practice Management Software

Medical Practice Management Software Outsourcing Healthcare IT Services

Outsourcing Healthcare IT Services IoT Solutions for Healthcare

IoT Solutions for Healthcare Medical Image Analysis Software Development Services

Medical Image Analysis Software Development Services Lending Software Development Services

Lending Software Development Services Payment Gateway Software Development

Payment Gateway Software Development Accounting Software Development

Accounting Software Development AI-Driven Banking App Development

AI-Driven Banking App Development Insurance Software Development

Insurance Software Development Finance Software Development

Finance Software Development Loan Management Software Development

Loan Management Software Development Decentralized Finance Development Services

Decentralized Finance Development Services eWallet App Development

eWallet App Development Payment App Development

Payment App Development Money Transfer App Development

Money Transfer App Development Mortgage Software Development

Mortgage Software Development Insurance Fraud Detection Software Development

Insurance Fraud Detection Software Development Wealth Management Software Development

Wealth Management Software Development Cryptocurrency Exchange Platform Development

Cryptocurrency Exchange Platform Development Neobank App Development

Neobank App Development Stock Trading App Development

Stock Trading App Development AML software Development

AML software Development Web3 Wallet Development

Web3 Wallet Development Robo-Advisor App Development

Robo-Advisor App Development Supply Chain Management Software Development

Supply Chain Management Software Development Fleet Management Software Development

Fleet Management Software Development Warehouse Management Software Development

Warehouse Management Software Development LMS Development

LMS Development Education App Development

Education App Development Inventory Management Software Development

Inventory Management Software Development Property Management Software Development

Property Management Software Development Real Estate CRM Software Development

Real Estate CRM Software Development Real Estate Document Management Software

Real Estate Document Management Software Construction App Development

Construction App Development Construction ERP Software Development

Construction ERP Software Development

BOOK A 30 MIN CALL

BOOK A 30 MIN CALL