PropTech Market 2026: Market Growth & Future Opportunities

- October 8, 2025

-

1399 Views

- by Ishan Vyas

The global real estate industry is going through a revolution, and proptech market is leading that change by combining property management with technology-driven innovation.

In 2026, the world of proptech is not just transforming how properties are being bought, sold, and managed it’s also unlocking new potential within sustainable data-driven real estate solutions.

From AI-driven marketplaces to smart building management applications, proptech is a driving force behind the evolution of real estate, and successful entrepreneurs in current times are scaling to new heights with it.

What is PropTech?

PropTech is a hybrid term for “Property Technology”, a phrase used broadly to define the various ways in which technology, software, and data solutions facilitate the blockchain-based property transactions, AI property valuation, IoT smart homes, or cloud-based property management systems.

This space spans innovative solutions that increase the ease of transaction for buyers and sellers; at the same time, it also enables property managers and investors with greater ability to analyze their data, security, and performance insights.

PropTech Market Overview

The proptech market has matured from a niche sector into a central pillar of global real estate strategy. This has translated into growing institutionalisation, merge with M&A, as well as a general acknowledgement that having tech is the difference between being competitive in a data-dominated world or quickly going out of business.

The vibrancy of the market is further fuelled by the intersection with other tech verticals, in particular FinTech (Financial Technology) and ConTech (Construction Technology), toward a unified digital ecosystem of built environment solutions.

What is the Property Technology (PropTech) Market Size in 2026?

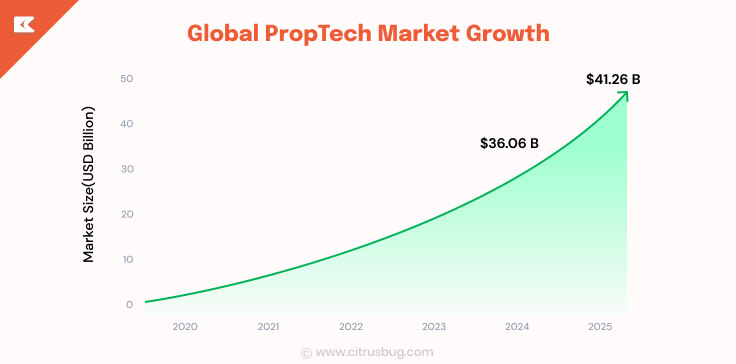

The property technology (proptech) market size has grown rapidly in recent years. It has reached $36.08 billion in 2024 and is expected to reach $41.26 billion in 2025, with a compound annual growth rate (CAGR) of 14.4%.

This valuation reflects the fact that the industry is growing, supported by a strong push for digital transformation, particularly in commercial real estate (CRE) and residential.

Where smart home and property management solutions are becoming standard. This market size is a clear indicator of the massive capital and functional shift occurring as real estate embraces its digital future.

PropTech Market Growth Forecast

The future outlook for the proptech sector is exceptionally strong. Beyond 2025, the market expected to continue its rapid growth, with a compound annual growth rate (CAGR) of 16% through 2034, potentially reaching a market size of over $179.03 billion.

This phenomenal growth rate is supported by various macro factors, such as global urbanization, compulsion to adopt ESG (Environmental, Social, and Governance) standards, increasing sophistication of technology, and fairly affordable prices of new-age technologies like AI and IoT sensors.

From just helping digitize existing processes, the market has now begun a fundamental redesign of the real estate lifecycle for a long-term growth.

Regional PropTech Market Insights

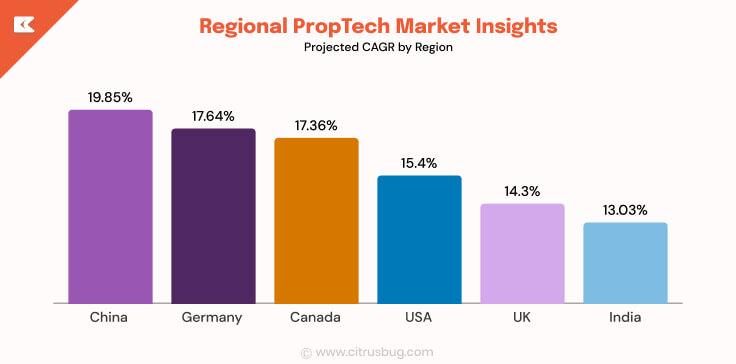

China: PropTech Growth Driven by Smart Cities and Digital Innovation

The revenue created from proptech solutions in China is projected to grow at a 19.85% CAGR from 2025 to 2035. It is because of the massive urbanization, government digital infrastructure initiatives, and increasing real estate demand across major cities, including Beijing, Shanghai, and Shenzhen.

With these booming housing demands, there is a strong push toward digital property platforms. China is set to remain the world’s most dynamic proptech hub in 2025.

Germany: Sustainability and Green Buildings Accelerating PropTech Market

The proptech market in Germany is expected to register a CAGR of 17.64% during the forecast period from 2025 to 2035. For German companies, it’s all about energy-saving solutions, IoT for property management, and digital investment platforms.

The increasing attention to green and sustainable real estate projects will be an additional catalyst for the acceleration of both adoption, making Germany one of the main European PropTech markets.

Canada: IoT and Smart Property Management Leading PropTech Growth

The proptech market in Canada is projected to expand at a CAGR of 17.36% from 2025 to 2035, due to stable demand for digital property management & smart buildings. This growth is because of urbanization and technology adoption in regions like Toronto, Vancouver, and Montreal.

Canadian real estate firms are utilizing IoT, AI, and blockchain technology to drive new efficiencies in property management and investment analysis. Other growth drivers include sustainable and energy-efficient construction projects, helping the market to proliferate at a fast pace.

USA: Innovation and Investment Powering PropTech Leadership

The US PropTech market is forecasted to grow at a CAGR of 15.4%, making it the world leader. Growth is being fueled by intense venture capital investment, the rise of digital property platforms, and technology, including blockchain transactions and AI to analyze properties. The U.S., thanks to its more mature real estate ecosystem, still sets the bar for global PropTech trends.

UK: Digital Property Platforms and Smart Housing Growth

UK proptech sales will increase at a CAGR of 14.3% due to the rise in digital transformation and regulatory change. Proptech solutions with built-in data analytics have broadened the scope of tech adoption even as property managers add efficiency-focused protocols to holistic facility management programs.

With robust government support for smart housing and the digitization of real estate. The UK’s tech-enabled property market is one of the fastest-growing engines.

India: Affordable Housing and Digital Platforms Transforming Real Estate

In India, the PropTech market is growing at a rate of 13.03% CAGR, boosted by urban population growth and the increasing demand for affordable housing options. Indian PropTech startups cover digital property platforms, intelligent home technologies, and AI-driven property analysis.

Smart city initiatives and real estate digitization incentives from the government are fueling mass adoption, and that’s why India is an important growth center for the PropTech ecosystem.

Key Drivers Fueling PropTech Adoption

- Growth in Urbanization and Housing Needs – Fast-growing urbanization is one of the leading drivers for PropTech adoption, making developers to think digital-first when planning housing solutions.

- Smart City Projects – Governments are adopting smart city projects to enhance the real estate technology market through large-scale digital infrastructure.

- AI and Big Data Integration – Combining AI tools with predictive analytics provides an enhanced tenant experience, adds to property valuation predictions, and helps in predicting long-term trends.

- Growing Investor Interest in PropTech Startups – Strong venture capital backing is supporting new property technology trends and platforms worldwide.

- Sustainable and Energy Efficient Building Demand – Smart buildings for the IoT (Internet of Things) era are transforming what real estate technology innovation look like.

- Better Customer Experience – Buyer engagement is being improved by virtual reality tours, chatbots powered with artificial intelligence, and smooth online transactions.

- Blockchain for Transparent Transactions – The fraud-free, secure blockchain systems are driving more transparency in property investments.

- Data-Driven Decision Making – With AI in real estate, figures and results are available on the spot, investors and developers can make quick decisions.

- Digital Transformation after the Pandemic – With remote work and online services gaining momentum, thanks to advances in E-property and Cloud-based property management solutions, this trend has been on the rise.

Major PropTech Trends Shaping 2026

Increasing Demand for Real Estate Digitalization

One of the most prominent proptech trends shaping 2026 is the growing demand for real estate digitalization. Whether it’s property listings or transaction services, the sector is quickly moving towards digital-first offerings.

AI-integrated home recommendations, virtual site tours, and cloud-based property management services are making the process more efficient for both buyers and sellers.

The transition to digital real estate not only improves the customer experience but also gives investors access to a level of data and intelligence about their assets that was inconceivable even a decade ago, making property technology adoption an imperative rather than an option.

Sustainability and Energy Efficiency

Sustainability is yet another hot topic in the proptech market. With the strict environmental mandates and higher power bills, property developers are increasingly seeking PropTech solutions to help optimize buildings for smart, eco-friendly performance.

Energy monitoring systems, green building certifications, and AI-enabled sustainability analytics for the built environment are all entering the mainstream.

Not only does this transition toward energy efficiency in infrastructure operations reduce operational expenses, it also increases real estate value; as a result, sustainability sits as one of the top property technology trends pushing forward global adoption.

Rising Investment and Venture Capital Funding

Venture capital and private equity investments continue to flow into the PropTech industry, driving technology advancements throughout the space. Digital property platforms, blockchain-based transactions, and AI agents in real estate are all drawing billions in investment across the globe.

Let’s face it, investors love companies that offer the promise of offering scale, automation, and better customer engagement. And as capital pours in at an ever greater rate, these new PropTech developments signify that the industry has firmly taken its place as a major catalyst in redefining the global real estate model for 2026 and beyond.

Blockchain Integration for Secure Transactions

The proptech market is quickly embracing blockchain technology, which provides transparency and security in property transactions. From fractional ownership formats to smart contracts, blockchain provides trust between buyer, seller, and investor.

As it removes middlemen, the risk of fraud decreases, blockchain adoption is making real estate investments simpler across borders. With increasing demand for faster, safer property transactions, blockchain will still be an essential trend in 2026, especially in high-end real estate.

Integration of PropTech with FinTech Solutions

The major trend of 2026 is the integration of property technology (PropTech) and financial technology (FinTech). This integration is impacting real estate financing in digital mortgages, peer-to-peer loans, or tokenized property investments.

Today, it is faster, more visible, and cheaper for buyers to enter into property financing. But now, with more and more digital adoption taking place, data privacy and security of these fintech apps are a big concern, making robust cybersecurity measures essential for safe and reliable property transactions worldwide.

Key Segments of the PropTech Market

To understand the market’s dynamics, it’s essential to examine its segmentation across deployment mode, property type, and end-user.

Global PropTech Market – Breakup by Deployment Mode

Cloud-based (SaaS): The cloud deployment model has covered the largest or fastest-growing proportion of the market and is frequently available as Software-as-a-Service (SaaS).

Its attractiveness lies in scalability, low initial capital costs, remote access, and ease of integration. The vast majority of PropTech newbies prefer using portfolio management and tenant-facing apps that are cloud-based.

On-Premises: Based on the proptech market trend, on-premises deployment held the largest share as it provides better control over the data, along with greater cybersecurity and customization in real estate operations.

These are more complex solutions that essentially have a higher starting cost and ongoing care, but they offer unlimited customization and privacy options. Even as more and more is moving to the cloud, some real-estate entities and government bodies are still going with on-premises in order to manage property data that’s too sensitive for the cloud.

Global PropTech Market – Breakup by Property Type

Residential Property: This segment contains solutions for smart homes, home property management (rent collection and maintenance), digital leasing, and consumer platforms (iBuyers, marketplaces). The residential segment, fueled by mass consumer adoption of smart devices, will continue to hold a high market share.

Commercial Property (CRE): This segment includes office, retail, and hospitality. CRE is the largest adopter of PropTech, with drivers being operational efficiency, space use analytics, and compliance with ESG requirements. Solutions here place strong emphasis on building management systems (BMS), facility management, and tenant experience platforms.

Industrial and Logistics: The growing e-commerce and logistics sector has spurred PropTech in this segment, focusing on warehouse automation, real-time inventory tracking, and supply chain management integration within industrial properties. This segment is expected to show one of the fastest growth rates.

Global PropTech Market – Breakup by End Use

Housing Associations: These groups are the most important end-users, streamlining everyday operations using PropTech to include tenant communication, lease management, maintenance scheduling, and accounting. They can leverage technology to handle larger and more complex portfolios with fewer resources.

Property Investors: PropTech Solutions are implemented by property investors for real-time market insight assessment to gauge property performance and make investment decisions based on facts. They use predictive analytics, blockchain-powered transactions, and AI valuation tools that will minimize risk while maximizing return.

Other End Users: This segment includes tenants (using tenant experience apps), contractors (using ConTech and maintenance platforms), and financial institutions (using FinTech integrations for underwriting and appraisal).

Future of Property Technology

The future of PropTech market will revolutionize the real estate sector through fast digital adoption and innovation. Artificial intelligence, blockchain, and IoT will fuel automation, openness, and effectiveness in property deals and management.

The industry will be taken over by smart buildings, eco-friendly solutions, and digital financing platforms, which will be the thing, making things quick and convenient.

Virtual reality (VR) and augmented reality (AR) will make the property decision-making process more fun and engaging for buyers and investors globally. Together, these are likely to ensure PropTech remains in the driving seat when it comes to transforming global real estate.

Conclusion

The PropTech sector, with the changes it is driving and trying to drive with AI, IoT, blockchain, or digital property platforms, is going to transform the real estate industry and will continue to do so.

Technology solutions are increasingly being embraced to prioritise usefulness, transparency, and customer experience in both residential and commercial applications.

Collaborating with a reliable real estate software development company, the business can build scalable, secure, and intelligent property solutions that offer long-term value and keep it ahead in technological upheaval within the real estate landscape.

SaaS Development

SaaS Development Web Application Development

Web Application Development Mobile Application Development

Mobile Application Development Custom Software Development

Custom Software Development Cloud Development

Cloud Development DevOps Development

DevOps Development MVP Development

MVP Development Digital Product Development

Digital Product Development Hire Chatbot Developers

Hire Chatbot Developers Hire Python Developers

Hire Python Developers Hire Django Developers

Hire Django Developers Hire ReactJS Developers

Hire ReactJS Developers Hire AngularJS Developers

Hire AngularJS Developers Hire VueJS Developers

Hire VueJS Developers Hire Full Stack Developers

Hire Full Stack Developers Hire Back End Developers

Hire Back End Developers Hire Front End Developers

Hire Front End Developers AI Healthcare Software Development & Consulting

AI Healthcare Software Development & Consulting Healthcare App Development

Healthcare App Development EHR Software Development

EHR Software Development Healthcare AI Chatbot Development

Healthcare AI Chatbot Development Telemedicine App Development Company

Telemedicine App Development Company Medical Billing Software Development

Medical Billing Software Development Fitness App Development

Fitness App Development RPM Software Development

RPM Software Development Medicine Delivery App Development

Medicine Delivery App Development Medical Device Software Development

Medical Device Software Development Patient Engagement Software Solutions

Patient Engagement Software Solutions Mental Health App Development

Mental Health App Development Healthcare IT Consulting

Healthcare IT Consulting Healthcare CRM Software Development

Healthcare CRM Software Development Healthcare IT Managed Services

Healthcare IT Managed Services Healthcare Software Testing services

Healthcare Software Testing services Medical Practice Management Software

Medical Practice Management Software Outsourcing Healthcare IT Services

Outsourcing Healthcare IT Services IoT Solutions for Healthcare

IoT Solutions for Healthcare Medical Image Analysis Software Development Services

Medical Image Analysis Software Development Services Lending Software Development Services

Lending Software Development Services Payment Gateway Software Development

Payment Gateway Software Development Accounting Software Development

Accounting Software Development AI-Driven Banking App Development

AI-Driven Banking App Development Insurance Software Development

Insurance Software Development Finance Software Development

Finance Software Development Loan Management Software Development

Loan Management Software Development Decentralized Finance Development Services

Decentralized Finance Development Services eWallet App Development

eWallet App Development Payment App Development

Payment App Development Money Transfer App Development

Money Transfer App Development Mortgage Software Development

Mortgage Software Development Insurance Fraud Detection Software Development

Insurance Fraud Detection Software Development Wealth Management Software Development

Wealth Management Software Development Cryptocurrency Exchange Platform Development

Cryptocurrency Exchange Platform Development Neobank App Development

Neobank App Development Stock Trading App Development

Stock Trading App Development AML software Development

AML software Development Web3 Wallet Development

Web3 Wallet Development Robo-Advisor App Development

Robo-Advisor App Development Supply Chain Management Software Development

Supply Chain Management Software Development Fleet Management Software Development

Fleet Management Software Development Warehouse Management Software Development

Warehouse Management Software Development LMS Development

LMS Development Education App Development

Education App Development Inventory Management Software Development

Inventory Management Software Development Property Management Software Development

Property Management Software Development Real Estate CRM Software Development

Real Estate CRM Software Development Real Estate Document Management Software

Real Estate Document Management Software Construction App Development

Construction App Development Construction ERP Software Development

Construction ERP Software Development